Thanks to the Roosevelt Recession, in the spring of 1938 the New Deal’s “Keynesians” finally found themselves in the saddle, displacing the planners, reformers, and trust-busters whose legislative efforts had petered out some months before. The Keynesians’ rise was symbolized by the $3 billion spending program FDR announced during his fireside chat that April.[1]

But the crisis that gave Keynesians the upper hand also proved fatal to the Roosevelt administration’s more ambitious plans, Keynesian or otherwise. Thanks to it, voters sent many Democrats, and New Deal democrats especially, packing that November. Although Democrats retained a strong majority in Congress, the election’s real winners consisted of a combination of Republicans and Southern Democrats that came to be known as the “conservative coalition,” which was to dominate Congress for the next three decades.

While some historians have since labeled the Keynesian ascendancy a “Third New Deal,” the Keynesians themselves saw their preferred policies as far less radical, if more expensive, alternatives to the more aggressive sorts of interference with private enterprise their predecessors favored. In that important respect, although they were certainly in the New Deal, they weren’t truly of it. Even so, their large-scale spending plans were hardly likely to sail through the new Congress. On the contrary: the conservative coalition first showed its mettle in June 1939, by scuttling the $3 billion-plus Works Financing Act—some Newsweek wag dubbed it FDR’s “Great White Rabbit”—that was supposed to continue the administration’s 1938 spending program. The New York Times’s Arthur Krock therefore had every reason to report, after the elections, that “The New Deal has been halted.”

Far Off

Though the New Deal may have been halted, the depression hadn’t. At the start of 1939, six-and-one-quarter million workers, or about 12 percent of the labor force, were unemployed; another three-and-one-quarter million, or roughly 5 percent of the labor force, were on work relief. Adults were working only four-fifths as many hours as they had in 1929; industrial production was still 10 percent below its 1929 peak; and real private nonresidential investment languished at two-thirds its pre-depression level.

Of course, the situation in March 1933 had been far worse. But if “recovery” meant returning to anything like the state of employment throughout most of the 1920s, or that decade’s trajectory for industrial output, the U.S. economy still had a very long way to go. “Despite the New Deal’s exertions and innovations,” David Kennedy (1992, p. 166) writes, “and contrary to later mythology,” it and the Depression had been “Siamese twins, enduring together in a painful but symbiotic relationship that stretched to the end of the decade.” That most other formerly depressed economies, with the notable exception of France, were by then faring much better than the United States, only gave Americans further grounds for aggrievement.[2]

Nor were the New Dealers themselves, FDR included, unaware of their failure. Observing, in his 1939 State of the Union address, that the United States continued to “suffer from a great unemployment of capital,” while Europe’s dictatorships had “solved, for a time at least, the problem of idle men and idle capital,” the president wondered whether the United States could “compete with them by boldly seeking methods of putting idle men and idle capital together and, at the same time, remain within our American way of life.”

Over the Hill

Perhaps the most weighty acknowledgment of the New Deal’s failure to achieve recovery came from the American Keynesians themselves, including Harvard’s Alvin Hansen, who was by now their most influential spokesman. The confession was implicit in Hansen’s “secular stagnation hypothesis,” a hybrid of British-style Keynesianism and the version of Frederick Jackson Turner’s “frontier” thesis Stuart Chase had popularized in the work that gave the New Deal its name.

According to Turner, American enterprise depended for its unique vitality on continued westward expansion. The “closing” of the western frontier therefore threatened to put paid to American prosperity. Between them, WWI and the Roaring Twenties put Turner’s thesis on ice. But the depression, and Chase’s book, gave it a new lease on life. The prosperity of the ’20s, Chase wrote, was a mere “flash in the pan”: not only had the frontier passed, but population growth was grinding to a halt, leaving markets for everything from shoes to automobiles at their “saturation points.” As for technological progress, instead of helping, it would only bring that much more unemployment: Chase (p. 82) even though it might “be a jolly good thing to declare a moratorium on inventions for at least a decade.” But, moratorium or no moratorium, American progress had run out of steam.

