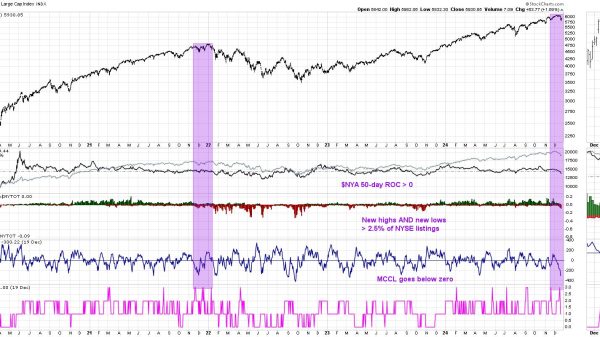

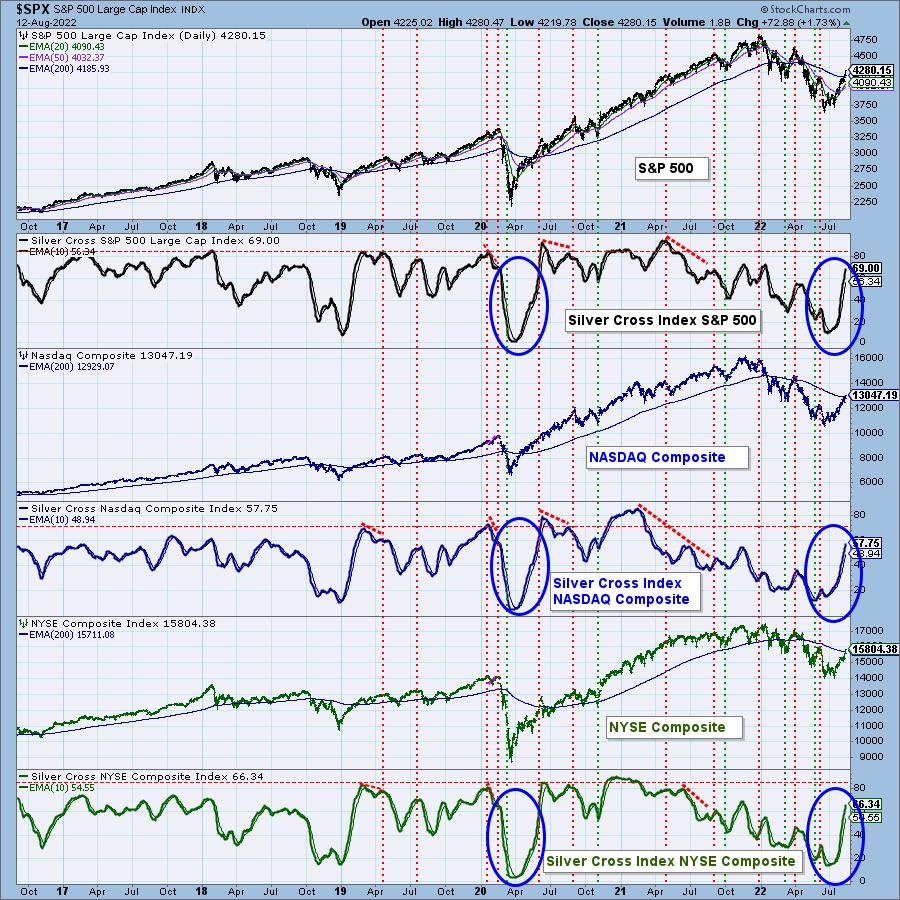

We decided to take a look at our Silver Cross Index (SCI) and Golden Cross Index (GCI) across the broad markets. They were startling, to say the least. As we all debate whether this is the end of the Bear Market of 2022, these two indicators suggest it just might be.

Our SCI measures how many stocks have a 20-day EMA above the 50-day EMA, and the GCI measures how many stocks have a 50-day EMA above the 200-day EMA. Those numbers have been steadily increasing and, in the case of the SCI, the increase has been nearly vertical. The SCI has been on a roll as more and more stocks have “silver crosses.” Notice how similar behavior was occurring at the end of the 2020 Bear Market.

Additionally, on the improving GCIs, we have an oversold bottom and positive crossover on all of them. The last time the GCIs bottomed in oversold territory, it was the end of the 2020 Bear Market.

Conclusion: We can’t say for sure that the bear market is over, but we are seeing compelling evidence on our DecisionPoint indicators that suggest it just might be. On the flip side, the SCIs are overbought, which could mean a market top ahead. If you haven’t checked out the daily and weekly $ONE RRGs, I suggest you do. DP Alert subscribers will see them and our analysis in today’s report as well as in EVERY DP Alert report.

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

Trend Models

Price Momentum Oscillator (PMO)

On Balance Volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear Market Rules

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.