My last post argued that, despite what Diamond and Dybvig’s famous theory suggests, bank runs have seldom proven fatal to otherwise sound banks. Instead, when people run on a bank, it’s usually because it’s already in hot water.

In response to that post, a Twitter correspondent wondered whether the Panic of 1907—the proximate cause of the reform efforts culminating in the Fed’s establishment—was an exception to my claim, and therefore evidence of the inherent vulnerability of fractional reserve banking. The gist of my two-tweet reply was that it wasn’t. But since 560 characters hardly allowed me to elaborate, I do so here.

A Quick Review

Before we look into the 1907 episode, let’s quickly go over Diamond and Dybvig’s theory of runs along with the alternative, “information-based” theory. If you want to know more about them, have a look at my previous post linked above, and (if that doesn’t suffice) at an earlier pair of posts I wrote about Diamond and Dybvig’s work.

In essence, that work treats runs as results of sheer panic: all it takes to inspire depositors to rush to withdraw their money from a bank is the fear that other depositors might do so. It follows that sound banks are as likely to be a target of runs as unsound ones, and that a run can itself cause a bank to fail.

In contrast, the theory that runs are information based holds that depositors only run on a bank when they have reason to believe that it’s already in trouble, owing to some shock to its investments, to unwise investment decisions, or to willful misconduct. Runs thus tend to expedite the closure of unsound banks, without compelling sound ones to close. However, because depositors generally lack complete knowledge of their banks’ undertakings, the tendency is only that: even information-based runs can become “contagious,” spreading from unsound to sound banks. But in practice such contagions tend to be limited: typically they only affect sound banks operating in the same area as those known to be unsound, or have business connections to them.

An Unfalsifiable Theory

Because a Diamond-Dybvig run can be triggered by anything, or nothing at all, the Diamond-Dybvig theory can’t be tested or falsified: instead, it’s consistent with any run, or set of runs, under any circumstances in which depositors face some risk of loss, if only because they panic. In contrast, as Gary Gorton explains, the hypothesis that runs are information-based is testable: it suggests that runs should display a pattern at least roughly consistent with “movements in variables predicting deposit riskiness.” The theory that runs are information-based also implies that runs on sound banks should be relatively rare even in banking systems lacking insurance or a public lender of last resort.

It follows that, no matter what I tell you about the Panic of 1907, I can’t claim that any of it disproves the Diamond-Dybvig theory. I can only hope to convince you that the evidence, which is bound to be consistent with their theory, is also fully consistent with the alternative, information-based theory of runs, with its very different policy implications. I leave it to you to decide whether evidence consistent with the information-based alternative is a good reason for preferring it, or just a remarkable coincidence from which no practical conclusions can be drawn.

A Trust Company Panic

Although Kerry Odell argues convincingly that the stage for the Panic of 1907 was set by a string of events starting with the great San Francisco earthquake of April 1906, its proximate cause was a failed mid-October, 1907 attempt by the Heinze brothers, Otto and Frederick, and their associate, Charles W. Morse, to corner the market in shares of the United Copper Company. The idea was to put a bear squeeze on speculators who’d been selling the company short. If the squeeze succeeded, the short sellers would have to buy back the shares they’d borrowed and sold at an inflated price. But it didn’t: after rising sharply in mid-October, United Copper’s share price collapsed even more precipitously, ruining the schemers. Their comeuppance coincided with runs on various banks and trust companies, culminating in a general restriction of bank payments on the 26th. Before the dust settled a month later, 42 trust companies failed.

So much for the bare facts. But was the “Panic” of 1907 truly a case of bank and trust depositors’ “sheer blind, unreasoning fear,” as Edwin Lefevre put it in an oft-repeated remark from a 1908 article? The answer, in brief, is no. As Lefevre himself understood, “there were reasons why there should have been a panic, and why it should have been exactly the kind that it was, and also why it should have raged at the time when it did and not much earlier and not much later.” He might have added that there were also reasons why it affected certain banks and trust companies more than others.

That the panic affected financial institutions at all is itself easy to explain: after making his way from the copper mines of Montana to New York City at the start of 1907, Frederick Heinze went into the banking business along with Morse; and when United Copper collapsed, both were serving on the boards of numerous banks and trust companies, including the Mercantile National Bank, which they controlled, with Heinze serving as its President. That their roguery and downfall should have raised serious concerns about the financial institutions they were associated with is hardly surprising. But if runs are information-based, those concerns shouldn’t have spread very far beyond those institutions.

