Travis Fisher and Joshua Loucks

This blog is part of a series on technology innovation and free expression.

Artificial intelligence (AI) has emerged as a transformative technology, promising to revolutionize industries, amplify productivity, and unlock innovations unimagined a decade ago. However, as with every disruptive technology, AI presents new demands on the resources that enable its growth—and none is more critical than electricity.

Meeting the rise in electricity demand driven by AI requires the same high-tech creativity that gave us AI in the first place. If we are to deliver on the promise of an AI revolution in America, we must recognize that the US electricity industry—as it exists today—is not up to the task of powering a fast-moving new industry with an insatiable thirst for “juice.”

Only by reimagining the industry through the lens of liberty and market dynamism can we meet the AI moment.

How Much Electricity Does AI Need?

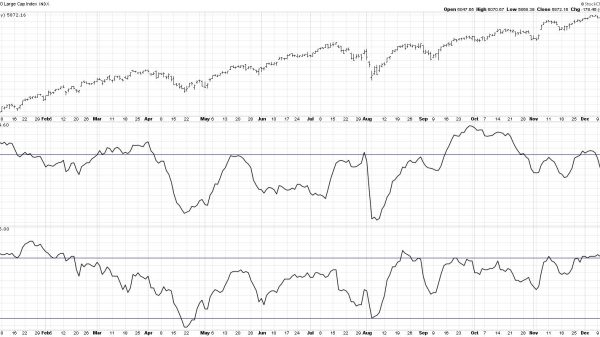

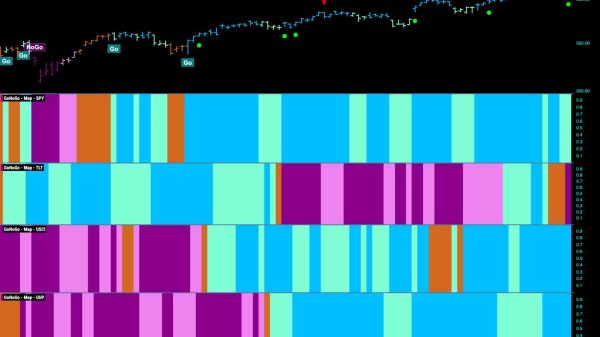

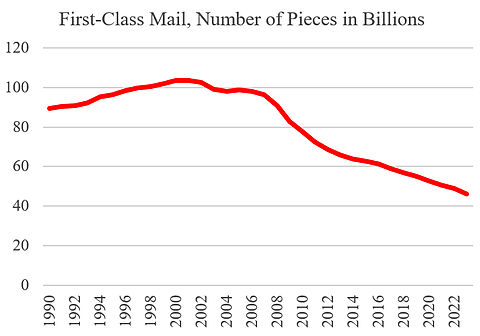

Data centers—the backbone of AI operations—consume vast amounts of electricity to train models, process information, and support real-time applications. As industries integrate AI into their workflows, the demand for power will surge far beyond current projections. Experts disagree over the precise size and speed of electricity demand growth necessary to support AI, but the consensus is that demand growth over the next several years will be much steeper than we have seen in decades.

According to the North American Electric Reliability Corporation, peak US electricity demand is projected to increase by 132 gigawatts (GW) over the next 10 years in the summer and 149 GW in the winter, a 15 percent and 18 percent increase, respectively. For context, the output of a large nuclear reactor, such as Unit 3 at Plant Vogtle in Georgia, is approximately 1,100 MW or 1.1 GW, and the entire fleet of nuclear reactors in the United States is about 95 GW.

This demand surge is largely due to the rise of data centers, which currently consume about 4 percent of US electricity generation annually but are expected to grow to between 4.6 percent and 9.1 percent by 2030, as estimated by the Electric Power Research Institute. The Federal Energy Regulatory Commission reports that data center load grew from 19 GW in 2023 to nearly 21 GW this year and is expected to climb to 35 GW by the end of the decade.

Goldman Sachs similarly finds that US power demand, driven in part by AI, electrification, and industrial reshoring, will spike in a way not seen since the early 2000s, with data centers projected to consume 8 percent of US electricity by 2030, up from just 3 percent in 2022. Notably, over the past two years, the 5‑year load growth forecast has surged more than fivefold, from 23 GW to 128 GW, according to Grid Strategies.

Source: John D. Wilson, Zach Zimmerman, and Rob Gramlich, “Strategic Industries Surging: Driving US Power Demand,” Grid Strategies, December 2024.

Regulatory Barriers to Electricity Supply Should Be Removed

Although the United States is the global leader in data centers today, our ability to support new growth is an open question. Like the moment in Gulliver’s Travels when the title character is tied down in his sleep by numerous tiny people (who were probably bureaucrats), the electricity industry has been lulled to sleep by decades of little demand growth and now finds itself blanketed in red tape and struggling to rise and meet the AI moment.

