The Immigration Skills Charge – a scheme to train UK workers using money from a levy on businesses hiring skilled migrants – has raised almost £1.5 billion, though how it is used remains unclear, the Social Market Foundation think tank has discovered.

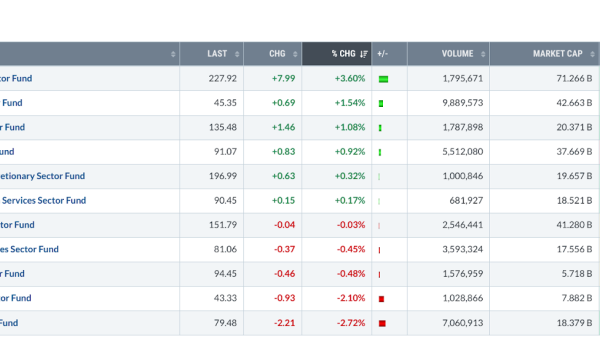

Numbers just published by the government reveal that the Immigration Skills Charge (ISC) generated £586 million in 2022/23, bringing the cumulative total raised since its introduction six years ago to £1.47 billion.

Under the scheme, medium and large employers sponsoring skilled foreign workers coming to the UK for more than a six-month period are charged on average £1,000 per worker in order to fund the training of the domestic workforce of tomorrow.

The proceeds from the charge have substantially increased in the last couple of years as hiring of overseas workers has rebounded very strongly post-pandemic, and post-Brexit the charge now applies to sponsoring of EU as well as non-EU workers.

Yet with no explanation of how the money is used, the SMF is calling on government to ‘use it or lose it’ – clarify how it is being invested to support the domestic skills base, or drop the charge entirely.

In a piece published today, the think tank argues that the current lack of transparency over how the proceeds are used is a huge missed opportunity to build public trust in the fairness of the UK’s work immigration system, by demonstrating and publicising that the benefits of immigration are being widely shared to benefit all of society.

Jonathan Thomas, SMF Senior Fellow, said: “The purpose and positive potential of the ISC is that the proceeds of a charge paid by employers to sponsor a skilled overseas worker today are used to train the local workforce of tomorrow. But there is no evidence that this is happening. It is totally unclear how the money raised is being used.”

“Using the proceeds of the Immigration Skills Charge for their proper purpose, and clearly accounting to the British public for that, is a perfect opportunity to counter the sense that hiring overseas workers leaves local talent overlooked and local training under-developed, instead showing that the overseas and domestic skills base can be mutually supportive and work in tandem.”

Read more:

Government urged to disclose how £1.5bn raised from migrant employment tax to train UK workers is being spent