For the first time in our national history since the opening of the West, we have to deal with a roughly static rather than an expanding structure. There is no prairie, no mountain, no forest to which we can escape; there are no elastic real estate values to muffle the impact of our industrial blunders. Our luck has run out; we have at last to face real things in a real world (p. 74).

To his credit, Hansen rejected Chase’s jaundiced view of technological progress. “There can be no greater error,” he said in his December 1938 American Economic Association presidential address, “than that which finds in the advance of technology, broadly conceived, a major cause of unemployment.” But in other respects, he shared Chase’s outlook. “We are passing,” he said, “over a divide which separates the great era of growth and expansion of the nineteenth century…into no one knows what.” Between them, the exploitation of new territory and population growth had supplied outlets for roughly half of the capital formation during the former era. Now those outlets were “rapidly being closed,” leaving only the outlet “created by the progress of technology.” But technological progress only helped if it gave rise to whole new industries, and there was little prospect that the future would see anything “as rich in investment opportunities as the railroad, or more recently the automobile.”

Hansen’s secular stagnation or “economic maturity” thesis implied that “pump-priming” and other strictly countercyclical policies could no longer be counted on to achieve economic recovery. Instead, eliminating unemployment would require nothing short of a massive and permanent increase in government spending on public works, or relief, or both. It followed that the New Deal’s recovery schemes were, not just failures, but exercises in futility. The heart of American private enterprise could no longer be expected to ever beat hard enough on its own. It needed a Big Government pacemaker.

War!

Despite the conservative coalition, a pacemaker is just what the U.S. economy got, though it was only a makeshift. On the first of September, 1939, Germany invaded Poland. The war the world had been dreading ever since Hitler came to power began at last. Although the United States wouldn’t join the conflict until December 1941, it began to mobilize in earnest, and to ship arms and other materials to Britain, after France fell in June 1940. According to Robert G. Gordon and Robert Krenn, by the time the Japanese attacked Pearl Harbor, the United States economy had been running at full capacity for several weeks. The number of unemployed workers had fallen from 7.7 million to just 3.4 million, while U.S. industrial production was 25 percent higher than its 1920s pinnacle. Before long, material and labor shortages had the government placing limits on “non-essential” construction and production.

The claim that World War II, and the government spending that went with it, ended the depression, has long been conventional wisdom. Still, it hasn’t gone unchallenged. Christina Romer, whose work we noticed earlier in this series, claims that fiscal policy “contributed almost nothing to the recovery,” not only throughout the 1930s, but until1942: gold, on the other hand, poured into the U.S. Treasury faster than ever, thanks in part to European governments’ purchases of U.S.-made war materials. For their part, Brad DeLong and Lawrence Summers (1988, p. 467) claim that, by the time the war began, “more than five-sixths of the Depression decline in output relative to trend had been made up.”

But such revisionism has itself been revised in turn, by Gorden and Krenn, and also by J.R. Vernon (1994). Vernon argues, I think convincingly, that at the start of the last quarter of 1940 the recovery was no more (and probably less) than half complete, and that it took a big dose of fiscal medicine to complete it. Gordon and Krenn take Vernon’s argument a step further, by showing that federal government spending began to play a decisive role as soon as France fell. Contradicting DeLong and Summer’s claim (1988, p. 467n46) that it didn’t change, they note that the federal government’s share of GDP doubled between then and December 1941, with defense expenditures alone growing almost tenfold, from $1.5 billion to $14.3 billion.[3] During the same period the number of active military personnel increased from just 335 thousand to more than 1.8 million. Compared to later wartime figures, these magnitudes pale. Still, Gorden and Krenn show that, by the close of 1941, the government’s contribution was already large enough to account for almost 90 percent of the recovery that took place between January 1939 and December 1941.

Concerning those post-Pearl Harbor statistics, Robert Higgs (1992, p. 55) warns against taking them at face value. As soon as the United States declared war on Japan, he says, the government “began imposing such pervasive and sufficiently effective controls that, by the beginning of 1943, the economy became a thoroughgoing command system.” Consequently, the superficially remarkable “wartime boom” of 1942-1945 is in truth little more than a statistical artifact.[4] Before Pearl, on the other hand, relatively few controls were imposed. For that reason, despite being the furthest thing from a Keynesian, Higgs allows “that “[i]n 1940 and 1941 the economy was recovering smartly from the Depression.” Small wonder that Keynesians themselves viewed the wartime recovery as a successful test of their proposed, permanent solution to unemployment!

