(This is the last installment of a three-part essay. The other parts are here and here.)

A Capital Bank

As its title suggests, the best-known history of the RFC, James Stuart Olson’s (1982) Saving Capitalism: The Reconstruction Finance Corporation and the New Deal, 1933 -1940, is nothing if not a sympathetic review of that agency’s undertakings. Yet according to it, most of those undertakings—or most of them until World War II began—were no more successful than the Reconstruction Finance Committee’s commercial lending venture. The RFC’s support of state relief agencies and public works “did little to stimulate…employment” (ibid., 20); its early agricultural lending projects were failures (ibid., 21; see also 144), as were its efforts to keep the financial system from crashing (ibid., 29) and to raise commodity prices by financing gold purchases (ibid., 110). The Corporation’s loans to railroads “had not improved the railroad bond market” (ibid., 23); its Mortgage Company, formed in 1935 with $10 billion in capital, was a “cumbersome failure” that “never lived up to its expectations,” as were its other attempts to “buttress the real estate mortgage markets” (ibid.; 156; 174; 176). The RFC’s Business Loans Division sputtered out (ibid., 163-4); and the experience of the Export-Import Bank, of which the RFC “was firmly in charge” starting in 1936, “was no different,” its commercial loans having been “hardly enough to affect recovery” (ibid., 153; 164 and 174). The most obvious exception to this otherwise poor record was the corporation’s preferred share purchase program. But as we’ve seen, although that program “set the stage” for recovery by helping to stabilize and repair the nation’s banks and trusts, it was supposed to get banks lending again, and with regard to that objective it, too, was a failure.

Olson recognizes two other success stories among the RFC’s many flops: the Electric Home and Farm Authority (EHFA), which financed consumer appliance purchases, and the Commodity Credit Corporation (CCC), which made no-recourse loans to farmers secured by their crops, which it ended up owning and storing if their value fell below that of the lent sums. But the EHFA, Gregory Field (1990, 55) notes, “was never more than a minor league operation”: when Roosevelt shut it down in 1940, it had arranged a grand total of just a quarter of a million sales, worth $36.1 million, or less than 2 percent of all electrical appliance installment sales over the same period (ibid., 57). Olson’s favorable appraisal of it, Field says (ibid., n52), seems to depend in part on his belief that the agency financed 70,000 refrigerator sales in 1934 alone, when the agency’s records actually show that it negotiated only 4,886 refrigerator sale contracts for the entire period from its foundation through June 1935.

As for the CCC, while the $1,885 million in loans it made through the end of June 1941 certainly helped prop up the prices of various farm commodities, they did so only by saddling the CCC with losses equal to almost 10 percent of that sum, and far more crops than it knew what to do with, notwithstanding droughts that spared it a still bigger burden by severely reducing the 1934 and 1936 corn harvests (Shephard 1942, 591-98). Had it not been for WWII, which dramatically increased the demand for all sorts of farm products, the CCC would have ended up costing taxpayers a great deal of money. But even had it suffered no losses at all, the CCC could not be said to have helped end the Great Depression, or even to have helped U.S. farmers taken as a whole (Johnson 1954, 11).[1]

Yet the RFC had one client that benefited immensely from it, and that was glad to take full advantage of its exceptional lending capacity: the federal government itself, and particularly its executive branch. The RFC’s status rendered it “free from the most part from the annual pilgrimages other agencies made to beg for appropriations” (Olson 1982, p. 43). Government officials were quick to recognize the potential advantages of this unusual arrangement, which made it possible for them to secure funding for their various projects without having to pass an appropriations bill. Once they did, appropriations could be dispensed with altogether, for, as a former Federal Reserve official observed some years later, the RFC’s own undertakings “could be enlarged indefinitely, as they were to almost fantastic proportions” (Olson 1982, p. 43).