In fact, as Carola Frydman, Eric Hilt, and Lily Zhou showed several years ago, the runs triggered by United Copper’s collapse “were strongly influenced by any observable connection to Charles Morse or the other speculators involved in the failed corner.” The Mercantile National Bank was, naturally enough, the first to face the music, on October 16. Other banks associated with Morse and Heinze were attacked soon after. But the runs ended when the New York Clearing House affirmed their solvency. It also helped free up some of their reserves by authorizing their employment of clearing house “loan” certificates in lieu of conventional (that is, fully legal-tender-backed certificates) as means of settlement.

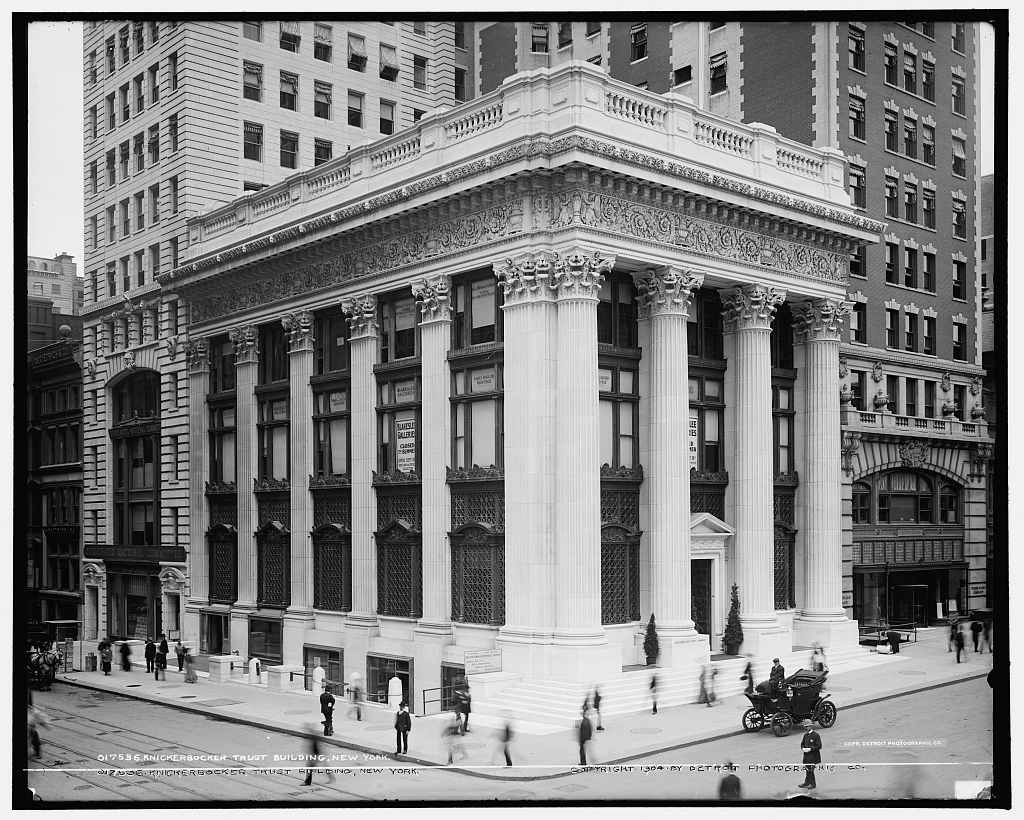

The banks having thus been spared for the time being, trusts alone remained vulnerable. But though many suffered runs, these were anything but indiscriminate. The stampede started with a run on the Knickerbocker Trust on October 21st, which came fast on the heels of two bits of bad news. The first concerned Knickerbocker’s president, Charles Barney, who had just been ousted because of his connections with Morse and Morse’s banks. The second was that the National Bank of Commerce was no longer willing to serve as Knickerbocker’s clearing agent. Two days later, the Trust Company of America, which had Barney among its directors, “endured the heaviest bank run in America up to that time” (Frydman et al., p. 911). Some weeks later, the disgraced former bank president shot himself.

In the meantime, runs spread to other trusts, but the pattern stayed the same: five had either Otto Heinze or Morse, or both of them, among their directors, while three had at least two directors in common with one of those five (ibid., p. 909). Trusts with direct or indirect connections lost more than twice as many deposits, through runs or otherwise, as others between August and December 1907. In short, the runs and deposit withdrawals trusts faced were clearly information based, where the relevant information concerned the extent of trusts’ “personal connections” to men implicated in the copper scandal.

A Flawed Arrangement

For banks, the story is more complicated. As we’ve seen, action by the New York Clearing House temporarily spared its members from runs of the sort trusts were subjected to. But the story didn’t end there. Instead, as A. Piatt Andrew reported,

The closing months of 1907 were marked by an outbreak of fright as wide-spread and unreasoning as that of fifty or that of seventy years before, by the suspension of cash payments on the part of a very large proportion of our sixteen thousand banks, by the issue of private and unauthorized currency in multitudes of towns and cities, and by the appearance and continuance during two months of a considerable premium upon legal money.