That, so far as the Keynesians were concerned, was the good news. The bad news was that the very success of this test, and the war more generally, eventually took the wind out of the stagnationists’ sails. They did so, most obviously, by turning the once-urgent problem of unemployment into yesterday’s news, while confronting the government with entirely different, but no less urgent, challenges. But they also did so, paradoxically, by causing many, and conservatives especially, to doubt that capitalism needed to be on life support after all.

Medical Referral

The change in the government’s priorities was evident in Roosevelt’s own rhetoric, beginning with his January 1941 state of the union address, better known as his “Four Freedoms” speech. Here the president stressed “the immediate need…to change a whole nation from a basis of peacetime production of implements of peace to a basis of wartime production of implements of war,” and to “prepare…to make the sacrifices that the emergency—almost as serious as war itself—demands.” Although Roosevelt also insisted that “this is no time for any of us to stop thinking about the social and economic problems which are the root cause of the social revolution,” including unemployment, the preparations that were temporarily putting an end to that problem, if only by drafting millions of young men into the armed services, weren’t aimed at solving it: their purpose was defeating Hitler and the Japanese.

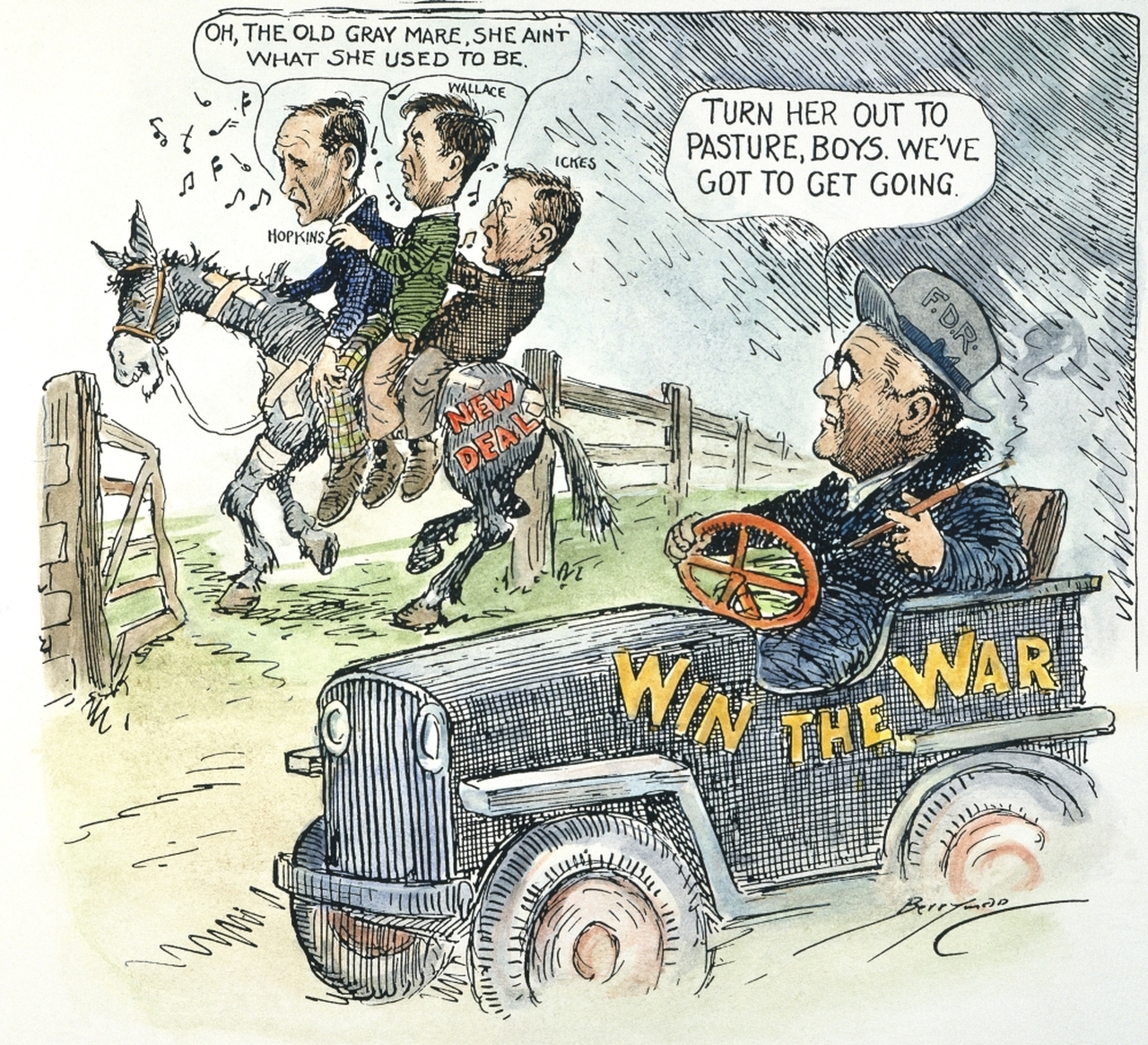

Moreover, the plain truth was that many people had stopped thinking about unemployment and other prewar problems, and that FDR himself eventually seemed to quit thinking about them. Observing, during a December 1943 press conference, that the president had stopped using the term “New Deal,” a reporter asked why. Comparing the prewar U.S. economy to a sick patient, Roosevelt explained, while “Dr. New Deal” had been a perfectly competent internist, the patient had since been “in a pretty bad smashup.” Since Dr. New Deal knew nothing about mending broken arms and legs, “Dr. Win-the-War” had taken over. A “new” New Deal would have to wait until the war ended—assuming it ever saw the light of day.

But would it? The war didn’t just change the government’s priorities. It also changed the public’s outlook for the future. According to Alan Brinkley (1996, p. 171), despite the government intervention that gave rise to it, the spectacle of a fully-employed economy caused a general retreat from the previously widespread belief that capitalism was chronically, if not mortally, ill. Just as the First World War had sent Turner’s original frontier thesis into cold storage, the second deprived Hansen’s new version of its former appeal, undermining support for Keynesians’ ambitious plans for keeping the postwar economy on its feet.

