Stock markets across Europe and beyond fell sharply this morning following a dramatic escalation in the global trade war by former US President Donald Trump.

On Thursday night, Trump announced a new wave of tariffs on imports from 92 countries, igniting fears of a significant blow to international commerce and a renewed slowdown in global economic growth.

In early trading, Germany’s DAX index dropped by 1.1 per cent, while France’s CAC 40 fell by nearly 1 per cent and Spain’s IBEX lost 0.6 per cent. London’s FTSE 100 was also down 0.5 per cent despite the UK and EU finalising a trade deal with the US earlier this week.

Economists warned the tariffs could damage business confidence and disrupt supply chains just as global trade had started to stabilise post-pandemic.

“This is a huge blow to global commerce,” said Atakan Bakiskan, US economist at Berenberg Bank. “The tariffs distort competition between firms producing in the US and those based abroad.”

However, Bakiskan noted that the blanket nature of the tariffs – a uniform 15 per cent levy applied to all affected countries – might cushion the blow compared to a more targeted approach.

“European, Japanese and South Korean manufacturers tend to compete more with each other than directly with US producers,” he explained. “Since they’re all subject to the same tariff rate, the competitive distortion is less severe than if the US had singled out individual countries with varying tariffs.”

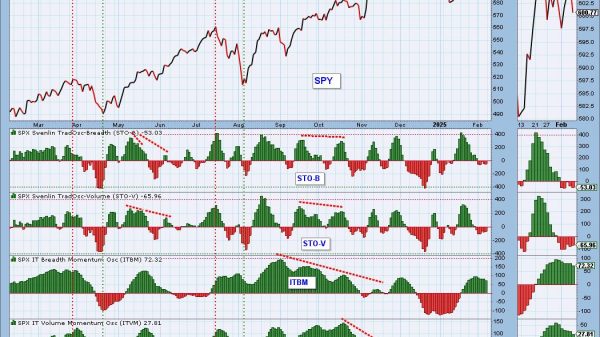

Nevertheless, the financial markets are clearly spooked. Analysts say Trump’s aggressive trade stance risks igniting retaliatory measures, disrupting international supply chains and pushing up prices for consumers and businesses alike.

The announcement comes amid a volatile period for the global economy, with inflation pressures lingering in key markets and central banks walking a tightrope between interest rate cuts and economic fragility.

If sustained, the latest tariffs could also test the strength of recent transatlantic trade agreements, as well as the willingness of major economies to maintain cooperation in the face of mounting protectionist pressure.

Investors will be closely watching the response from affected nations in the days ahead—and whether global markets can absorb yet another shock from the White House.

Read more:

Global markets slip as Trump unleashes sweeping tariffs on 92 countries