Adam N. Michel

The House Ways and Means Committee Republicans recently released legislation to retaliate against individuals and businesses based in countries that impose extraterritorial taxes on American companies. The proposal is a reaction to ongoing efforts by the OECD to coordinate a global tax increase on large multinational companies.

Instead of raising taxes, Congress should stop funding the OECD and focus on making the United States the most attractive place to do business.

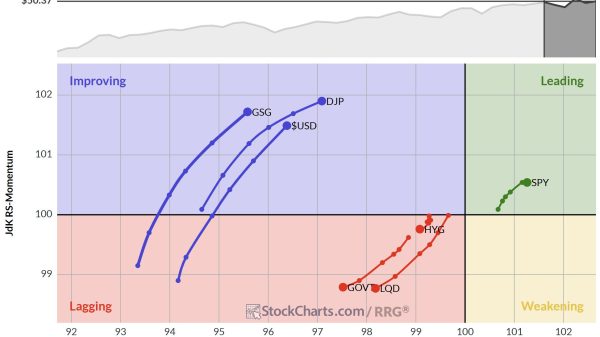

The Republican proposal would have Treasury identify extraterritorial and discriminatory taxes levied by other countries on U.S. companies. Individuals and corporations based in the offending countries would then face higher tax rates on their U.S. income. The legislation specifically targets the OECD’s under‐taxed profits rule (UTPR) and digital services taxes (DST). UTPR allows foreign countries to tax profits earned outside their borders if effective tax rates are lower than 15 percent. UTPR is one of five OECD‐proposed rules that will enforce its proposed global minimum tax.

Biden Boxes Congress In

By working with the OECD to develop their Two‐Pillar plan to increase global corporate taxes and then agreeing to the proposed outline for the new rules, the Administration has given Congress few options to reassert their legislative powers and protect American businesses from higher taxes. The Two‐Pillar proposal is intended to more comprehensively tax the profits of multinational businesses by raising effective tax rates and reallocating taxing rights away from some countries and toward others.

The Ways and Means proposal is thus a predictable reaction to the Biden Administration using the OECD as an extra‐legislative venue to advance policies that do not have congressional buy‐in. The Administration has disregarded Congress’ constitutional tax‐writing powers and unilaterally acquiesced to upending decades of international tax norms by giving other countries taxing rights to profits earned elsewhere.

The Republican proposal is a strong signal to other countries that the United States Congress is not ready to follow the Administration’s lead in outsourcing international tax rules to OECD bureaucrats in Paris. Sending this message is important, but Congress should focus on cutting taxes rather than raising them.

The tit‐for‐tat tax scheme concedes too much. The problem is more than UTPR and the possibility of new DSTs. The issue is the last two decades of OECD tax work to harmonize international tax law and end international tax competition. The OECD’s tax work no longer primarily coordinates tax systems to eliminate double taxation. Instead, it now proposes ever more complicated new tax systems and reporting requirements to raise taxes on multinational businesses. This is a recipe for increasing taxes, reducing tax competition to benefit high‐tax governments, and reducing global investment by making international business operations more expensive.

Thanks to the OECD work, multinational businesses are now more likely to face higher effective tax rates, more tax uncertainty, and new forms of double taxation.

A Better Path

The OECD has proven it no longer serves the interests of the United States and has abandoned its founding mission to promote international economic growth. Therefore, Congress should stop financially supporting the OECD and reform our domestic tax laws.

First, Congress should follow through on the proposal of 10 House Republicans who asked the Appropriations Committee to prohibit any U.S. funding for the OECD in next year’s budget. The United States currently funds almost 20 percent of the organization’s budget.

Second, Congress should make America the most attractive place to do business in the world. The Tax Foundation ranks the United States 22nd out of 38 countries on international corporate tax competitiveness. Even after the 2017 tax cut, the United States still has an above‐average corporate income tax rate, and key investment rules are in the process of expiring. Lowering or eliminating the corporate income tax and making full expensing for new U.S. investments permanent would both benefit American workers and undercut the OECD project. Congress could also increase financial privacy protections, prohibit the automatic exchange of taxpayer information with other countries, and cut the capital gains tax rate.

The most powerful message Congress could send is if it played the game the OECD is trying to stop. Making the United States an international tax haven would be a tit‐for‐tat game that benefits everyone.