While the Hoover administration took relatively little advantage of the RFC’s ability to finance “backdoor spending,” Roosevelt wasted little time turning the agency into “the capital bank for the New Deal”—a device for financing all sorts of executive undertakings, such as the Treasury’s gold purchases, including the establishment of other alphabet agencies.[2] Under the Leadership of Jesse H. Jones, whom Roosevelt placed in charge of it (and who himself later wrote of Roosevelt’s inclination “to use the RFC as a sort of grab bag or catchall in his spending programs” (Jones 1951, 4), the RFC steered vast amounts of money, directly or indirectly, into every congressional district; and “[o]n any given day there was a line of senators and congressmen waiting outside” Jesse Jones’s office, with the aim of making sure there’s got its share (Olson 1982, p. 49). Little wonder that the Saturday Evening Post described him, on the last day of November 1930, as the second most powerful man in the nation, second only to FDR himself.

And the Post hadn’t seen anything yet.

“Unlimited Power to do Anything”

When, following Germany’s invasion of the Low Countries on May 10th, 1940, Roosevelt responded by promising to equip the nation with “production facilities for everything needed for the Army and Navy for national defense,” it was only natural for him to look not just to Congress but to Jesse Jones for some of the billions that effort would ultimately cost. But if the RFC was to contribute any substantial amount toward that effort, its lending capacity would have to be considerably enhanced. Besides having its borrowing capacity greatly increased, it would have to be allowed to take greater risks in extending credit to firms supplying war materiel than it could take otherwise. Despite initial objections by many legislators, including the arch anti-New Dealer (and isolationist) Senator Robert Taft’s (R-OH), to an administration proposal Taft characterized as one that would give the RFC “almost unlimited power to do anything,” Congress eventually did just that, allowing the corporation “to take any action deemed necessary” by the President and Federal Loan Administrator “to expedite the defense program” (Cho 1953, 82-87). Asked, at a Senate Banking Committee hearing held toward the end of the war, just what he understood this language to mean, Jones explained: “We can lend anything that we think we should…any amount, any length of time, any rate of interest, and to any-body.”

For the duration of the war, the RFC’s defense-related activities overshadowed all of its other undertakings, to the point, Olson (1982, 217) says, where it “ceased to be a recovery agency and came to resemble its ancestor, the War Finance Corporation” (ibid., 216). But Olson here understates things considerably, for during WWII the RFC was nothing less than the government’s principal financial agent (Cho 1953, 319). By June 30, 1947, when its authority to do so expired, it had authorized $1.85 billion worth of “national defense” loans to private firms, which was about $300 million more than its ordinary industrial loans. It had lent hundreds of millions to other government agencies for war-related purposes. But its biggest contributions by far consisted of its financing, to the tune of more than $21 billion dollars, eight wartime subsidiaries, including an $8 billion Defense Plant Corporation which, at the war’s end, owned around 11 percent of the United States total industrial capacity (Cho 1953, 109).

All told, the RFC’s defense-related wartime commitments amounted to about $25 billion, with actual disbursements of some $23.5 billion (Cho 1953, 162). During the same period, the RFC handed just $90 million to financial institutions—less than 3 percent of its pre-1935 disbursements to them. In short, if the RFC was promoting recovery during the war, it was doing so fortuitously, as a conduit for military spending.

It’s owing to that RFC role, and in spite of his awareness of the failure of so many of its projects, that James Stuart Olson credits the RFC with “Saving Capitalism.” Olson has in mind not the RFC’s activities prior to 1940, when it was ostensibly serving as a New Deal recovery agency, but its contribution to “massive federal spending” afterwards, which he, like most people, credits with ending the depression (Olson 1982, 220). The war thus saw to “the fulfillment of [the RFC’s] 1930’s expectations” (ibid, 224). Perhaps so. But whatever it did for the U.S. economy, the Second World War was not part of the New Deal plan.

A Parade of Scandals

That Congress allowed the RFC to become so powerful was mainly a result of what Hyo Won Cho (1953, 320) calls its “unbounded confidence” in Jesse Jones. But as Cho, a student of the agency’s “evolution,” remarks, “a sound government principle cannot be built upon faith in one man, for officials are mortal and fleeting” (Hyo Won Cho, 1953, 320).

After having held the RFC’s purse strings for a dozen years, during the last five of which he served concurrently as Federal Loan Administrator and Secretary of Commerce, Jesse Jones had to let go when Roosevelt offered both of his jobs to Henry Wallace.[3] Although Jones, who detested Wallace, ultimately persuaded Congress to put Wallace in charge of the Commerce Department only, he never worked for the federal government again.

