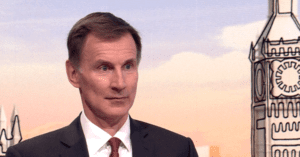

Chancellor Jeremy Hunt has urged regulators to rigorously scrutinise Daniel Kretinsky’s proposed £3.6 billion takeover of Royal Mail, amidst concerns about a potential break-up of the iconic postal service.

Hunt emphasised the importance of extending the safeguards currently promised by Kretinsky beyond their initial periods.

Speaking to LBC, Hunt highlighted the possibility of extending the legally binding commitments made by Kretinsky, whose company EP Group is the largest shareholder in Royal Mail. “It’s entirely possible we will decide that we should extend it beyond that, but that’s for three years’ time,” he noted.

Kretinsky’s assurances, part of his bid, include a promise not to split Royal Mail’s profitable parcels business, GLS, from its struggling letters division. However, this guarantee is only valid for three years after the deal concludes, causing anxiety about the company’s future structure.

Additionally, Kretinsky has committed to maintaining several key Royal Mail services for five years. These services include the one-price-goes-anywhere system and Saturday deliveries for first-class post. Other promises involve preserving the Royal Mail brand, protecting employee pensions, keeping the headquarters and tax residency in the UK, and continuing to recognise existing unions.

This acquisition marks the first time in its 500-year history that Royal Mail will be under foreign ownership. Kretinsky, who also holds significant investments in Sainsbury’s and West Ham Football Club, reassured that his goal is not to dispose of GLS but to potentially acquire additional companies to strengthen the business. He remarked, “Royal Mail is going strategically in the right direction, but not with the right speed.”

The deal is set to undergo a review under the UK’s national security laws, given concerns about the impact on critical infrastructure. Hunt reassured the public that essential services, such as six-day deliveries, will be preserved. “We will make absolutely sure that we protect what people want from Royal Mail,” he stated.

Labour has echoed these sentiments, committing to review the deal and uphold key Royal Mail services.

Addressing concerns about foreign ownership of national assets, Hunt underscored the necessity of international investment for modernising the UK economy. “I do think that for our economy to modernise, we need to attract investment from all over the world,” he said. “We have grown faster than other European economies because we’ve been more open to investment.”

As the government and regulators examine the details of the takeover, the focus remains on ensuring that Royal Mail continues to serve the public effectively while safeguarding national interests.

Read more:

Hunt Pledges to Safeguard Key Royal Mail Services Amid £3.6bn Takeover