What finally brought the Great Depression to an end? We’ve seen that, whatever it was, it took place not during the 30s but sometime between then and the end of World War II, when a remarkable postwar revival occurred instead of the renewed depression many feared. We’ve also seen that, while postwar fiscal and monetary policies weren’t austere to the point of preventing that revival, they alone can’t explain it, because they can’t explain the reawakening of private business investment from its decade-and-a-half-long slumber.

Animal Spirits

To get to the bottom of that reawakening, we must first recall the part businessmen’s fear of punitive federal government policies played in investment’s prewar quiescence. As I explained in an earlier series of posts, by mid- 1930s, New Deal policies and rhetoric had given businessmen ample reason to be apprehensive about the future. The planners frightened small businesses by treating them as relics of a bygone age, and compelling them to abide by codes mainly set by their larger rivals. The trust-busters scared big businesses by threatening to break them up. Neither group put much stake in either monetary or fiscal policy, let alone in Keynes’s advice to the effect that a depression was not the right time to be pushing their reforms. In this and other respects, as I explained in another set of posts, the New Deal, far from having tested Keynesian policies, was at loggerheads with Keynes’s own advice for achieving economic recovery.

Although it has long been customary to boil that advice down to a call for augmenting total spending (“aggregate demand”) through expansionary fiscal or monetary policy, Keynes himself did not leave it at that. Instead, in The General Theory’s chapter on “The State of Long-Term Expectations,” he recognizes a problem distinct from that of deficient aggregate demand that policymakers trying to end recessions or depressions must also reckon with, namely, the “extreme precariousness” of entrepreneurs’ assessment of the profits to be gained from their long-term investments. “Most, probably,” Keynes says,

of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits—of spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities… . [I]f the animal spirits are dimmed and the spontaneous optimism falters, leaving us to depend on nothing but a mathematical expectation, enterprise will fade and die.

When Keynes wrote these words, the animal spirits of U.S. industry were as dull as they’d ever been. And enterprise would not really revive until those mercurial sylphs once again cast their spell on businessmen, making them put aside “the thought of ultimate loss…as a healthy man puts aside the expectation of death.” For better or worse, this made economic prosperity

excessively dependent on a political and social atmosphere which is congenial to the average business man. If the fear of a Labour Government or a New Deal depresses enterprise, this need not be the result either of a reasonable calculation or of a plot with political intent;—it is the mere consequence of upsetting the delicate balance of spontaneous optimism. In estimating the prospects of investment, we must have regard, therefore, to the nerves and hysteria and even the digestions and reactions to the weather of those upon whose spontaneous activity it largely depends.

Keynes presumably had such thoughts in mind when, in February, 1938, he wrote FDR privately to tell him, in essence, that if his administration wished to promote recovery, it had to give businessmen reason to be optimistic, which meant being nice to them. “Businessmen,” Keynes wrote,

have a different set of delusions from politicians, and need, therefore, different handling. They are…easily persuaded to be ‘patriots’, perplexed, bemused, indeed terrified, yet only too anxious to take a cheerful view, vain perhaps but very unsure of themselves, pathetically responsive to a kind word. You could do anything you liked with them, if you would treat them (even the big ones), not as wolves or tigers, but as domestic animals by nature… . It is a mistake to think that they are more immoral than politicians. If you work them into the surly, obstinate, terrified mood, of which domestic animals, wrongly handled, are so capable, the nation’s burdens will not get carried to market; and in the end public opinion will veer their way.

Keynes was far from alone in offering such advice: that businessmen felt discouraged, and that New Deal policies were partly to blame for it, were depression-era platitudes to which some New Dealers themselves subscribed.[1] Alexander Sachs, another of FDR’s unofficial economic advisors, who ran the NRA economic research division, later maintained that entrepreneurship had been “stifled” by the NRA and other New Deal programs, as well as by policymakers’ all-too-evident contempt for capitalists. Businessmen, Sachs said, simply couldn’t be expected to invest in such an environment (Rosen 2007, p. 5). Getting them to do so meant freeing them “from the crippling controls and hostile atmosphere built up by the Roosevelt administration.” At one point Sachs shared his reflections with Keynes, who affirmed in reply that recovery depended on FDR’s becoming “reasonably kind to business” (ibid., p. 187).