Until Roosevelt’s death, the post of Federal Loan Administrator was filled by Fred Vinson, the future chief justice, after which it went to Jones’s former special assistant, John Snyder. But on June 30th, 1947, Truman signed an amendment that drastically overhauled the RFC. Besides depriving the agency of many of its former powers, now considered redundant, the amendment did away with the position of Federal Loan Administrator, returning control of the RFC to the Board of Directors, which effectively meant allowing it to manage any loan approved by at least any three of its five directors.

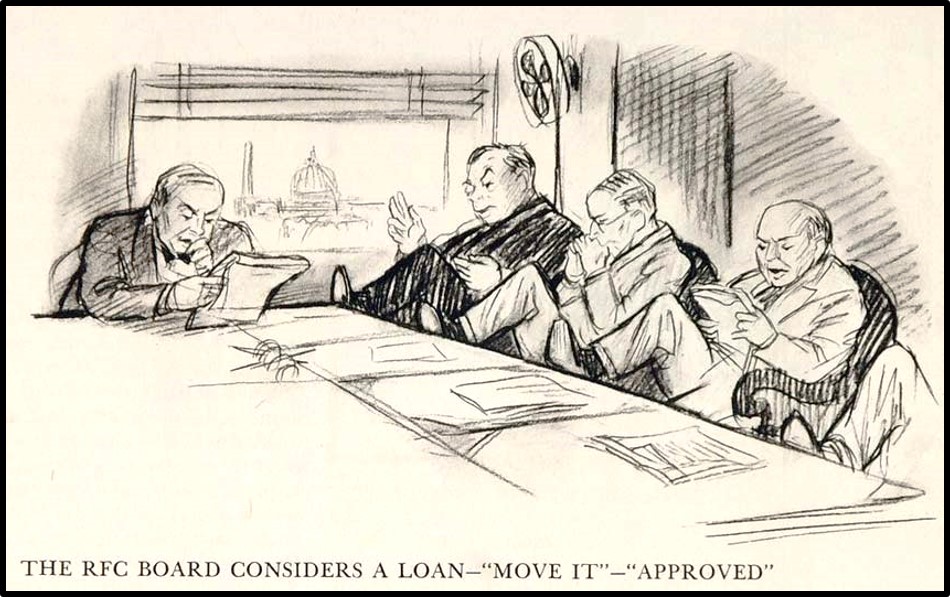

The outcome of this lack of overarching supervision was a panoply of postwar RFC loans the sole aim of which seemed to be that of gratifying either its directors’ acquaintances or strangers who bribed their way into their good graces (Cho 1953, 215-69). Although suspicions of RFC favoritism and insider dealing were as old as the agency itself, and those suspicions were far from groundless, its director’s postwar misconduct was far too brazen to stay undercover for long. The big reveal came in the course of hearings held between April 1950 and May 1951 by a special RFC subcommittee of the Senate Banking Committee, a.k.a. “the Fulbright Committee” after its chair, Arkansas Senator J. William Fulbright.

Those hearings, concerning RFC loans to Texmass Oil, to Lustron Corp. (a manufacturer of prefabricated all-metal homes), to the Kaiser-Frazer automobile company, and to Boston’s Waltham Watch Company, among other doubtful enterprises, make for painful if spellbinding reading. But as this essay is already too long, let’s skip to the committee’s February 5th, 1947 interim report, on “Favoritism and Influence.” “[I]n a five-man Board,” the report says, “it is possible for the individual members to avoid, obscure, or dilute their responsibilities by passing the buck from one to the other, or to subordinate employees” (United States Congress 1947, 2). And how! The report then proceeds to summarize the frequent, “improper use” of the RFC’s “vast authority” that resulted from outsiders’ influence over its directors, including a

large number of instances in which the Board of Directors has approved the making of loans, over the adverse advice of the Corporation’s most experienced examiners and reviewing officials, notwithstanding the absence of compelling reasons for doing so and the presence of convincing reasons for not doing so (ibid.)

Three months later, Herbert Hoover summed the situation up dryly before the full Senate Banking Committee. “It would appear,” he said, “that the test of public interest has been very little applied in recent years” (Cho 1953, 275).

