The working premise for 2023 is that, as long as the Fed continues to raise rates, stocks will struggle. In fact, there is a high level of speculation about the so called “terminal rate,” the interest rate to which the Fed is willing to go to in order to whip inflation. As of the most recent Fed “dot plot”, the central bank has communicated that it may raise rates above 5%.

It doesn’t take a whole lot of imagination to pencil in a whole lot of damage to both the stock market and the economy if they go much beyond that. That said, there are still some sectors of the stock market which will, more likely than not, outperform others due to the state of the supply and demand balance in their business. One of them is housing.

Housing Will Likely Surprise to the Upside

I’ve been bullish on the homebuilder stocks for quite a while. I was even bullish when the sector crashed and burned in the middle of 2022 as the summer blowoff in prices for existing homes imploded. And I remain long-term bullish.

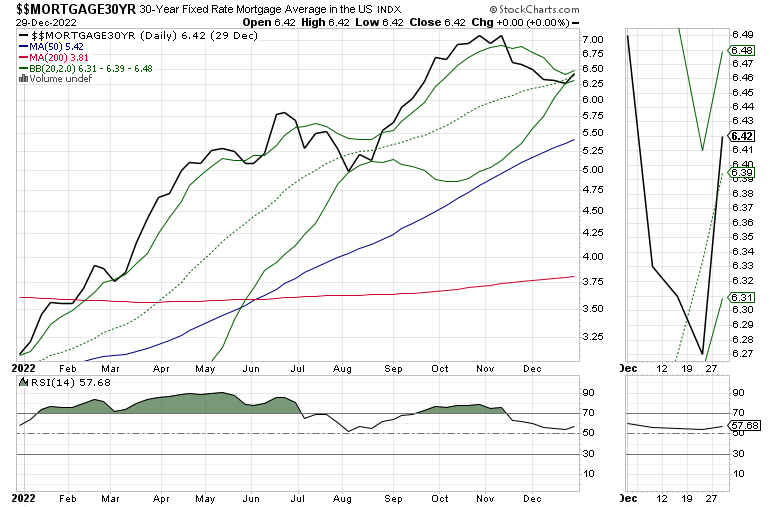

Of course, as the Fed continues to raise interest rates, mortgage rates will likely retain their recent upward bias. This will have a negative effect on home sales and create short-term difficulties for homebuilders. The recent rebound in mortgage rates will not be helpful.

At the same time, it’s important to delineate the important differences between the homebuilders (new housing), the existing home markets, and the rental markets.. That’s because even though they are all related, each has its own set of internal dynamics which influence how they operate.

The Brave New World of Housing

To understand the U.S. housing markets it’s important to review the two seismic events in recent history which have shaped the current supply and demand balance: the 2008 subprime mortgage crisis and the COVID pandemic. Although they were twelve years apart, they are irreversibly intertwined and, together, created the environment which favors homebuilders the most for the present and likely for the future.

After the 2008 crash, many homebuilders faced near-death experiences as their overbuilt inventory sat idle for years. As a result, they stopped building homes. This created a long-term supply crunch for new homes. Moreover, when the overall situation improved, they still didn’t overbuild. This perpetuated the undersupply of new homes, even as populations grew and shifted.

The pandemic caused a population shift from cities to suburbs and, in many cases, to other states, especially the sunbelt, where COVID restrictions were fewer and jobs and economies recovered faster compared to states which kept pandemic restrictions in place longer.

Meanwhile, the Federal Reserve’s massive QE and zero interest rates added to the demand for housing, as buyers fleeing cities looked to own their homes instead of renting apartments. This demand was very pronounced in the sunbelt and states with lower restrictions, due to the large numbers of people who moved there. Initially, this also favored landlords in those areas, as the short supply of homes drove many to rent.

When the Federal Reserve began their interest rate increases, all segments of the housing market stumbled. But as time has passed, both realtors who deal in existing homes and landlords have struggled more than homebuilders. In fact, homebuilders have remained in the driver’s seat, as a low supply of existing homes in preferred locations, persistently high rents from landlords, and a continuation of the migration to the sunbelt, combined with a limited supply of new homes, have perpetuated the most favorable conditions for homebuilders in a generation.

