Although I’ve devoted many essays here to exploding myths about historical private currencies, there’s one I’ve yet to directly challenge. That’s the belief that such currencies only thrive in the absence of official alternatives. Otherwise, the argument goes, people would drop private currencies like so many hot rocks. Since this opinion assumes that private currencies are inevitably inferior to official ones, I hereby christen it the “ersatz” theory of private currency. Note that “currency” means circulating or (in today’s digital context) peer-to-peer exchange media: nobody denies that other sorts of private money, such as commercial bank deposits and traveler’s checks, can coexist with official alternatives.

Implicit appeals to the ersatz theory of private currency are as common as muck. Take, for example, this statement by the ECB’s Yves Mersch:

Only an independent central bank with a strong mandate can provide the institutional backing necessary to issue reliable forms of money and rigorously preserve public trust in them. So private currencies have little or no prospect of establishing themselves as viable alternatives to centrally issued money that is accepted as legal tender.

Since governments alone can declare a currency “legal tender,” it’s seldom possible for private currencies to “establish themselves” as such, no matter how good or popular they are. El Salvador’s decision to declare Bitcoin legal tender was a rare exception. But I take Mersch to mean that, legal tender or not, private currencies simply can’t hope to compete successfully against centrally issued money.

Paul Krugman explicitly appeals to the ersatz theory in observing, in a recent New York Times column, that although “private currencies did indeed circulate and function as mediums of exchange” during the United States “free banking” era, this was so “because there were no better alternatives: greenbacks—dollar notes issued by the U.S. Treasury—didn’t yet exist.” Krugman goes on to say that, because “greenbacks and government-insured bank deposits do exist” today, “stablecoins play almost no role in ordinary business transactions.”

Like Mersch and most others who subscribe to the ersatz theory of private currency, either explicitly or implicitly, Krugman doesn’t seem to consider another possibility, to wit: that private currencies seldom survive, not because the public prefers centrally-supplied, official currencies, but because governments routinely slant currency playing fields in official currencies’ favor, often by banning private alternatives outright. Let’s call this the “coercive” theory of official currencies. If the ersatz theory is correct, the historical record should show that private currencies died out on their own once official alternatives were available. If, instead, the coercive theory is correct, governments would have had to take further steps to seal private currencies’ fate.

Banking on the State

Before we look into how private currencies die, we should first consider the circumstances that tend to give birth to them. According to the ersatz theory, the key requirement is the lack of official, hence presumably superior, alternatives, as when a central government simply hasn’t gotten around to issuing its own currency. Yet it’s easy to show that private currencies often got going, not because there were no official alternatives, but because official money sucked.

Consider the earliest known paper money—the “Flying cash” of Tang Dynasty China (618 to 907 AD). It was developed by merchants as a substitute for official Chinese copper coins which, besides being incredibly bulky, were often unavailable in adequate quantities. In Europe as well, though much later, it was the shoddy state of official coins that gave rise to private paper substitutes. As William Stanley Jevons (chap. XVI) explains,

The origin of the European system of bank-notes is to be found in the deposit banks established in Italy from four to seven centuries ago. In those days the circulating medium consisted of a mixture of coins of many denominations, variously clipped or depreciated. In receiving money, the merchant had to weigh and estimate the fineness of each coin, and much trouble, loss of time, and risk of fraud thus arose. It became, therefore, the custom in the mercantile republics of Italy to deposit such money in a bank, where its value was accurately estimated, once for all, and placed to the credit of the depositor.

I can well imagine Krugman, or someone who thinks like him, saying, “Ah, but there was no official paper money people might resort to in these instances.” There wasn’t; but this is missing the larger point, which is that there might never have been had private innovators not come up with and tested the idea. In the past, like today, it was such innovators who came up with new and often superior exchange media. Governments then tended to muscle in, eventually snuffing out their would-be private rivals.

Nor was the result always an improvement. Take what happened in China. At the start of the Chin-dynasty, emperor Hsiao-tsung (1163-90) gave China its first nationally-regulated paper money, suppressing private substitutes. Before you could say Jack Robinson, China experienced “the first nation-wide inflation of paper money in world history.”

Green with Envy

Now let’s consider a case in which private currencies had to compete with relatively close, official substitutes. As Krugman, in endorsing the ersatz theory, instances notes issued by state banks during the U.S. “free banking” era (1837-1865), one might suppose that, if any private currencies ever went “gentle into that good night” as soon as official alternatives became available, those issued by state banks must have done so as soon as the U.S. Treasury entered the currency business.