The Fulbright Committee’s revelations only served to turn the volume up on what had already been “a clamor for abolition of the RFC from the Congress as well as from the public” (ibid., 322). The clamorers included none other than Jesse Jones himself, who expressed his opinion to the committee in a letter dated April 10, 1950. “As for the future of the RFC,” he wrote, “I think it should be given a decent burial, lock, stock, and barrel.” The first, and most compelling, reason Jones offered for taking this position was simply that “none of the conditions which prompted the creation of the RFC exist today” (Cho 1953, 278).

What Jones didn’t say was that most of those conditions had ceased to exist by sometime in mid-1935.

Still, neither the Truman administration nor the Democratically-controlled 82nd Congress chose to bury the RFC, decently or otherwise. On the contrary: they ended up extending its life until 1956. But the grim reaper had other plans: on November 4th, 1952, Eisenhower won by a landslide, and the Democrats lost control of both houses of Congress. The following June, the new government passed the Reconstruction Finance Corporation Liquidation Act, calling for the corporation to be dissolved two years ahead of schedule. Just as it had taken a Republican president to give birth to the RFC, so, too, did it take one to kill it.

Continue Reading The New Deal and Recovery:

Intro

Part 1: The Record

Part 2: Inventing the New Deal

Part 3: The Fiscal Stimulus Myth

Part 4: FDR’s Fed

Part 5: The Banking Crises

Part 6: The National Banking Holiday

Part 7: FDR and Gold

Part 8: The NRA

Part 8 (Supplement): The Brookings Report

Part 9: The AAA

Part 10: The Roosevelt Recession

Part 11: The Roosevelt Recession, Continued

Part 12: Fear Itself

Part 13: Fear Itself, Continued

Part 14: Fear Itself, Concluded

Part 15: The Keynesian Myth

Part 16: The Keynesian Myth, Continued

Part 17: The Keynesian Myth, Concluded

Part 18: The Recovery, So Far

Part 19: War, and Peace

Part 20: The Phantom Depression

Part 20, Coda: The Fate of Rosie the Riveter

Part 21: Happy Days

Part 22: Postwar Monetary Policy

Part 23: The Great Rapprochement

Part 24: The RFC

Part 25: The RFC, Continued

Part 26: The RFC, Conclusion

___________________________

[1] That the CCC did not contribute to recovery isn’t very surprising, given that its particular aim, like that of its Hoover-era predecessor, the Federal Farm Board, and of New Deal farm policies generally, was not so much promoting growth in national income as assuring U.S. farmers their “fair share” of it. Hence Henry Wallace’s statement, in his last (1940) annual report as Secretary of the Treasury, that “Even full domestic employment…would not remove the need” for those programs, and the programs’ persistence long after the depression ended. Yet the “fair share” goal itself was rather dubious because the brief pre-WWI period that served as the basis for arriving at it happened to be one during which farmers were more prosperous than ever. On this see Willard D. Arant, Farm Parity Fallacy. New York: National Economy League, 1941.

[2] A story Jones tells in his autobiography (1951, 456-64), illustrates, amusingly, the sort of flexibility of which the RFC was capable, and just how willing FDR was to make use of it. One day in 1942, Roosevelt sent Jones a memo asking him to look into the possibility of having the government buy the Empire State Building, or the “Empty State Building,” as it had come to be referred to, since it was mostly unoccupied for most of the 1930s. Those vacancies cost the building’s owner and principal occupant, former New York governor and Democratic presidential candidate, Al Smith, a lot of money. At the price Smith and his associates wanted for it, the skyscraper was no bargain; but Roosevelt wanted to “do something for Al Smith,” who helped get Roosevelt’s own brilliant political career started. But why had he approached Jones? “If the President wanted the government to buy the world’s tallest skyscraper for government use,” Jones explains, “he should have asked the Public Buildings Administration to buy it; but then he knew that the Congress would not authorize the money, so he turned to me.” Jones, being Jones, demurred.

[3] As Cho (1953, 168) explains, although Jones had to resign his position as RFC chairman upon being made Federal Loan Administrator in 1940, because his authority in the new post “transcended that of [the RFC’s] Board of Directors, he continued to dictate the RFC’s policies and supervise its activities.

The post The New Deal and Recovery, Part 26: The RFC, Conclusion appeared first on Alt-M.