Last week, the number of companies reporting earnings expanded, with heavyweight names Tesla (TSLA) and Netflix (NFLX) getting the most attention. Both companies sold off sharply on Thursday despite beating estimates. The selling spread to other Nasdaq stocks after two heavyweight Semiconductor companies signaled continued weakness in the chip market.

Stocks from beaten-down areas of the market were treated quite differently, however, with healthcare giants Johnson & Johnson (JNJ) and Abbott Labs (ABT) spiking higher after beating guidance and raising their full-year outlook. Bank stocks — another area that’s underperformed amid a crisis — were the biggest winners, as they continued to rally on earnings even if they missed views.

The result was a week where the worst performing sectors year-to-date were last week’s top performeres, while winning sectors were at the bottom.

Could it be that investors are paying attention to valuations as earnings reports roll in? Next week will certainly test this possibility, with four mega-cap companies due to report while a host of additional bank and healthcare companies release results. Microsoft (MSFT), Meta Platform (META), Alphabet (GOOGL), and Amazon (AMZN) are also seeing a rebalance in their Nasdaq 100 weighting on Monday, in addition to their reports later in the week.

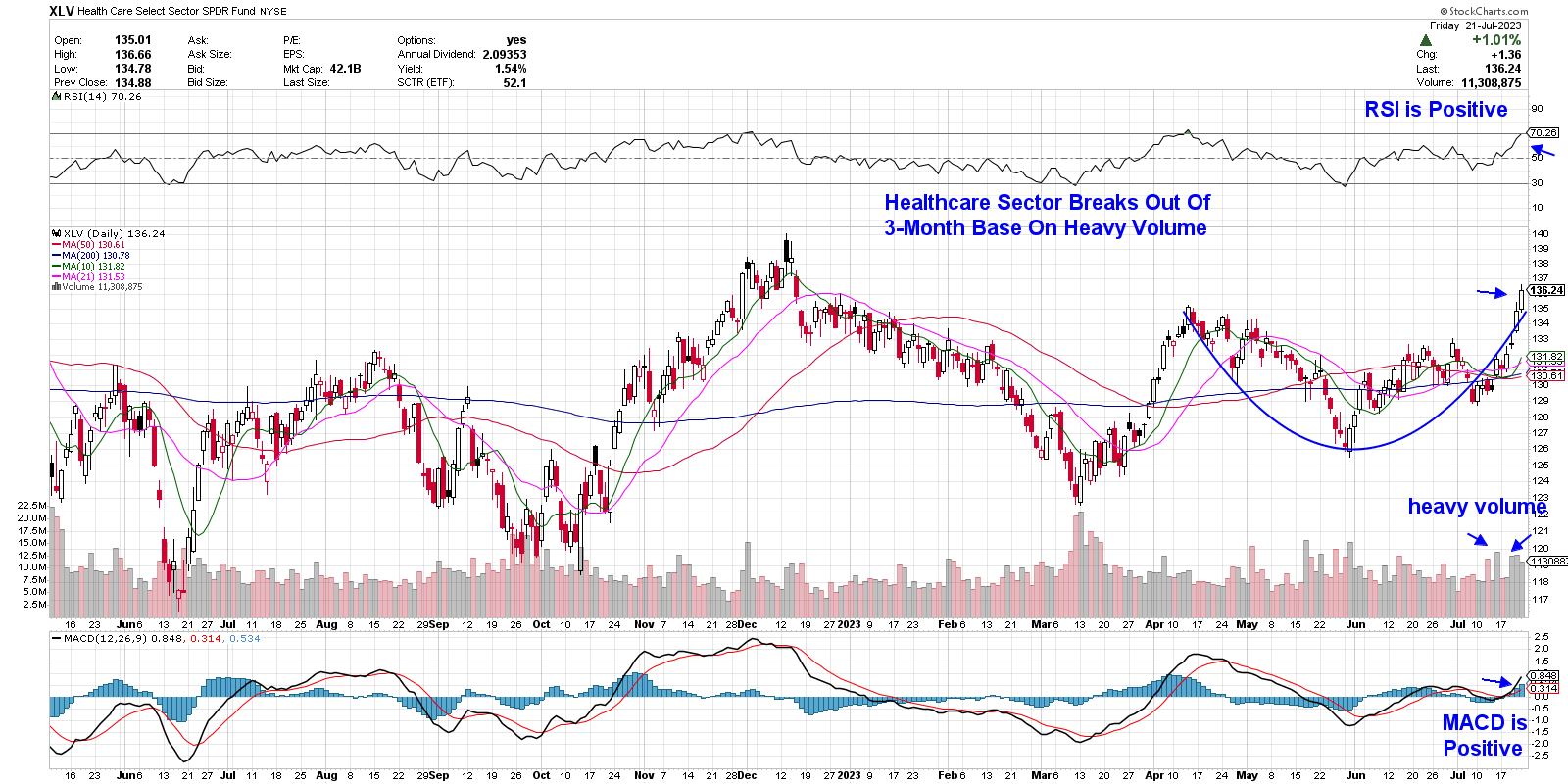

Daily Chart of Healthcare Sector

Above is a daily chart of the Healthcare sector after last week’s 3.5% rally pushed the group out of a 3-month base on heavy volume. With the sector poised to trade higher, I believe that pharmaceutical giant Novo Nordisk (NVO) deserves a close look after last week’s move back above resistance at its 50-day moving average.

NVO sells two weight loss drugs while also working on additional treatments that are seeing positive results in trial studies. Today, Wall Street firm Morgan Stanley raised their forecast for annual sales of weight loss drugs to $77 billion, as patient demand for the medicines has outstripped supply amid a social media frenzy.

Daily Chart of Novo Nordisk (NVO)

NVO’s downtrend reversal occurred on above-average volume, while the MACD has just entered positive territory. Both positive characteristics join an already-positive RSI, as can be seen on the daily chart above.

Earnings season has always been a critical period for the markets, as not only is investor sentiment revealed based on responses to results, sector rotation such as last week’s move into Healthcare can take place. If you’d like to be alerted to these critical shifts, use this link here to trial my twice weekly MEM Edge Report. We alerted subscribers to January’s move into Semiconductors while highlighting Nvidia as a buy candidate. The stock has gained 158% since then!

Warm Regards,

Mary Ellen McGonagle, MEM Investment Research