That businessmen themselves agreed with Keynes and Sachs goes without saying. For example, on New Year’s Eve, 1937, GM’s Alfred Sloan bemoaned the failure up to then of the economy’s normal “forces of recovery,” which he blamed on

fear as to the future of American enterprise and the rules upon which it is to be conducted. In other words, our difficulties are political economic rather than purely economic. It seems to me that there is one remedy, and only one. Confidence must be reestablished on a firm foundation by demonstrated fact and understanding as to objectives and methods before American business can go forward with confidence. Panaceas’ will accentuate the lack of confidence that is already existing (quoted in Akerlof and Shiller 2009, pp. 71-2.)

Although Europe’s rearmament gave many U.S. businesses a new lease on life, it didn’t suffice to dispel businessmen’s fears. According to a November, 1941 Fortune poll more than 90 percent of business executives still anticipated “some kind of radical restructuring of the nation’s economy that would decrease their expected returns from investing in their businesses” (ibid., p. 70). Small wonder that private investment remained scanty.

What businessmen didn’t know that November was that the confidence they’d lost during the 1930s was about to be restored, with a vengeance. Within a year during which the U.S. government did all it could do to “persuade them to be patriots,” the animal spirits that had been dimmed for so long were glowing brighter than ever.

Reform on Ice

The proximate cause of this dramatic change in businessmen’s outlook was, of course, America’s entry into World War II. That step was to completely overhaul the government’s treatment of businessmen. However, as Alan Brinkley explains, in his brilliant 1996 book, The End of Reform, the stage for this dramatic turnaround was set several years before, by the 1937-8 collapse. From then on, Brinkley (1996, p. 139) says, the New Deal’s reform plans were swamped by a “growing conservative tide in national politics.”

When that collapse happened, the New Deal’s planners were already out of favor with FDR; and when the European war began they’d already ceased to be “either numerous or influential” (ibid., p. 40). (Rex Tugwell, their leader, left at the end of 1936.) In the meantime, the public had become extremely leery of Roosevelt’s Brandeisian-inspired attacks on business, regarding them—much as Keynes and Sachs did—as discouraging recovery (Gary Best (1991, p. 199): according to an August 1, 1938 report in Forbes, “all yardsticks for measuring public sentiment reveal[ed] that President Roosevelt’s anti-business policies are losing their popularity” (ibid.). When Gallup asked, around the same time, what the government should do to hasten recovery, the favored reply—”Let business alone”—echoed French businessmen’s famous reply to Jean-Baptiste Colbert, Louis XIV’s comptroller general of finance, when he asked how the government might help them: “Laissez nous faire!”

The results of the 1938 election reflected these opinions. Republican victories, including 81 seats gained in the House, 8 in the Senate, and 13 new governorships, were widely seen as a rejection of the New Deal: Joseph Alsop, already a highly-respected journalist, called the vote “a repudiation of precisely the intellectual liberalism for which the New Dealers stand” (quoted in Best, 1991, p. 204). Because many of the Democrats who survived the election were conservative Southerners, most of whom never cared for the New Deal, the administration could no longer count upon Congress’s support for its domestic reform initiatives. On the contrary: the new Congress quickly pulled the plug on several New Deal programs, including the CCC, the WPA, and the National Youth Administration. Gary Best (ibid., p. 204) calls the June, 1938 passage of the Fair Labor Standards Act the New Deal’s “final twitch.”

So much for public opinion. “The only question that remained,” Best (ibid., p. 205) says, “was whether Roosevelt and his advisors would accept the verdict and change course.” At first, some didn’t. FDR’s own, immediate reaction was “to lash out once again at business” during a post-election press conference. But other New Dealers quickly got the point. By mid-December the New York Herald-Tribune‘s Walter Lippman could already sense a change among some “from a prejudice against business” to a “wish to free business to flourish”(Herald Tribune December 13, 1938; cited in ibid.). Before long, again according to the Trib, a “civil war for the president’s mind” was being waged between the administration’s die-hard radicals, who wanted FDR to keep up his attacks on business, and its “converted” moderates.

Freed Enterprise

America’s involvement in the Second World War completed this process of regime change. It did so first by causing the Roosevelt administration to renounce its plans for radical economic reform, and then by convincing many that reports of capitalism’s decrepitude had been premature.