Let us see. The first “greenbacks,” officially called “demand notes” because the U.S. Treasury was supposed to redeem them in specie on demand, were made available in August 1861. By December, the Treasury had reneged on its promise (sound familiar?), effectively placing the nation on a greenback standard, where it remained until 1879. In all, $60 million in demand notes were authorized. In February 1862, these were supplemented by $150 million in new legal-tender greenbacks, $400 million of which would ultimately be authorized. By the end of 1862, there were more greenbacks than state banknotes in circulation. Since greenbacks, besides being legal tender, were free of default risk, if only because the Treasury had already broken its solemn promise to redeem its paper in specie, the public must surely have preferred them to state banks’ riskier products.

Yet, instead of shrinking, the quantity of state banknotes kept growing. From $184 million in December 1861, it had risen to $239 million on the first of January, 1863. Whatever else greenbacks were doing, they weren’t driving state banks out of the currency business.

National Banknotes

But greenbacks weren’t the only central-government-sponsored currency state bankers had to contend with. In February 1863, President Lincoln signed the National Currency Act, authorizing national banks. The notes of these federally-chartered banks had to be more than fully secured by U.S. Treasury securities.

The foremost aim of the new law, and of that last stipulation in particular, was to help fund the Union war effort: the greater the number of national banks, the greater the market for government bonds. But the law’s authors were especially keen on seeing state banks convert to national charters so that the nation could at last say good riddance to those pesky state-authorized banknotes. Because most banks back then depended for their survival on being able to keep notes in circulation, that’s just what would have happened had the public really preferred national currency.

Alas for the Union’s plan, it turned out that the public was rather fond of those old state banknotes—so fond, in fact, that few state banks opted to convert to the new, national charters. In 1860, there were 1,650 state banks, almost all of which issued their own notes. By the end of 1863, only nine, almost all formerly part of the State Bank of Ohio system, had switched to national charters. A year later, fewer than 200 had done so.

As I’ve explained at length elsewhere, the fact that most state banks kept issuing notes without switching to national charters wasn’t a result of any identifiable market failure. Nor can it be attributed to less-stringent state bank regulations: were national banknotes truly preferred, most state banks, and those in rural areas especially, would have had no choice but to either switch to national charters or go out of business, because their profits depended on their circulation. Although many state banks did close in 1863, according to Matt Jaremski (p. 384), they did so, not because the new national currency was preferred to their own, but because of losses they suffered as a result of the outbreak of the Civil War. The simple truth is that state banks, and the notes they issued, survived the 1863 Act because the public was happy to go on using their currency. Indeed, between 1863 and 1864, 25 new state banks opened.

This conclusion will undoubtedly seem incredible to those who recall horror stories about antebellum U.S. currency. But while some of those stories are true, they refer only to a relatively small proportion of antebellum banknotes. They also refer mainly to the early years of the so-called “free banking” era. Although the outbreak of the Civil War caused another cluster of Midwestern “free” banks to fail, owing to the depreciation of Western and Southern bonds they were obliged to hold as backing for their notes (ibid., p. 382), elsewhere state bank currencies, though still far from perfect, had improved considerably. Despite the tremendous handicap of barriers to branch banking, banknote discounts had come down to very modest levels; and some banknotes, including those issued by most Northeastern banks, circulated at par almost everywhere.

Carrots and Sticks

Disappointed by state bankers’ response to the National Currency Act, the government tried again, passing a revised version—the National Bank Act—in June 1864. The new version tried to make national banknotes more appealing by requiring every national bank to receive all national banknotes at par. (It was ultimately this requirement, rather than the notes’ implicit Treasury guarantee, that ruled-out discounts.) It also tried to make national charters more appealing to state bankers by relaxing national bank capital and reserve requirements, and by allowing converted state banks to incorporate their original names into their new ones. Thus the “Merchants and Mechanics Bank” of Troy, New York, could become the “Merchants and Mechanics National Bank” of that same city, instead of having to be “the Third National Bank of Troy New York” as the earlier law had required. That state banks wanted to keep their old names suggests that they feared losing valuable brand-name capital, which they wouldn’t have done had the words “national bank” alone made up for the loss.

