Inflation in the UK is forecast to accelerate sharply this month, with figures due next week expected to show the steepest monthly rise since October 2022, as households absorb a fresh wave of bill increases.

City analysts predict that the Office for National Statistics (ONS) will report inflation climbing to 3.6% in April, up from 2.6% in March — marking the largest month-on-month jump in more than two years.

This surge is being driven by widespread increases to energy and water bills, alongside rising employer payroll costs, higher minimum wages, and other administrative charges introduced at the start of the new financial year.

In April, Ofgem raised the energy price cap by 6.4% to £1,849, while the average annual household water bill rose by 26% (£123) to £603 — both major contributors to the expected inflation jump.

Sanjay Raja, chief UK economist at Deutsche Bank, forecast inflation to reach 3.4%, citing “historically large increases in energy and water bills” and additional inflationary pressure from changes to council tax, vehicle excise duty, and air passenger duty.

“Index-linked and administrative bills will be on the rise,” said Raja. “A later than usual Easter will also add to price momentum.”

Asset manager Investec anticipates a 3.3% reading, noting that the rise “will not come as a surprise to the Bank of England.” Economists expect several Monetary Policy Committee (MPC) members to comment on the data next week.

While global energy prices have eased, and the pound has strengthened against the dollar — lowering the cost of imports — domestic pressures are intensifying.

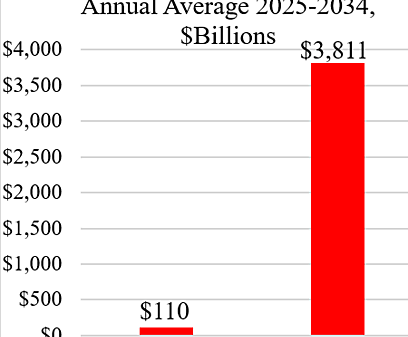

From April 6, businesses have faced a £25 billion rise in employers’ national insurance contributions, alongside a 6.7% increase in the minimum wage — both policies introduced by Chancellor Rachel Reeves in last year’s October Budget.

These increases are expected to hit sectors such as retail, leisure, and hospitality, which employ large numbers of low-paid and part-time workers.

Analysts at Pantheon Macroeconomics echoed these concerns: “Payroll tax hikes and the minimum-wage increase that kicked in at the start of April are likely to be the perfect excuse for a range of firms to jack up prices.”

Raja also suggested price increases could filter into cultural services, including concerts and gallery admissions, noting the Bank of England previously estimated that the NIC changes would add 0.2 percentage points to inflation.

Despite the near-term spike, inflation is forecast to hover around 3% for the rest of 2025. Investors still expect the Bank of England to deliver two further quarter-point interest rate cuts before the year ends, following cuts in February and May, which brought the base rate to 4.25% — its lowest level in over two years.

While short-term pressures remain, the overall inflation trajectory is expected to stabilise. However, policymakers will need to weigh the impact of domestic fiscal changes and global trade tensions — including tariff uncertainty following President Trump’s policies — as they navigate the path toward sustainable growth and price stability.

Read more:

UK inflation set for sharp rise in April after surge in household bills