Perhaps the take-home message is that, even after a huge increase in interest rates in 2022, homebuilders are still in a very profitable position.

REITs and Rentals – Online Brokers and Existing Homes

For stock investors, the rental market is best traded via the real estate investment trusts (REITs). These are fairly easy to trade, because they will usually rally when interest rates fall, and fall in price when interest rates rise. They are particularly sensitive to the Federal Reserve’s interest rates and to the trend in yields in government bonds, especially the U.S. Ten Year note (TNX).

In the current market, corporate entities own a disproportionate amount of rental units. This dominance of the market, combined with low supply in attractive locations, has kept rents at high levels for an extended period of time. But as the economy has slowed, landlords in high tax, high-regulation states have seen their vacancy rates rise, while those in low tax, low regulation states have seen high occupancy rates.

Existing homes are equally interest rate-sensitive, but are a bit harder to trade via the stock market. One way to trade the trend in existing homes is via the shares of companies, which own real estate brokerages such as online broker Redfin (RDFN).

Generally speaking, these types of stocks do well when existing home sales are rising and interest rates are falling.

Homebuilders Beat to a Different Drum

Homebuilder stocks are also interest rate-sensitive, as mortgage rates are tied to bond yields. As a result, the price of stocks such as D.R. Horton (DHI) and Lennar (LEN) often follow the same price trend as REITs and online brokers.

But the current situation is slightly different. You can see that shares of D.R. Horton and Lennar fell for several months in 2022 as the U.S. Ten Year Old Note yield rose. However, the stocks responded well when the yields reversed. You can see that RDFN shares have yet to recover.

The reason that homebuilder stocks responded more favorably to the yield reversal is multifold:

There are fewer new homes available than there is demand. That’s because homebuilders stopped building after the 2008 housing crash and never quite picked up the rate of building to the levels prior to the crash.Demand for new homes remains high because there is a migration from high tax states to low tax states with a higher availability of jobs – especially sunbelt states such as Texas, Florida, and Georgia.Older homes are often less attractive than new homes due to their outdated amenities, location limitations, and, in many cases, poor upkeep. Moreover, in some states, rents are so high that it makes more sense to own a home.

These factors make new homes more attractive than existing homes. As a result, homebuilders remain in a more favorable position than real estate brokers and landlords.

Of course, that does not guarantee uninterrupted up trends in these stocks. And, if interest rates do rise significantly, they will have an adverse effect on the homebuilder stocks. Yet, when they eventually fall, the homebuilders will be in a better position than many sectors in the stock market because supply is on their side.

Higher interest rates are never good for most stocks. But it’s still possible to make money in stocks during periods of rising interest rates, if you know where to look. You can see when and how to fight the Fed and win in my latest video here.

I own shares in DHI and LEN.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

NYAD Remains 200-Day Moving Average

The New York Stock Exchange Advance Decline line (NYAD) remained below its 50- and 200-day moving averages, but really went nowhere in the final week of the year.

A similar picture can be seen in VIX, which means no major bets from put buyers materialized. When VIX rises, stocks tend to fall, as rising put volume is a sign that market makers are selling stock index futures in order to hedge their put sales to the public. A fall in VIX is bullish, as it means less put option buying. The lack of rise in VIX has been the reason for the lack of a complete meltdown in stocks.

Liquidity remained surprisingly stable as the Eurodollar Index (XED) has been trending sideways to slightly higher for the past few weeks.

The S&P 500 (SPX) seems to have found temporary support at 3800, but remains below its 20-, 50-, and 200-day moving averages. Accumulation/Distribution (ADI) has stabilized, but On Balance Volume (OBV) remains near its recent lows. ADI suggests short sellers are making quick profits and getting out, while OBV suggests that sellers are not quite done yet.

The Nasdaq 100 index (NDX) may have made a triple bottom, with the 10,500-10,700 price area bringing in some short covering.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition—Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader, and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.