Justin Logan

Fiscal hawk Brian Riedl, a senior fellow at the Manhattan Institute, has an article in The Bulwark titled “In Defense of Defense Spending.” He argues that critics of US defense spending possess “a fundamental misunderstanding of federal budgeting, they also ignore looming threats to our national security.” I think he’s completely wrong about the national security questions, but I want to focus here on some of his economic analysis.

As the coauthor of an article titled “Why the U.S. Military Budget Is Foolish and Sustainable,” I have never been someone who thinks US defense spending is the root of all fiscal woes, or that cutting military spending can solve the national debt.

However, Riedl makes several missteps in his economic analysis. He protests that defense spending isn’t a problem because it

“has been the slowest growing category of federal spending” (emphasis in original) and

“has in fact declined from half of all federal spending in 1962 to just 13 percent this year,” and “as a share of the economy… from 6 percent to 3 percent of GDP.”

A few thoughts. First: Who cares how quickly defense spending has grown compared to other programs? The sizes of other federal programs’ increases are irrelevant to spending the right amount on defense. Measuring defense spending as a share of overall federal spending or as a share of national economic output can tell us nothing about whether our defense spending is too high, too low, or just right. The country could be broke and threatened, rich and safe, or any combination of those factors.

But the overall size of other federal programs is relevant. Voters frequently oppose tiny programs like foreign aid, but cutting those tiny programs can do little to help pay down the debt or close the nation’s yawning budget deficits. Riedl has been someone who argues for massive reforms to the biggest programs—Social Security and Medicare—to help fix the problem (we agree on this one!) but people who have to win elections haven’t been listening to us. Given that, it seems foolish to put much hope in huge reforms to those programs to fix the problem. It seems more likely it will get worse.

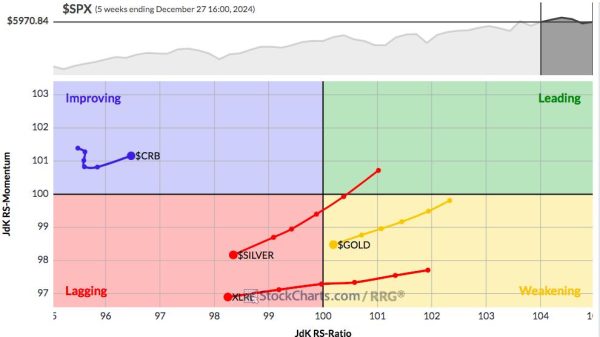

As this graphic makes clear, if Social Security and Medicare/Medicaid aren’t politically ripe for major cuts, that leaves you with interest on the debt, which isn’t amenable to many policy reforms, as well as defense spending and “income security,” which includes things like unemployment compensation, TANF, SNAP, and other welfare programs. The defense budget is going to be an increasingly appetizing target for deficit reduction. If forced to choose between Aunt Sally’s hip replacement and an exquisite new defense project, I suspect I know which voters will choose.

Riedl veers into full military Keynesianism when he defends aid to Ukraine on the basis that “much of what is categorized as ‘Ukraine aid’ stays in the US, replacing, upgrading, and modernizing American military supplies.” The suggestion here is that the US weapons being sent to Ukraine have little or no value to us, but quite a bit to Ukraine, and that the money spent replacing those missing weapons spurs US economic growth somehow. It’s the military‐industrial version of Keynes’ call to pay workers to dig holes and then to fill them up again.

Finally, Riedl draws on the work of Australian economist Peter Robertson to argue that Russia and China combined, when using the proper currency valuations, spend roughly as much as the United States spends on defense. Everyone hates defense economics, but there are real issues here. Robertson’s more recent work alleges that China’s defense spending is roughly 59 percent as much as US defense spending—about $476 billion. Robertson’s figure is the highest figure worthy of consideration. I haven’t figured out what, exactly, I think of it, but let’s accept it for the sake of argument here.

Riedl pockets that figure and moves on to an AEI report which takes the “military PPP” conversion rate that Robertson uses, then brings onto the books a number of (para)military Chinese programs, then compares overall Chinese spending to the US DOD budget. The report concludes that spending on the PLA is roughly equivalent to US defense spending.

Including China’s off‐book defense expenditures suggests you should also consider off‐book US expenditures, which are substantial. As MIT’s Eric Heginbotham explained at Cato in 2022, “if you’re going to go there, you have to compare that to a full notional US defense budget.” As Heginbotham showed, going there shows you a US defense expenditure at or above $1 trillion. The AEI report does not do this, instead comparing the assembled Chinese figure to the DOD base budget. Apples and oranges.

I’m happy we’re beginning to have a debate about defense spending. For me, the strategic questions are central. But Riedl’s piece was a useful opportunity to look at some of the curious economic judgments that underpin the case for ever‐higher military spending.