Even before the U.S. entered it, the war had added a fourth “R”—Rearmament—to the New Deal triad of Relief, Recovery, and Reform; and it did not take long for that upstart R to start shoving the original three aside. By putting many formerly unemployed Americans to work, rearmament rendered New Deal relief and recovery efforts otiose—at least temporarily. And conservatives in Congress, if not the New Dealers themselves, were convinced that rearming either Europe or the U.S., and doing so quickly, meant putting New Deal reform efforts on hold. “The conservative bloc forged during the New Deal era,” Charlie Witham (2016, p. 22) observes,

reminded Roosevelt that there would be no question of the nation’s defense being provided by anything other than private enterprise: there was no suggestion of nationalizing industries as in Europe. Rather, federal censure of big business was relaxed as corporations were enticed to switch to war production.

It appears, furthermore, that after Pearl Harbor Roosevelt no longer needed much convincing. Despite having long vilified American businessmen, he couldn’t possibly achieve his ambitious rearmament goals, including fulfilling his promise to get 60,000 warplanes built in 1942, without their cooperation, and he understood “that businessmen would respond more readily to direction from other businessmen than to orders from what they considered a hostile federal government” (Brinkley 1996, p. 190; compare Herman 2012, p. 119).

Businessmen consequently came to play important parts in the federal government itself, often as heads of newly-established government departments (Witham 2016, pp. 22, 60). “By mid-1942,” Brinkley (1996, p. 190) observes, “over ten thousand business executives (most of them Republicans) had moved into offices, cubicles, and even converted bathrooms in the hopelessly overcrowded headquarters of the war agencies.” At first these businessmen-bureaucrats, many of whom were “dollar-a-year” men whose real salaries continued to be paid by their old companies, “had to confront New Dealers who opposed their role and suspected their motives” (Herman 2012, p. 54). But their growing numbers soon “shifted the balance of influence within key departments away from those with low, New Deal assumptions about business toward a more pro-business outlook” (ibid., p. 60).

As businessmen filed into Washington, the last of the old-line New Dealers filed out. A year after Pearl Harbor, hardly any were left (Brinkley 1996, p. 145). Of the biggest guns, Hopkins and Ickes alone remained. But businessmen no longer had much reason to fear Hopkins, who began patching things up with them when he became Secretary of Commerce in December 1938: Hopkins even went so far as to admit, in The Economist’s words, “that the administration had been wrong in mixing so much reform with its recovery.” They had even less to fear when he went to London to serve as FDR’s personal emissary to Churchill (Best 1991, p. 207). Ickes, who considered handing control of government agencies to businessmen “an affront to Democracy” (Herman 2012, p. 72), was thus left feeling isolated and impotent (Brinkley 1996, p. 145), and all the more so after the 1942 election sent 53 former Democratic representatives—8 Senators and 45 Congressmen—packing.

Thus what began as a temporary expedient ultimately resulted in a permanent shift in government policy from high-handed interference with business, and big business especially, to cooperation with it. As Brian Waddell puts it (1999, p. 233), the war set

the nation on a trajectory of political development very different from that begun during the New Deal. Mobilization…shifted political authority and resources from New Dealers to military and corporate personnel…and quashed controversial aspects of New Deal interventionism.

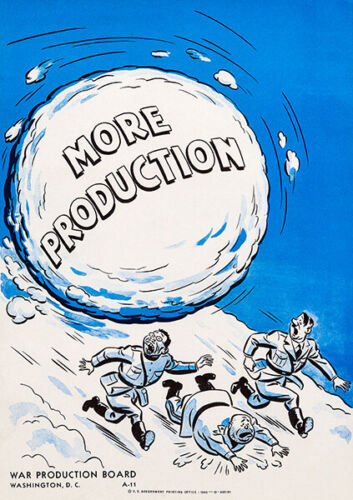

Capitalism, After All

As the war wore on, many New Dealers themselves discovered, in working alongside businessmen, that they “did not always have horns” after all (Brinkley 1996, p. 173). Nor could they deny the war industries’ remarkable achievements: “No other wartime economy,” Arthur Herman (2012, p. 255) observes, “depended more on free enterprise incentives than America’s, and…none produced more of everything in quality and quantity, both in military and civilian goods.” Although the government left private enterprise in the saddle, and chose to rely, for the most part, on carrots alone rather than sticks to encourage the production of war materiel, the United States produced more military supplies than all the other combatants combined, and did so with the least sacrifice of consumer goods output, even correcting for misleading wartime output statistics. Even in 1944, when 70 percent of U.S. manufacturing was being devoted to winning the war, more than half of all U.S. businesses, including several major military contractors, were still making consumer goods. In this respect, the United States was the least mobilized of all Second World War belligerents (ibid., pp. 335-6).

