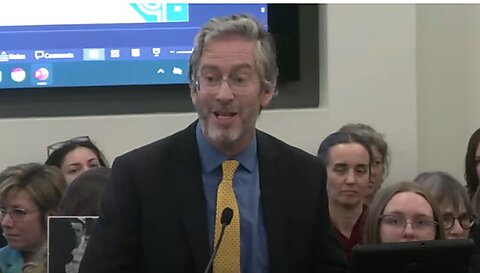

Greene King chief executive Nick Mackenzie has warned that rising business rates and employment costs are putting huge pressure on the UK pub sector, calling on the government to “level the playing field” and deliver meaningful reform by 2026.

Speaking after the October budget, which introduced significant tax changes for hospitality businesses, Mackenzie said Greene King expects to be hit with nearly £50 million in additional costs each year. He also revealed that national insurance increases and minimum wage rises will add a further £24 million annually — a figure that could double when full wage changes are included.

“The industry has been paying a disproportionate amount of rates for many, many years,” said Mackenzie. “We’re urging ministers to work with us to create a fairer system — one that delivers real and lasting change in 2026.”

Labour has pledged to introduce two permanently lower business rates tiers for hospitality, leisure and retail properties with rateable values below £500,000, beginning in 2026–27. But Mackenzie warned that businesses need certainty and support now to safeguard jobs and investment.

Greene King operates 2,600 pubs across the UK, including 878 managed pubs and 1,114 leased and tenanted sites, alongside two breweries. Its portfolio also includes 580 destination pubs under brands like Hungry Horse, Chef & Brewer, Flaming Grill and Farmhouse Inns.

Despite the pressures, Greene King reported 3.2% revenue growth in the year to December 29, reaching £2.45 billion, with strong Christmas trading and events such as Euro 2024 lifting performance. Adjusted operating profit rose 6.4% to £198 million, but statutory figures tell a different story.

A £208.5 million non-cash impairment linked to property and goodwill valuations pushed the company to a statutory operating loss of £16.4 million, compared with a £167.2 million profit a year earlier. Pre-tax losses reached £147.1 million, down from a £45.2 million profit in 2023.

Mackenzie said these impairments reflected not only market uncertainty but also the government’s policy decisions, which have “dramatically increased our costs”. A sharp rise in bond yields added further pressure to property valuations.

While Greene King continues to invest and modernise, Mackenzie stressed the need for government action to support a vital industry. “We need policies that encourage growth — freeing up investment, reducing red tape, and ensuring pubs remain at the heart of our communities.”

Founded in 1799, Greene King is best known for its beers including Greene King IPA, Abbot Ale, and Belhaven. The company was acquired in 2019 by CK Asset Holdings, controlled by Hong Kong billionaire Li Ka-shing, in a £4.6 billion deal.

Read more:

Greene King boss calls for business rates relief as budget adds £50 million in annual costs