That the Keynesians found themselves fighting an uphill battle was first made clear by the fate of the National Resources Planning Board (NRPB). Established in 1939 as the last of a series of similar boards, all charged with helping to coordinate New Deal policies, when the war broke out its focus changed to domestic postwar planning. Concerning that subject, it produced a stack of reports and pamphlets several feet high, including several by Alvin Hansen, its most prominent advisor. Not surprisingly, these all stressed the need for public works and relief planning on a large scale to avoid a postwar collapse. Hansen took for granted, furthermore, that Congress could be convinced to cede to the administration its power of the purse so as to give it a free hand with which to regulate compensatory spending (Rosen 2005, p. 228).

Such recommendations would have gotten a cold welcome from the conservative coalition under the best of circumstances. But Roosevelt’s decision to publish them in early 1943 was particularly ill-timed: the 1942 mid-term election had given Democrats another thrashing, leaving them with a paper-thin majority only in the House, and a much-reduced one in the Senate. So it was hardly surprising that the 78th Congress turned a deaf ear to the NRPB’s proposals. But that was just for starters. The Senate’s “antistatists,” led by Robert Taft, also planned to reduce the NRPB’s budget to just $200,000, only to be one-bettered by the Appropriations Committee, which quit funding it altogether.

Jobs for All

When the NRPB was officially abolished that August, Roosevelt transferred many of its undertakings to the Bureau of the Budget, which became the Keynesians’ new, if unofficial, headquarters. There, at the Fed, and at several other executive departments, they soldiered on, producing more papers, reports, and forecasts. According to Michael Sapir, one of the economists then working at the Bureau of the Budget, the “whole tone and emphasis” of these productions “was on the drastic primary impact…curtailed government outlays” would have on postwar “income and employment in the private economy.” Demobilization, they argued, would have “strong deflationary tendencies,” and would leave some 8 to 12 million workers without jobs unless the government ran huge peacetime deficits.