Small wonder, then, that many liberals who once considered businessmen their bitter enemies changed their tune. “The capitalism that had been damned as bankrupt just a few years before,” Robert Collins (1981, p. 81) writes, “was now celebrated for its prodigious feats of production.” The war thus “muted liberal hostility to capitalism and the corporate world, [diverting] their efforts into less direct, confrontational channels” (ibid., p. 7).

This change of attitude was evident in politicians’ rhetoric as well as in actual policies. According to Collins (1981, pp. 80-81), “[t]he attacks on business—both actual and rhetorical—of the late 1930s petered out,” giving businessmen “a welcome respite from the tensions of the Depression and the New Deal.” “By 1945,” Alan Brinkley (1996, pp. 6-7) says, “the critique of modern capitalism that had been so important in the early 1930s…was largely gone, or at least so attenuated as to be of little more than rhetorical significance.”

Ickes, admittedly, remained unmoved: instead of seeing the U.S. economy’s wartime experience as proof that capitalism was alive and kicking, he thought it demonstrated the merits of NRA-type corporatist planning. He therefore imagined that it would deal the coup de grâce to the idea that government “should rely upon private enterprise and individual initiative to invent and develop.” But hardly anyone else thought to. “What is striking,” Mark Wilson (2016, pp. 183-4) says, “is how little traction [Ickes’] perspective had during the reconversion period and longer Cold War era.” American policymakers instead drew precisely the opposite conclusion, as did businessmen generally. So far as they were concerned, “[t]he fifteen-year debate over the health of U.S. capitalism had…been settled in favor of private enterprise” (Witham 2016, p. 60).

Besides appearing to demonstrate the merits of capitalism, the war gave a bad odor to anything that smacked of fascism, including the activist managerial state. Between them, Italy’s invasion of Ethiopia, the Spanish Civil War, and the rise and crimes of Hitler, forever laid to rest the “cautious admiration for Mussolini” and corporativismo that many New Dealers once expressed (Brinkley 1996, p. 155). The Cold War in turn put left-wing interventionists on the defensive. As a result of both wars, Alan Brinkley (1996, p. 155) observes, Americans not only saw “autocracy as the greatest threat to democracy and peace.” They also came to see the United States as “admirable above all for not being a totalitarian state.” And not being a totalitarian state meant rejecting both fascism and socialism in favor of something closer to free enterprise, if not the very thing.

Nor was there any lack of support for “the very thing.” Several postwar anti-totalitarian writings, and Friedrich Hayek’s The Road to Serfdom above all, treated the interventionist state, not as a desirable compromise between totalitarianism and laissez-faire, but as a malignant tumor that threatened to metastasize into full-blown totalitarianism, casting it in the role New Dealers once assigned to large, inadequately regulated corporations. Such writings didn’t just appeal to conservatives and libertarians. Among American liberals, they reinvigorated “a powerful strain of Jeffersonian anti-statism…that had been present all along” (Brinkley 1996, p. 160). They also impressed at least one very important European liberal. After reading The Road to Serfdom on his way to the 1945 Bretton Woods conference, Keynes wrote Hayek from a New Jersey hotel, calling it “a grand book,” and declaring himself “in agreement with virtually the whole of it; and not only in agreement with it, but in a deeply moved agreement.”

Although Keynes and Hayek are usually regarded as being poles apart, viewed against the background of the New Deal, especially in its more militant phase, let alone against that of outright fascism, socialism, or communism, they are more alike than dissimilar, for both preferred free markets to heavy-handed interventionism. Setting arcane (albeit bitter) disputes about monetary theory, with their opposite implications for addressing business cycles, aside, the difference between them was mostly one of degree rather than of kind. But there was another, more important difference, for while Hayek considered Keynesian-style interventionism a slippery slope that ultimately posed a threat to capitalism, Keynes saw it as a means for “safeguarding Capitalism” against its real enemies, including fervent New Dealers. In truth, both men played their part in the capitalist revival; and it is only because that revival took place that they can now be cast, in textbooks, monographs, and humorous videos, as extreme antagonists.

Spontaneous Optimism

Between them, the war boom and changed political climate swept away most of the concerns that had stood in the way of a revival of business confidence, “allow[ing] businessmen to finally shake off the pessimism of the Depression years” (Witham 2016, p. 6; compare Bert Hickman 1960, p. 161). Capitalism now seemed healthier than ever, and “[n]o one wanted to return to the state of uncertainly that dominated the pre-war years” (ibid.). Much as businessmen tended then, and still tend, to be fiscal conservatives, and despite the tendency of many today to deprecate “Keynesianism,” back in the 1940s Keynesianism was a welcome change from the old New Deal, with its anti-business rhetoric, micro-interference, sometimes punitive taxes, and continuous, often disconcerting experimentation.

