Today we saw a large decline in mega cap names Microsoft (MSFT) and Alphabet (GOOGL) after both companies reported earnings and sales that were well below estimates. Citing a strong dollar and high inflation among other factors, both companies warned of slower growth going forward amid a tough environment.

Adding to the woes among Large Cap tech, Meta Platforms (META) came in with earnings and sales below estimates after the market’s close today, and the stock is getting clobbered after hours.

Large Cap Technology stocks have led the last several bull market cycles and a loss of this leadership may be difficult to overcome.

That said, there are bright spots emerging within the markets this week. I use a service that breaks the market down into 197 Industry Groups and of those, 85% outperformed the markets today.

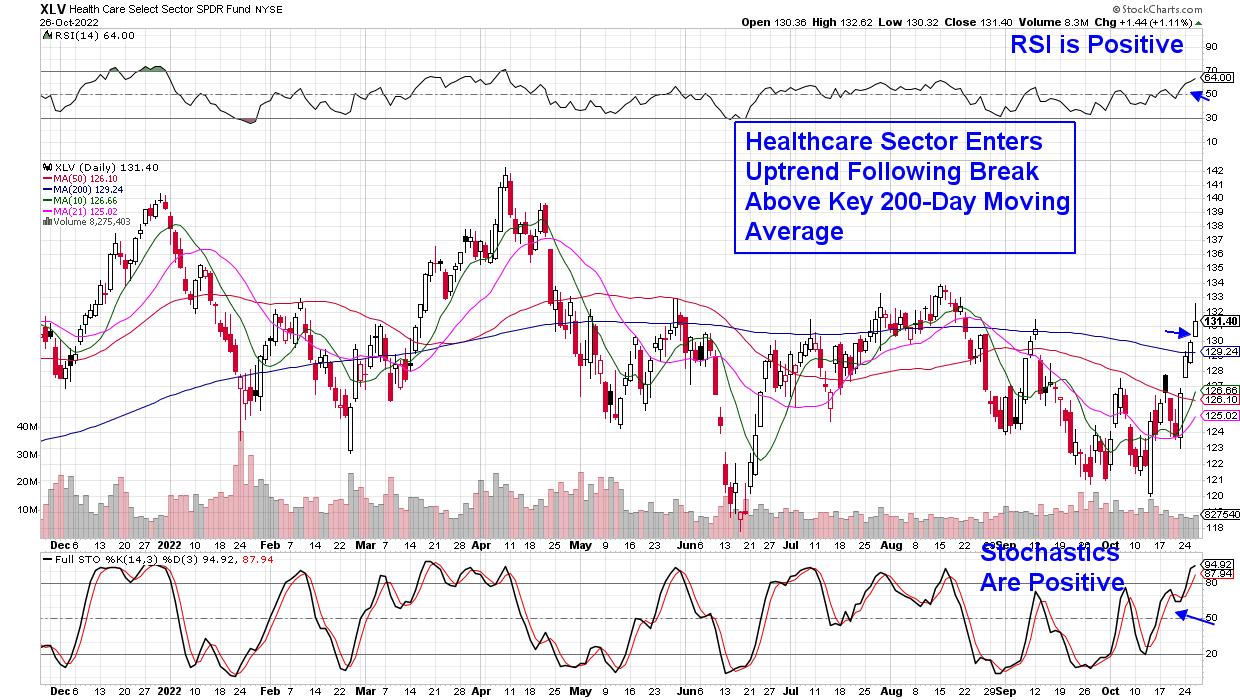

Among the outperformers were Energy, Healthcare and select areas of Retail to name a few, and the gains were driven by earnings that were above estimates. In addition, Real Estate and Utility stocks are coming back to life as well, with gains that are setting them up to reverse their downtrends.

DAILY CHART OF HEALTH CARE SECTOR (XLV)

The gains in these non-Tech areas are helping to strengthen breadth in the markets, with the percent of stocks above their 50-day moving averages steadily rising. While this is good news, it’s important to note that the rally stage that began in the markets last Friday is part of a bear market. In other words, we have not seen the characteristics necessary to call a market bottom.

I outline these needed characteristics regularly in my twice weekly MEM Edge Report, and a slowdown of inflation is among them. With that, I’m participating in this rally with select Energy and Retail stocks that are outperforming however, it’s with caution. If you’d like access to this select List of buy ideas, use the link below. You’ll also be alerted to new names as they’re added as well as being provided with exit strategies.

I have actively advised professional money managers through several bear markets and with the current tricky period, I hope you’ll take advantage of my special trial offer below.

Warmly,

Mary Ellen McGonagle, MEM Investment Research