Policymakers should recognize what’s at stake and commit to major regulatory and administrative changes. Three main obstacles stand in the way of unprecedented growth in the electricity sector: 1) a wholesale power grid that already faces severe backlogs and can’t expand quickly, 2) a federal regulatory and permitting regime that punishes builders, and 3) monopoly protections at the state level that prevent entrepreneurs from offering new solutions.

Grid bottlenecks abound. The interconnection backlog for generation resources is well-worn territory, and researchers at the Rocky Mountain Institute (RMI) have covered this problem for years. The wait time for a typical new generator to interconnect to the transmission system is approximately five years. RMI finds that there is as much potential generation capacity waiting in interconnection queues as there is actively operating on the grid today. In addition to long wait times for generators, there is now an interconnection queue for large new electric loads (customers like data centers). If AI needs to move fast, today’s grid won’t cut it.

Permitting and regulatory barriers are a perennial problem. Beyond socializing the cost of new transmission projects, which we do not support, there are plenty of reforms that align with a free-market policy approach. Some even align with Trumpism, like the idea of expediting approvals for especially large or strategically significant projects. Perhaps nothing embodies the permitting hurdles facing AI better than a recent bee incident—Meta’s plans for a large new data center were reportedly quashed by the presence of rare bees at the proposed site.

The most painful sting does not come from the bees, per se, but the stifling NIMBYism enabled by well-meaning environmental statutes. And although the Environmental Protection Agency’s Clean Power Plan 2.0 is almost certain to be eliminated by the second Trump administration, it is another example of burdensome regulations that presently make it much harder than necessary to build the new power plants required to meet the AI moment. Left in place, it would force the early closure of hundreds of existing power plants in an era of increasing demand. Good riddance!

America should stop protecting electric monopolies. We must break the chains of state-sanctioned monopoly and allow competitive forces to drive innovation, efficiency, and investment in new electricity resources. The prevailing system of electricity delivery is a relic of the past. Utilities were granted exclusive control over certain territories in exchange for state oversight to regulate prices and ensure universal service. Monopolistic utilities, shielded from competition, have little incentive to innovate, improve efficiency, or adapt quickly to changing market dynamics. The result is an energy system that is sclerotic and ill-equipped to handle the surging demands of AI and other high-tech advancements.

Enter the concept of private grids. As I recently wrote, “One solution to the monopoly problem is to allow new, private utilities to develop and compete wherever they make sense. But to disentangle these new utilities from the massive regulatory red tape that has enveloped existing utilities for decades, they would have to be physically unconnected to existing grids.” This concept is gaining momentum, and a new white paper reinforces two things: 1) huge “micro” grids are becoming more feasible every day, especially with large data centers looking for new ways to power their operations, and 2) the coalition behind private grids is incredibly broad and includes people of all political stripes and supporters of a diverse set of energy technologies.

Emergency Authorities Undercut Private Investment

President-elect Trump said he will “declare a national emergency to allow us to dramatically increase energy production.” Both the Trump and Biden administrations have flirted with using emergency powers when a closer embrace of market forces would produce much better results—using emergency authorities to influence energy markets sets a dangerous precedent that distorts competitive forces and undermines long-term reliability and affordability.

The previous Trump administration considered using Section 202(c) of the Federal Power Act to direct power plants to remain operational, particularly coal and nuclear facilities, under the guise of grid reliability and national security. Trump also considered using the Defense Production Act (DPA) to support struggling sectors of the energy market (primarily coal-fired power plants). The Biden administration invoked the DPA to boost the domestic production of supposed critical energy components such as solar panels and battery materials, further entrenching government intervention in energy markets.

Emergency measures create market distortions, artificially propping up specific energy sources or technologies at the expense of innovation and efficiency. The incoming Trump administration should reject the use of these wartime authorities, including Section 202(c), the DPA, and other similar mechanisms, to intervene in energy markets. Instead, it should focus on fostering competitive markets that can naturally adapt to changing energy needs.

America’s Electricity Future Should Be Defined by Markets

Imagine Benjamin Franklin visiting us today and marveling at the wonders of AI—machines that can compose music and visual art, diagnose illnesses, and free human beings from menial labor—all of which allow us to focus more deeply on our humanity. It is a fact that the widespread use of these innovations depends on abundant electricity. Not the occasional lightning strike or static electricity from a piece of amber, but the reliable provision of massive amounts of energy by wire at industrial scale.

When told that we mastered the technology of electricity production and distribution a hundred years ago but are bogged down by government red tape and monopoly privilege, Franklin might ask: How could we hold back such far-reaching human ingenuity with an antiquated system of regulation?

AI has the potential to solve some of humanity’s greatest challenges, but this potential will be squandered if we cling to an outdated energy model incapable of meeting the demands of the future. We must unleash the ingenuity of entrepreneurs and innovators eager to rise to AI’s energy challenge—or to the challenge posed by any other as-yet-created high-energy sector that could transform our lives for the better.