Although the war’s negative contribution to recovery has been overshadowed by that of massive wartime deficit spending, that contribution was no less important, serving as it did to carry out Keynes’s advice for rallying the U.S. economy’s animal spirits. “Conventional wisdom has it,” Gary Best (1991, p. 222) observes, “that the massive government spending of World War II finally brought a Keynesian recovery from the depression.” But, he continues, the fact that the government was no longer at war with business, as it had been during the original New Deal, deserves more credit. “That,” Best says, “and not the emphasis on spending alone, is the lesson that needs to be learned.” The Keynesian revolution was, in this important respect, a conservative revolution.

Yet Another New Deal?

“By 1945,” Alan Brinkley (1996, p. 269) says, “American liberals…had reached an accommodation with modern capitalism… They had, in effect, detached liberalism from its earlier emphasis on reform.” The new liberalism

was a result of many things: of the failures and unintended consequences of some of the reform efforts of the early 1930s; of the impact of the recession of 1937-38, the frustrations that unexpected crisis had created, and the reassessments it had inspired; of the emergence of a new set of economic ideas—ultimately identified with John Maynard Keynes—that provided an alternative to older, more institutional approaches; of the dramatic economic growth of the 1940s, the experiences of wartime economic mobilization, the resurgence of popular conservatism, and the growing fear of totalitarianism” (ibid., pp. 266-267).

Postwar liberals were “less inclined to challenge corporate behavior [and] more reconciled to the existing structure of the economy.” Nor were they keen on

controlling or punishing ‘plutocrats’ and ‘economic royalists,’ an impulse central to the New Deal rhetoric of the mid-1930s… . ‘Planning’ now meant an Olympian manipulation of macroeconomic levers, not direct intervention in the day-to-day affairs of the corporate world (ibid.).

Keynesian thinking was obviously crucial to this change. It’s therefore no stretch, let alone paradoxical, to say that it was such thinking rather than the New Deal that brought the Great Depression to a close.

Alas, games with names make that straightforward conclusion harder to swallow than it ought to be. For although postwar liberals no longer had “much interest or faith in many of the reform ideas that had once been central to the New Deal,” many continued to “wrap themselves in [the New Deal’s] mantle” (Brinkley (1996, pp. 4, 265). Consequently postwar liberalism has come to be regarded by many historians, not as something that supplanted the New Deal, but as a mere continuation of the Second New Deal, or (alternatively) as a “Third New Deal” with its roots in the ’37 downturn (Jeffries 1996). One historian even has the Second New Deal, which most sources have lasting no later than 1938, reaching its “intellectual zenith” during the war (Hamby 1968, p. 598), as if it had been a Keynesian program all along, rather than one replete with just the sort of business-intimidating reforms Keynes warned against!

The tendency to conflate Keynesianism, and postwar Keynesianism especially, with the New Deal policies of the 1930s, makes it all too easy to credit “the New Deal” with ending the Great Depression. But to do so is to overlook the fact that Roosevelt only came around to Keynesianism reluctantly, and that he was persuaded to do so because of the New Deal’s evident failure to end the depression, because public sentiment had turned against it, and because between them the conservative coalition and the need to mobilize for the war ruled-out its continuation. And by “Keynesianism” here I mean Keynesian doctrines. If instead one takes the switch to Keynesianism to mean the actual adoption of Keynesians’ (including Keynes’s own) advice, the need to distinguish wartime and postwar Keynesianism from the New Deal becomes all the more obvious, for it was [a] military necessity, rather than any rethinking of New Deal strategies for ending the depression, that caused the government to make peace with businessmen, and to resort to large-scale deficit spending.

The thinking of the United States’ most prominent Keynesian also suggests that the turn there to Keynesianism represented a sea change from, rather than a mere twist upon, the New Deal. Although Alvin Hansen was nominally a New Dealer, during an interview with him toward the end of 1941, Richard Strout learned that he did “not give a whoop about the New Deal one way or another” (Strout, December 29, 1941, pp. 888-89): unlike true-blue New Dealers, but like many later Keynesians, he considered the role of government to be a “marginal” one, aimed at “promoting the expansion of private enterprise” through the use of deficit spending to avoid or counter unemployment.

