The winner of Britain’s 4th July election will face an economy burdened by slow growth and high debt, posing challenges for achieving a strong recovery according to the recent data from the Office for National Statistics.

The economic challenges facing the UK are deeply rooted and multifaceted. Since the global financial crisis, the country has been further destabilised by subsequent events like Brexit, the COVID pandemic, and rising energy prices. As a result, the UK’s economic performance has lagged, especially in terms of productivity and living standards compared to other G7 countries.

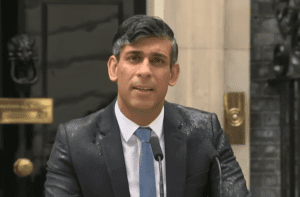

Prime Minister Rishi Sunak, despite facing a substantial opinion poll deficit, asserts that the economy is on the mend. He points to falling inflation and recent GDP growth as evidence of this improvement. However, economic forecasts remain cautious, predicting modest growth rates of 0.7 per cent in 2024 and 1.5 per cent in 2025, according to the International Monetary Fund (IMF). These figures are significantly below the pre-crisis average, indicating a long road to recovery.

The Labour Party, currently leading in the polls, attributes the decline in living standards to the policies of the Conservative government. Labour promises to revitalise the economy through increased private investment, aiming to address the stagnation that has characterised the past few years. Their proposed policies are focused on fostering a business-friendly environment that can drive growth.

However, Labour’s plans depend heavily on improving trade relations with the European Union. Since Brexit, strained UK-EU relations have hurt trade and investment. Labour admits that better relations are key to economic revival but faces significant challenges.

Both parties recognise that economic recovery requires immediate growth measures and long-term strategies to boost productivity, attract investment, and improve living standards. The upcoming election is crucial for setting the UK’s economic direction. Decisions made by the next government will profoundly impact the UK’s future and its ability to navigate the global economic landscape.

Khalid Talukder, Co-Founder, DKK Partners: “The upcoming July election is a pivotal moment for the UK to champion business and technology as key drivers of economic recovery. Despite current challenges, Britain can leverage its position in innovation and international trade.

The next government must prioritise policies that support the business and tech sectors, including investment in robust payment systems and attracting private investment. This will enable businesses to expand into new markets, drive technological advancements, and generate fresh revenue streams.

As we approach the election, focusing on strategic initiatives to bolster the economy is crucial.”

Read more:

Election Victory Means Inheriting UK’s Economic Burden