Former Deputy Prime Minister Sir Nick Clegg has warned that the current wave of valuations across the artificial intelligence sector is “crackers”, arguing that many AI businesses have yet to demonstrate viable paths to profitability despite the billions pouring into machine learning.

Speaking at The Times Tech Summit, Clegg said that even the world’s leading AI firms — including so-called “hyperscalers” developing large-scale models — are struggling to show how their capital expenditure will translate into sustainable returns.

“I think there’s certainly a correction coming in valuations,” he said. “These valuations do seem pretty crackers. I don’t see any business model yet, even of the leading AI hyperscalers, that can recoup that capital expenditure. Some of the AI labs that don’t have a particularly good business model will be very exposed in a market correction.”

Clegg’s comments add to growing concerns from economists and regulators that the AI boom may be inflating a bubble similar to the dotcom era. The International Monetary Fund’s chief economist recently drew parallels to the early 2000s internet crash, which wiped $5 trillion from markets, while the Bank of England has cautioned against a potential “sudden correction” in AI-related valuations.

Investors have poured tens of billions into foundation model developers and AI infrastructure providers, betting on long-term dominance in generative and enterprise applications. But analysts warn that high compute costs, slow commercial deployment and unclear monetisation models are creating tension between hype and profitability.

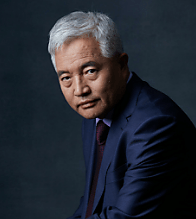

Clegg, who stepped down this year as Meta’s president for global affairs after six years with the company, also used his appearance to criticise Britain’s heavy dependence on American technology infrastructure.

“I think it’s pretty difficult to assert anything other than that we are a vassal state of American technology,” he said. “We are wholly dependent on every level of the stack for technology from a country where the geostrategic interests are no longer aligned in the same way they have been for the last 30 years.”

He warned that the UK’s lack of domestic AI infrastructure and homegrown capability left it in a “perilous state”, particularly amid widening political rifts between the United States and Europe.

Clegg’s intervention reflects a wider unease in Silicon Valley and global markets as AI development enters its first period of scrutiny since the 2022–23 hype cycle. While some companies — including OpenAI, Anthropic and Google DeepMind — continue to secure massive funding rounds, investors are beginning to demand clearer paths to revenue growth and operational sustainability.

Analysts expect 2026 to mark a turning point for the sector, with a likely market correction separating commercially resilient players from speculative bets. For now, Clegg’s warning serves as a reminder that even amid rapid innovation, the AI gold rush may be running ahead of economic reality.

Read more:

Nick Clegg: AI company valuations are ‘crackers’ and ripe for correction