This isn’t to say that the New Deal, properly understood, contributed nothing to postwar stability and growth. First and most importantly, New Dealers managed—albeit with plenty of help from Hoover’s men—to put an end to the monetary crisis that had brought an already depressed U.S. economy to its knees. For decades (not forever, alas), early New Deal reforms made further bank runs rare, and ended banking crises altogether. How long the depression might have lasted had the banking situation not been stabilized is anyone’s guess. To the extent that they increased the size of government, New Deal reforms also reduced somewhat the U.S. economy’s vulnerability to adverse changes in private investment. Because they tended to enhance rather than undermine business confidence, such policies contributed to recovery as well as to stability going forward.

It remains true, nonetheless, that the Great Depression was still going strong when World War II broke out in Europe, and that this was so because, while some New Deal efforts promoted recovery, others, including those that frightened businessmen, tended to thwart it, if not to set progress back. Since much of the recovery that did take place before the war was due not to New Dealer’s efforts, but to the “gold rush” caused, first by Hitler’s rise to power, and then by the outbreak of war itself, New Deal policies cannot even claim credit for more than a small portion of the limited prewar recovery.

To point this out is not to dismiss the New Deal tout court, for economic recovery was far from the only goal New Dealers sought to achieve—that was indeed, according to Keynes, one reason why they failed to achieve it. Those wishing to celebrate the New Deal might do so, first of all, by pointing to any of its many longer-term achievements that they consider worthwhile. They can also note how it provided jobs to millions of otherwise unemployed Americans. And, if they don’t mind the fact that Hoover appointees wrote the script for them, they can credit early New Deal actions with arresting the 1933 downturn, thereby making it possible for recovery to begin. But they cannot say, without contradicting a wealth of evidence, or confusing the New Deal with the limited-government Keynesianism that succeeded it, that subsequent New Deal policies and rhetoric promoted recovery more than they hampered it.

Continue Reading The New Deal and Recovery:

Intro

Part 1: The Record

Part 2: Inventing the New Deal

Part 3: The Fiscal Stimulus Myth

Part 4: FDR’s Fed

Part 5: The Banking Crises

Part 6: The National Banking Holiday

Part 7: FDR and Gold

Part 8: The NRA

Part 8 (Supplement): The Brookings Report

Part 9: The AAA

Part 10: The Roosevelt Recession

Part 11: The Roosevelt Recession, Continued

Part 12: Fear Itself

Part 13: Fear Itself, Continued

Part 14: Fear Itself, Concluded

Part 15: The Keynesian Myth

Part 16: The Keynesian Myth, Continued

Part 17: The Keynesian Myth, Concluded

Part 18: The Recovery, So Far

Part 19: War, and Peace

Part 20: The Phantom Depression

Part 20, Coda: The Fate of Rosie the Riveter

Part 21: Happy Days

Part 22: Postwar Monetary Policy

Part 23: The Great Rapprochement

______________________________

[1] Despite this, and Keynes’s otherwise tremendous influence, until relatively recently business confidence, or the lack of it, as a factor in the slow recovery, has received scant attention from modern economists, Robert Higgs‘ (1997) work being a notable exception. According to George Akerlof and Robert Shiller (2009, p. 70), that’s so because most “would rather focus on things they can measure,” and confidence, as Bert Hickman (1960, p. 173) observed many years before, “is intangible.”

The Great Recession has, however, revived interest in the part that low business confidence, particularly as informed by “economic policy uncertainty,” plays in prolonging downturns. Scott Baker, Nicholas Bloom, and Steven Davis (2016) have even developed an “index of economic policy uncertainty.” Using that index, Huseyin Gulen and Mihai Ion (2016) discover “a strong negative relationship between policy uncertainty and capital investments” during the 2007-9 financial crisis, and estimate that that uncertainty accounted for “roughly one-third of the 32% fall in capital investments” that took place then. Gabriel Mathy (2019) uses a similar index as well as others to assess the contribution of policy uncertainty to the Great Depression, and finds that it “mattered a great deal” then as well, with “uncertainty shocks” accounting for “roughly 40–70% of the peak [1933] decline in industrial output.” However, in a separate study, Mathy (2016) finds that the New Deal itself was not a major cause of uncertainty. I discuss that finding in a previous installment to this series.

The post The New Deal and Recovery, Part 23: The Great Rapprochement appeared first on Alt-M.