One of the Keynesians’ more important documents was a joint Fed-Bureau of the Budget memorandum on “Postwar Employment,” written by Hansen and Gerhard Colm, the Bureau of the Budget’s principal fiscal policy expert, and circulated confidentially in October 1944 (Nourse 1956, p. 194). The memorandum made achieving “full employment,” which it defined as “productive work for all who are willing and able to work,” the administration’s first economic policy priority.

Fearing more Congressional backlash, FDR tabled the memo. But that didn’t stop him from drawing on it for his October 28, 1944 campaign speech at Chicago’s Soldier’s Field. Reminding the crowd of 150,000 that the “Second Bill of Rights” he’d proposed in his State of the Union Address that January included Americans’ “right to a useful and remunerative employment,” he now explained that guaranteeing it would take “close to sixty million productive jobs,” and a corresponding “expansion of our peacetime productive capacity.” He then promised that the Government would “do its part in helping private enterprise” finance the needed expansion.

Having taken Congress’s temperature, Roosevelt doubled-down on his commitment to make achieving full employment a joint government-private market undertaking:

I believe in free enterprise—and always have.

I believe in the profit system—and always have.

I believe that private enterprise can give full employment to our people.

If anyone feels that my faith in our ability to provide sixty million peacetime jobs is fantastic, let him remember that some people said the same thing about my demand in 1940 for fifty thousand airplanes.

What Roosevelt didn’t say was that 50,000 B-17s in 1940 cost about $10 billion, and that, if the Keynesians’ estimates were right, avoiding mass unemployment after the war would cost at least that much every year, at least for several years, and (if the secular stagnation thesis was correct) perhaps forever. Hansen himself thought that maintaining full employment would cost the government “some $18 billion annually,” or close to four times what Keynes had thought necessary in 1934. Other estimates of the required annual deficits ran the gamut, from Walter Salant’s relatively sanguine range of $10 to $15 billion (Jones 1972, p. 126) to Paul Samuelson’s especially gloomy $25 billion.

Needless to say, such large-scale deficit spending couldn’t be flipped on like a switch. Yet the liberation of Paris that August made it obvious to everyone, apart perhaps from the Führer himself, that Nazi Germany’s days were numbered. If the government was to keep its promise to avoid a severe postwar depression, it had no time to spare to start planning for peace. Alas, the Battle of the Bulge that December put to rest all talk of starting the process of economic reconversion before Germany threw in the towel.

The Full Employment Act

In his January 6, 1945 address to Congress, President Roosevelt once again called for a national program to assure full employment. “The Federal Government must see to it,” he said, “that these rights become realities… . This means that we must achieve a level of demand and purchasing power by private consumers…sufficiently high to replace wartime Government demands.”

FDR, and the Keynesians whose recommendations he was following, found their main champion in Congress in Montana Senator James Murray, a staunch New Dealer who chaired the War Contracts Subcommittee of the Senate Military Affairs Committee. On January 22, 1945, Murray introduced his subcommittee’s Full Employment Bill, based on a draft prepared by several Keynesian economists, as S. 380. A month later, Congressman Wright Patman (D-TX) introduced the House equivalent as H.R. 2202. The bills’ centerpiece consisted of a National Production and Employment Budget that was to include an estimate of the level of GNP consistent with full employment, the private sector’s expected contribution, and the gap between these that the government would be mandated to fill.

Though the text of both bills was the same, the fates they suffered in their respective chambers couldn’t have been less alike. S. 380 wended its way through the Senate with relatively little opposition. Even so, by the time it passed the Senate, with minor amendments only, by a vote of 71 to 10 (with 15 senators abstaining) on September 28, 1945, Roosevelt—who never got around to endorsing it—had been dead for more than five months, and both Germany and Japan had surrendered.

Yet the conservative-leaning House Executive Expenditures Committee, to which H.R. 2202 had been assigned, was taking even longer, having only begun hearings on it days before S. 380 passed the Senate. During the course of these hearings, anti-Keynesians at last took to the offensive, assailing the very idea of a “right” to employment; exposing the vagueness of the concept of “full” employment; and casting doubt on the Keynesians’ ability to forecast the course of private spending and employment with any reasonable degree of accuracy.[5] Their acerbic testimony led in turn to a clamorous series of “close votes and compromises” (Wasum 2013, p. 99).

