Giving written evidence to the UK Parliamentary Treasury Committee inquiry into SME finance, ACCA set out a gloomy picture of SMEs struggling to access finance.

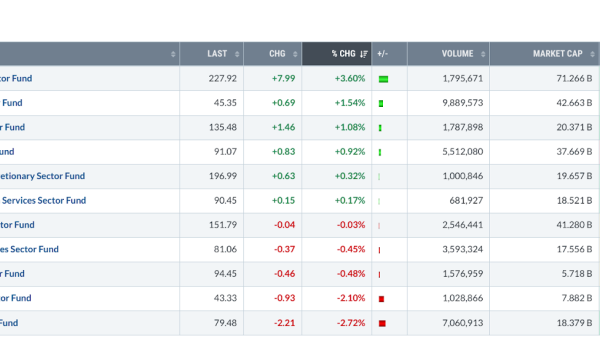

Drawing on its Global Economic Conditions Survey (GECS), ACCA says that the proportion of SMEs having problems accessing finance remains below the long-term average.

ACCA data shows that firms are struggling to secure working capital due to several factors including rising interest rates. Over half (57%) reported borrowing to manage cash flow has been more difficult in the last quarter than over the previous 12 months. Almost half (47%) say that supplier credit is harder to access, while over a quarter (27%) report accessing support from HMRC’s Time to Pay scheme is more difficult.

Glenn Collins, head of technical and strategic engagement, ACCA UK, said: ‘More effort is needed in encouraging banks to reach out to the SME community and to provide more suitable financial products. But the established high street banks aren’t the only show in town when it comes to business finance. Equity finance offers an alternative route to raising funds. And government needs joined up thinking to make sure it is not accidently restricting the flow of finance to this crucial sector.’

Late payment continues to be a persistent problem in the UK, hindering cashflow throughout supply chains ultimately leading to devastating consequences for some SMEs. ACCA members noted that late payments by large corporate companies has the biggest and most detrimental impact on the stability of small businesses. Late payment from large businesses creates a ‘domino effect’ throughout the supply chain.

ACCA members report that SMEs are looking to alternative channels for finance other than banks.

They currently remain the most significant source of external finance for formal small firms. But bank finance is generally only available to those businesses that can offer collateral or a strong record of generating profit. This leaves out a sizeable proportion of the SME population, including those in the informal sector, and at the other end of the scale, those with high growth ambitions and mostly intangible assets in need of large investments. SMEs are consistently critical of banks’ service and communication.

While SME funding is difficult across the board, under-represented groups struggle in particular. ACCA is calling for funders to publish statistics to show the proportions of funding applications approved, agreed in full, partially agreed or rejected by demographic, for example, gender, ethnicity, type of business. Such statistics might help establish whether there is or continues to be a disparity or whether businesses might be self-selecting out through perception issues.

Read ACCA’s submission.

Read more:

MPs told UK SMEs facing working capital squeeze