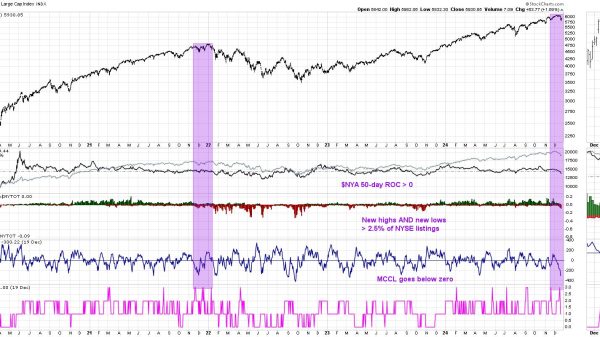

The revised law did lead to more state bank conversions (see the figure reproduced from Jaremski’s article below*), with another 245 state banks converting in 1864 alone. But these conversions were mostly of larger state banks in bigger towns and cities, and major financial centers especially, where banks could survive on deposit-taking alone. Rural state banks, in contrast, still stuck to their old charters, so that they could still issue their own notes, for which there was still a robust demand. In all, over one-thousand state banks survived into 1865.

The continued survival of so many state banks of issue, despite what were by then substantial numbers of national banks’ notes from which might circulate anywhere, ought to have suggested to government officials that state banks and their currencies were meeting needs national banks could not. Instead it persuaded them to start playing hardball with obstinate state bankers. And hardball is what they played by including a prohibitive 10 percent tax on state banknotes in the March 1865 Revenue Act.

A Hollow Victory

The OCC says that, in taxing the notes of state banks, the federal government was “signaling its determination that national banks would triumph and the state banks would fade away.” But that “fade away” is so much sugar-coating: deprived of their ability to issue currency, state banks dropped like flies. Although they were granted a stay of execution by a law delaying the implementation of the tax until August 1866, by the end of the decade only 250 state banks were left. Nor was their demise a reflection of the public’s belated discovery of their notes’ inferiority. According to Jaremski (p. 386), who has studied the matter closely, the 10 percent tax “seems to have been the only piece of legislation capable of closing state banks” (my emphasis).

And just what sort of “triumph” was this? It was surely not one for currency users, who had long had the option of refusing state bank notes, but were now deprived of the option of having them. Nor was it a triumph for the communities that lost their former state banks: being unable to muster up the capital needed to establish national banks, many ended up being deprived of banks altogether. The Midwest and the South were especially hard hit, with the latter suffering not only because it had been impoverished by the war, but because the total circulation of national banknotes was limited until 1875, and almost all had been spoken for by the time the Civil War ended. Many, myself among them, believe that the lack of banks was an important cause of the South’s persistent post-bellum underdevelopment.

“But at least the new currency was more reliable!” In some respects, perhaps. And as an alternative to state banknotes, which it was until that damned tax was passed, it could only have been beneficial. But in other respects, the nationalized paper currency system was deeply flawed. Consequently, by making national banknotes and greenbacks the United States’s only legal paper monies, the government unwittingly helped set the stage for the recurring “currency panics” of the last decades of the 19th century and the first decade of the 20th. Those panics were consequences of the “inelastic” supply of official paper currency—of an absolute limit on greenbacks and the bond-backing requirement for national banknotes. Had state banks not been forced out of the currency business, their notes might have met demands for currency that national banks couldn’t meet, and we might have been spared yet another federal government “triumph” in the field of currency.

The Rest of the Story

I’ve singled out the story of U.S. “national” currency because Krugman refers to it. But it is only one historical instance of many that I might offer contradicting the ersatz theory of private currency, while affirming the coercive alternative. In fact, so far as I’m aware, private paper currencies, including notes issued by ordinary commercial banks without the benefit of official guarantees, have never been driven to extinction by the mere presence of official alternatives. Instead, they’ve always been forced out of existence, by prohibitive taxes, impossibly onerous regulations, or (most often) outright prohibition. This was so in England and Wales. It was so in France and in Italy. It was so in Sweden and Switzerland and Canada and…but it would be tedious to list all the cases I’m aware of. Instead, I challenge my readers to inform me of an exception, that is, a case where some official currency out-competed private rivals, fair and square.

Of course, even if no such exception exists, it may still be true that private digital currency can’t compete successfully, on a level playing field, against centrally-supplied alternatives. But we’ll never know unless governments allow such competition to take place. Perhaps Paul Krugman will welcome such competition. But I doubt it. He may say that private currencies tend to die out naturally. But what he means is that, since they’re doomed anyway, the government might as well kill them.

_________________

*Observe that, because it uses end-of-year data, the chart is a bit misleading: the numbers shown straight above any year refer to banks in existence that December rather than in the middle of that year.

The post Paul Krugman and the “Ersatz” Theory of Private Currencies appeared first on Alt-M.