Chris Edwards

I testified yesterday at a House hearing focused on low-income welfare programs, including housing and food programs. The Trump administration and congressional Republicans are proposing to cut some of these programs.

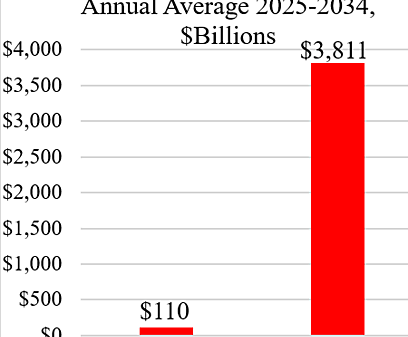

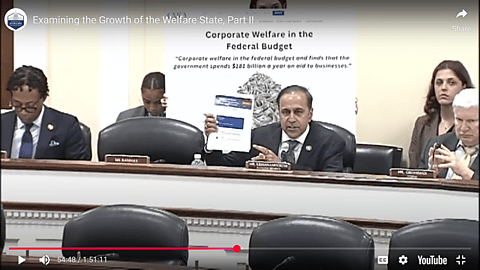

Such cuts were opposed by Democratic members at the hearing, and ranking member Raja Krishnamoorthi (D‑IL) argued that the GOP is more eager to cut low-income welfare than corporate welfare. On a large foam board, he highlighted my Cato study, which found $181 billion in corporate welfare in the federal budget.

Krishnamoorthi’s point was a good one, and I responded that I favored cutting both corporate welfare and low-income welfare. Both types of welfare create dependency, and both usually create outcomes worse than what is promised.

Furthermore, both types of welfare are less effective at solving problems than market-based solutions. My testimony discussed numerous market-based ways of tackling the housing affordability crisis.