When the dust settled, an Executive Expenditures Committee subcommittee found itself drafting a substitute for H.R. 2202. The result scrapped everything beyond the original measure’s preamble. Instead of establishing workers’ “right to employment,” the “Employment-Production Act of 1945” merely had the government “aiding and assisting” the unemployed; and instead of mandating Keynesian compensatory spending, as specified by a National Production and Employment Budget, it merely provided for a strictly advisory “Economic Report of the President.” Finally, instead of assigning responsibility for drafting that report to the Bureau of the Budget, it assigned it to a new Council of Economic Advisers to be appointed by the president. It also created a new Joint Economic Committee, charged with advising Congress on economic affairs. Both the CEA and the JEC were advisory bodies only: neither could “authorize programs, pass laws, or appropriate funds” (Wasum 2013, p. 145). It was this impotent substitute, rather than H.R. 2022, that the House eventually passed, by a vote of 255 to 126.

It remained for the Conference Committee to decide between the House and Senate bills, or something in between. It did so by choosing the House alternative, and weakening it still further by downplaying, or omitting altogether, its references to government spending, public works, and loans. The conference report was accepted by the House on February 6, 1946, by a vote of 320 to 84, and unanimously agreed to by the Senate two days later. At last, on February 20th, more than six months after Emperor Hirohito announced Japan’s unconditional surrender, President Truman signed the Employment Act of 1946 into law.

Shock Therapy

Much as later Keynesians might look upon the Employment Act of 1946 as a triumph for their way of thinking, the fact remains that, even if that act hadn’t been so toothless, it would have come too late to compel Congress to take steps to avoid the mass unemployment Keynesians had long feared. That Congress in the meantime, having gutted their proposed legislation, didn’t put the Keynesians’ recommendations into practice on its own initiative, goes without saying.

The upshot was that postwar economic reconversion went ahead without the benefit of peacetime compensatory spending. Instead, between Fiscal 1945 and Fiscal 1946, government outlays fell by 40 percent, from $92.7 billion to $55.2 billion, while the deficit fell as well, from almost $50 billion, or 21 percent of GDP, in 1945, to just $16 billion, or about 7 percent of GDP, in 1946. In fiscal 1947, federal revenues exceeded outlays for the first time since 1930; and in 1948, the surplus rose to nearly $12 billion! In the meantime, the military returned some 10 million Americans to civilian life.

According to most American Keynesians, fiscal surpluses were the last thing those Americans needed.[6] Instead, as we’ve seen, they believed it would take annual deficits of at least $10 billion, and, according to Samuelson, perhaps $25 billion, to provide for their employment. In offering his estimate Samuelson (p. 51) spoke for most Keynesians in warning that

were the war to end suddenly…were we again planning to wind up our war effort in the greatest haste, to demobilize our armed forces, to liquidate [sic] price controls, to shift from astronomical deficits to even the large deficits of the thirties—then there would be ushered in the greatest period of unemployment and industrial dislocation which any economy has ever faced.

If the Keynesians were right, the U.S. economy was headed for disaster: not only were deficits about to give way to surpluses, but most wartime controls, instead of being removed only gradually as they’d recommended, would be lifted soon after V‑J Day, and the rest would be gone within a year. In short, the U.S. economy was about to receive, at close to the fullest conceivable amperage, what historian Jack Stokes Ballard later called the “shock of peace.”

Keynesian economists were hardly alone in dreading the outcome. Although businessmen tended to be more upbeat, with many actually looking forward to a postwar boom driven by free enterprise (Wasum 2013, p. 47), Newsweek, Time, United States News, and most of the rest of the more liberal press “feared a gradual slide into a major depression” rivaling that of the early ’30s, with between five and seven million former workers and soldiers on the dole before the end of the year (Hinchey 1965, p. 125). Not to be outdone, Business Week put peak unemployment at 9 million, or around 14 percent of the labor force. But that was nothing compared to Senator Harley Kilgore’s (D-W. Va.) prediction (ibid, p. 126) that the new depression would be far greater than the Great Depression, with 18 million men and women failing to find jobs. Finally, Leo Cherne of the Research Institute of America, and Boris Shishkin, an economist for the American Federation of Labor, each upped the ante yet again, forecasting 19 and 20 million unemployed respectively, or unemployment rates in excess of 35 percent! Now that it was too late for the government to heed their warnings, these pessimists could only wait in helpless trepidation for the Great Depression to return with a vengeance.

