Chris Edwards

On May 11, 60 Minutes examined the huge fraud problem in federal spending programs. The piece stressed the growing losses from large-scale looting of benefit and subsidy programs by criminal gangs based both here and abroad.

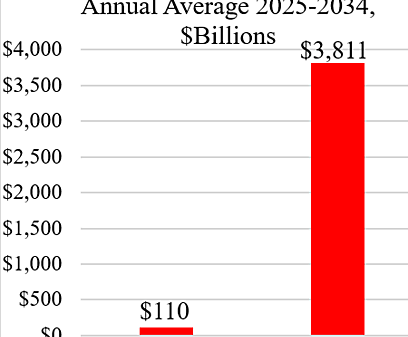

The federal government is a vast transfer machine. It spends more than $4 trillion a year on 2,400 aid, benefit, and subsidy programs—from Social Security and Medicare to hundreds of lower-profile programs that members of Congress probably don’t even know they are funding.

There is substantial fraud in nearly all the federal programs I’ve examined. People rip off the earned income credit, food stamps, housing tax credits, corporate subsidies, and many other programs. Medicare scammers rack up charges of more than $200 million before being caught.

In the past, when programs were administered by paper, large-scale scamming was more difficult. But today, looting-by-laptop is the norm. That is, submitting multiple false electronic claims to the government. In one scam during the pandemic, a California prison inmate and accomplices submitted hundreds of false claims for the Employee Retention Tax Credit and received $550 million in payouts from the IRS.

Such uncontrolled fraud is unfair to taxpayers and is one reason to eliminate programs. Running cleaner programs might be possible, but members of Congress resist rigorous safeguards, as that may slow the flow of benefits to their constituents.

Here are excepts from 60 minutes:

The fraud we’ll tell you about tonight is complex, pervasive and being carried out by transnational criminal organizations often using stolen identities to target U.S. taxpayers – costing the government hundreds of billions of dollars a year.

… No one knows the ins and outs of government fraud better than Linda Miller. She spent a decade at the Government Accountability Office, tracking how taxpayer money is spent and misspent, and even wrote the rulebook on preventing fraud in federal programs.

… Last year, the Government Accountability Office released a report estimating the federal government loses as much as $521 billion a year to fraud. But Miller and other fraud experts believe the number is higher.

Linda Miller: I believe the government is losing between $550 billion and about $750 billion a year. We’re coming up close to the $1 trillion amount — is lost, every year, to fraud.

Cecilia Vega: When most people think of government fraud, I imagine they’re thinking somebody is claiming disability benefits when they’re not actually eligible, somebody collecting food stamps when they’re not actually eligible. Are those the biggest offenders?

Linda Miller: Not at all, not by a long shot. What we’re really talking about is nation-state actors. We’re talking about organized crime rings. We’re talking about using vast amounts of stolen Americans’ identities to monetize them for, you know, criminal activity.

The problem exploded during the pandemic – when the government rushed trillions of dollars into the economy to help struggling Americans.

Applications for relief programs moved online, making it easier for people to access aid, but with few safeguards, scammers, hackers and organized crime rings also cashed in.

… Last year, the FBI unraveled one of the largest digital fraud cases in U.S. history, in which cyber criminals from around the world used stolen identities to pocket $6 billion in pandemic unemployment funds.

… Cecilia Vega: Why is the government a target for this type of fraud?

[The FBI’s] Bryan Vorndran: Because of the massive amount of money that exists in the federal government and in the state government.

… Cecilia Vega: What are the hot spots for fraud, right now?

Linda Miller: Disaster funding — is a really big issue. When a disaster happens in the country, the fraud actors see where it’s coming. They look at the zip codes. And they begin buying stolen identities, so that they can begin applying for disaster loans, disaster grants, on behalf of stolen identities.

… It’s not just one program. Where there’s money, there’s fraud — in unemployment, food stamps, disability, tax refunds — leaving Americans struggling to access what they’re owed.

All the while, criminals are one step ahead, using AI tools like deepfakes — often of innocent people — to cover their tracks.

… Multiple law enforcement and national security officials told us China is a top destination for stolen taxpayer dollars but the schemes are so complex and difficult to investigate, the true losses are unknown.