That sure sounds like the sort of panic Diamond and Dybvig’s theory predicts. And so it was, in some respects. Yet it doesn’t follow that Diamond and Dybvig’s theory explains why the panic broke out, or that their favorite solution—deposit insurance—could have prevented it. To see why, it’s necessary to look beyond the panic itself to several circumstances lurking in the background.

Of those circumstances, four were especially important. The first consisted of the fact that the demand for paper currency spiked during the autumn “crop moving” season. The second consisted of peculiar U.S. regulations, dating from the Civil War period, that made it difficult for banks to accommodate that seasonal demand. National bank notes had to be fully backed by specific U.S. government bonds, which became increasingly scarce, and costly to acquire, during the decades following the war. And even if it managed to acquire the necessary bonds and sent them to the Comptroller of the Currency, it could take up to two months for a bank to acquire more notes in return, during which time its investment would be a dead loss to it. State banks, on the other hand, were altogether deprived of their ability to issue banknotes by a prohibitive tax that went into effect in August 1866.

The third circumstance consisted of barriers to branch banking. Most banks couldn’t even have branches within a single state; and while a few state laws did allow branching, neither state nor federal laws allowed banks to branch across state lines. These barriers to branching stood in the way of the development of a truly nationwide banking system, especially by denying most banks direct access to the major money markets, and especially to the central money market of New York City. Instead, banks had to access those markets indirectly, through correspondent banks located in them. The result was a three-tier arrangement: “country” banks kept balances with “reserve city” correspondents, and those correspondents in turn kept balances with major New York banks. The National Banking Acts themselves encouraged these arrangements by allowing national banks’ correspondent balances to satisfy a portion of their minimum reserve requirements, that is, to be treated as equivalent to so many gold coins or greenbacks.

The fourth and final circumstance consisted of New York banks’ tendency to invest funds received from their correspondents in the city’s call loan market, where they financed the purchase of stocks on margin. Ordinarily, the fact that these loans were callable on one day’s notice made them quite liquid, so that the New York banks had no trouble meeting correspondents’ requests to draw on their balances. But when heavy withdrawals coincided with a bear market, the same banks might be prevented from calling enough loans to meet them, in which case they’d have to resort to other expedients. One of those expedients, which was resorted to only when others failed, was a restriction of cash payments.

A Currency Panic

The circumstances just described, which (apart from the fluctuating demand for currency) were unique to the United States, amounted to the currency-market equivalent of a primed powder keg. Under the wrong set of conditions, including a falling stock market, the keg could explode. And conditions proved very wrong indeed in 1907.

During the first nine months of that fatal year, as the harvest season approached, shares fell by almost 25 percent, putting country bankers on the qui vive. As Robert Bruner explains (pp. 3-4), they had “learned from past experience that, during a panic, withdrawing deposits from reserve city banks could be difficult.” The keg having thus been primed, it only remained for United Copper’s collapse to light the fuse, triggering not only runs on trusts and banks that were more-or-less directly involved in that collapse, but a rush by country and reserve-city banks to withdraw their correspondent balances. When, on October 26th, the New York banks found their own reserves approaching minimum requirements, the clearinghouse allowed them to restrict payments. News of New York’s restriction in turn “triggered a national wave of hoarding currency and gold,” driving paper currency to a premium, and confronting safety deposit companies there and elsewhere with more box rental requests than they could handle.

Yet mad as it was, this scramble for paper money was no Diamond-Dybvig-type run: it was not, Piatt Andrew (p. 294) notes, “attributable, as is so often implied, to women, clergymen, and other timid small depositors.” Instead, the participants were mainly “large business interests” seeking “to provide for any possible contingency which might prevent their meeting their regular obligations in the usual way,” including manufacturing firms determined to be able to pay their workers at a time when pay-envelopes hadn’t yet given way to paychecks. The scramble was, in other words, a scramble to get hold of a particular type of payments medium, rather than one to avoid being left holding the bag if one’s bank failed.

And that difference was of crucial importance. It meant that deposit insurance, had it existed, wouldn’t have made any difference. It also meant that panic could instead have been avoided simply by allowing bankers complete freedom to swap their own paper IOUs for any amount of deposit credits. It was only because they couldn’t do so that banks had to meet exceptional demands for currency by drawing on their reserves, including their correspondent balances. And that’s why the United States experienced a currency panic not just in 1907 but in 1893 and, to a less severe extent, on some previous occasions. Although the solution actually chosen was a “decentralized” central bank capable of serving as a lender of last resort, it was chosen only after special interests and their Capitol-Hill cronies scuttled legislation that might have solved the problem, and solved it more reliably, by means of deregulation.

