Foreign multinationals paid £70 million in additional tax in Britain last year amid a crackdown on international companies diverting profits to lower-tax jurisdictions.

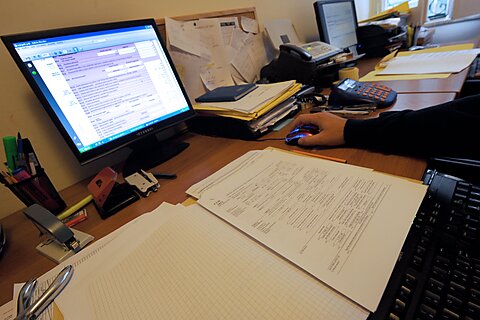

Data obtained by Pinsent Masons, the law firm, showed that HM Revenue & Customs had opened nearly 150 investigations into multinational companies using legal tax evasion strategies, resulting in tens of millions in recouped taxes last year.

However, the repaid taxes are still far below the near-£10 billion lost through tax evasion strategies in 2021, according to HMRC calculations.

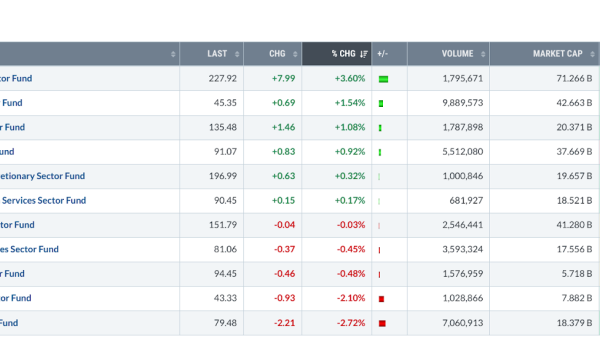

International companies can engage in “transfer pricing”, which allows multinationals to reduce their tax liability in the UK by shifting their profits to jurisdictions with lower taxes. Pinsents said such companies voluntarily had paid about £70 million in additional British taxes as part of a scheme to avoid being hit with penalties under HMRC’s diverted profits tax, which is charged at a rate of 31 per cent.

Companies that have underpaid taxes in the UK can come forward and top up their tax bills as part of the scheme to weed out legal tax evasion.

In 2020-21, HMRC collected about £68 million in additional taxes, far lower than the estimated £9.3 billion lost through transfer-pricing strategies.

Sam Wardleworth, senior associate at Pinsents, said: “HMRC’s approach has been quite successful in persuading multinationals to come forward and admit they have shifted profits overseas and reduced their tax in the UK. The alternative is a costly tax investigation. Businesses that wait for HMRC to investigate them are more likely to be hit with higher ‘geared penalties’.”

Britain is part of an effort to root out multinational tax evasion that will introduce a global minimum corporate tax of 15 per cent next year. The global minimum levy, negotiated by 140 countries in the Organisation for Economic Co-operation and Development, prevents countries from losing tax revenue to ultra-competitive jurisdictions that offer tax breaks to foreign companies.

Read more:

Multinationals companies pay £70m under tax crackdown