Yet, somehow, it never did.

___________________

[1] Although symbolically important, because it was undertaken despite Treasury opposition, on the basis of Keynesian reasoning, and large in absolute terms, Roosevelt’s 1938 spending program did not actually pack a very substantial punch. As David Kennedy points out (1992, pp. 358-9), “In a $100 billion economy, with more than ten million persons unemployed, $3 billion was a decidedly modest sum, not appreciably larger than most earlier New Deal deficits, considerably less than the deficit of 1936, and far short of the kind of economic boost that Keyness envisioned as necessary to overcome the Depression once and for all.”

[2] It bears noting that, at its own depression’s trough, in 1936, France’s recently victorious Front Populaire introduced major labor market reforms that, according to Paul Beaudry and Frank Portier (2002), “mirror[ed] the 1933 U.S. New Deal.” These included maximum workweek hours and government-imposed collective bargaining, the last of which quickly led to numerous nationwide strikes. In all, Beaudry and Portier report (p. 73), the reforms boosted the cost of labor in France’s by a remarkable 29 percent.

[3] DeLong and Summers refer to the government’s share of GNP rather than GDP, but these differ only slightly.

[4] Elsewhere Higgs (1992) and Steven Horwitz and Michael McPhillips (2013) ask a more fundamental question concerning the wartime increase in output, and associated drop in unemployment, to wit: whether, setting the accuracy of wartime statistics aside, these constituted “‘economic recovery’ in any sense relevant to American households’ day-to-day experience” (ibid., p. 343). That Americans continued to endure hardship throughout the war, in the shape of severe home-front deprivations, not to mention the horrors encountered by servicemen, including the prospect of dying early, can hardly be gainsaid. Still, the question seems moot, the answer hinging as it ultimately must on whether winning the war was a “public good.” The more important question was whether something apart from war could keep the U.S. economy from lapsing back into a depression.

[5] Concerning the challenge of defining “full employment,” see Nourse (1972). Challenged by critics of his 1942 pamphlets to say what that expression meant, Hansen replied by allowing that “at ‘full employment’ there would be at any one time between 2 and 3 million unemployed” (ibid., p. 194). As we shall see, the actual unemployment level throughout 1946 was closer to the lower end of that range.

[6] A remarkable exception was Federal Reserve Chairman Marriner Eccles, who prior to the war had been the Roosevelt administration’s most insistent champion of “Keynesian” countercyclical policies. The war made inflation Eccles’s chief concern; and by 1945 he was convinced that to keep inflation at bay after the war the government would have to have its peacetime budget in balance. Inevitably he and Hansen, who was then serving as a special consultant to the Board of Governors, clashed, causing Hansen to quit that August. Concerning the progress of Eccles’s thinking, see Vernengo (2009).

Continue Reading The New Deal and Recovery:

Intro

Part 1: The Record

Part 2: Inventing the New Deal

Part 3: The Fiscal Stimulus Myth

Part 4: FDR’s Fed

Part 5: The Banking Crises

Part 6: The National Banking Holiday

Part 7: FDR and Gold

Part 8: The NRA

Part 8 (Supplement): The Brookings Report

Part 9: The AAA

Part 10: The Roosevelt Recession

Part 11: The Roosevelt Recession, Continued

Part 12: Fear Itself

Part 13: Fear Itself, Continued

Part 14: Fear Itself, Concluded

Part 15: The Keynesian Myth

Part 16: The Keynesian Myth, Continued

Part 17: The Keynesian Myth, Concluded

Part 18: The Recovery, So Far

Part 19: War, and Peace

Part 20: The Phantom Depression

Part 20, Coda: The Fate of Rosie the Riveter

The post The New Deal and Recovery, Part 19: War, and Peace appeared first on Alt-M.