Evidence

Economists are so used to equating increases in the demand for currency with a general loss of confidence in banks that many will find it hard to believe that national and state banks themselves might have prevented panics using nothing other than their own paper promises. Yet there’s plenty of evidence supporting that claim, starting with the many “asset currency” reform proposals that took its truth for granted.

There’s also the fact, noted by Joseph French Johnson (p. 455), among others, that, although it broke out in the wake of a general crisis that was itself “felt in all the countries where gold was the standard money,” the 1907 panic itself was “confined to the United States.” Piatt Andrew (pp. 290-91) draws particular attention to the lack of any currency panic or premium in England, France, and Prussia; but because these places all had central banks, their avoidance of panics isn’t itself telling. Far more revealing is Canada’s experience, for Canada also avoided panics, and it did so, not by relying on a central source of emergency reserves, but simply by letting its commercial banks issue paper currency on terms roughly identical to those governing their creation and administration of deposits. The result was a perfectly “elastic” currency stock, meaning one that responded automatically to the public’s changing needs.

In a brilliant paper that deserves more attention, Bruce Champ, Bruce Smith, and Stephen Williamson modify Diamond and Dybvig’s model so as to capture the implications of either allowing or not allowing banks to issue their own redeemable paper currency, where the need for such currency fluctuates. They compare U.S. and Canadian seasonal and cyclical movements in interest rates, reserves, note circulation, and other variables, and then show that their modified model does a good job explaining both those patterns and the fact that the United States experienced occasional banking panics, while Canada didn’t.

A final body of evidence suggesting that U.S. banks might have fended for themselves, and avoided currency panics, simply by issuing notes backed by their general assets, consists of the successful employment of “emergency” currencies during those panics. On several occasions when U.S. banks restricted cash payments, a substantial part of the public’s currency needs was met by various temporary expedients, including small-denomination clearinghouse loan certificates, round-denomination cashiers’ checks, and local scrip; and that was never more the case than in 1907 when, according to Piatt Andrew, some $500 million of such ersatz currency was issued. This was about $150 million more than the total outstanding value of national banknotes. “For two months or more,” Andrew says,

these devices furnished the principle means of payment for the greater part of the country, passing almost as freely as greenbacks or bank-notes from hand to hand and from one locality to another (ibid., p. 515).

Like national banknotes, but unlike greenbacks, these temporary currency substitutes weren’t legal tender. What’s more, they were of doubtful legality, if not plainly illegal. Yet “no one thought of prosecuting or interfering with its issuers,” and “in default of any legal means of relief, it worked effectively and doubtless prevented multitudes of bankruptcies which otherwise would have occurred” (ibid., p. 516). As the late Steve Horwitz observes, in his own excellent analysis of the 1907 panic, if such ersatz currencies could do that, it’s hardly a stretch to suppose that, had they been free to issue proper banknotes, backed by their general assets, national and state banks might have been as safe from panic as their counterparts in the Great White North. Horwitz’s supposition was in fact shared by many contemporary authorities, including Joseph French Johnson (p. 466), a great admirer of the Canadian banking and currency system who observed, after the 1907 panic had ended, “That our banks should have had the legal right to do what they did outside the law during the panic is now pretty generally admitted.”

Pretty generally admitted; but, alas, never acted on.

The Freedom Fix

Saying that the United States might have avoided panics just by repealing laws that prevented banks from issuing more of their own paper banknotes isn’t saying that other reforms wouldn’t have been helpful. As Champ et al. (p. 860) note, while their model suggests that “a system of unrestricted banknote issue backed by general assets could…function fairly well,” it abstracts from “other organizational problems,” including barriers to branch banking, that can also contribute to instability. While freedom of note issue worked well in Canada, its success may have depended on the fact that Canada also allowed its banks to branch nationwide. Consequently, merely expanding U.S. banks’ ability to issue banknotes might not have sufficed to fully cure the United States’ currency and banking ills.

Nor were U.S. proponents of asset currency unaware of this. Instead, all championed various other reforms, often including the elimination of barriers to branch banking. They were especially anxious to make sure that, once they were no longer needed by the public, banknotes would be promptly returned to their sources for redemption. So, although freedom of note issue alone might not have been a viable alternative to a central bank, it was a crucial component of a viable set of mostly liberal banking reforms.

It follows from all this that, instead of serving as evidence that unregulated fractional reserve banking systems are inherently unstable, as both conventional wisdom and Diamond and Dybvig’s model suggest, the Panic of 1907 really demonstrates something quite different, to wit: that while in theory regulations make banking systems more stable, in practice they can do just the opposite.

The post Diamond and Dybvig and the Panic of 1907 appeared first on Alt-M.