Nicholas Anthony

Last week, I wrote about how there is a lack of official statistics regarding the effectiveness of the Bank Secrecy Act and how what little information exists is troubling.

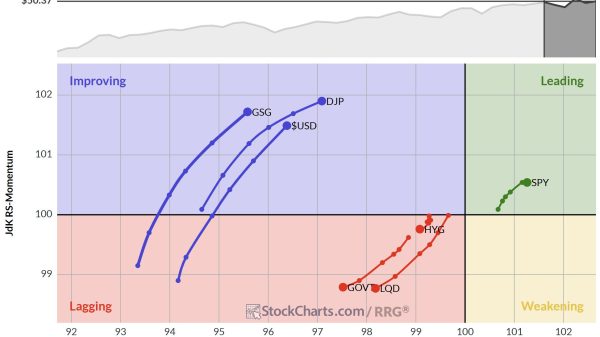

However, a few folks were kind enough to point out that the Financial Crimes Enforcement Network (FinCEN) defines money laundering under a broad umbrella, so I wanted to follow up to make sure readers had the full picture available. The figure below provides the complete list of subcategories that FinCEN defines as money laundering in its suspicious activity report (SAR) statistical database.

Much like I explained last week, the vast majority of reports are not filed because Americans are suspected of crimes such as human trafficking or terrorist activity. Instead, financial institutions file most of these reports to the government because they’re not sure where a customer’s funds came from, they suspect the transactions were out of the norm for the customer, or they see that the customer used multiple accounts.

We can also add some more context to the number of IRS investigations that FinCEN cited in its report. My colleague Chris Edwards was kind enough to point out that although FinCEN only cited the percentage of IRS criminal investigations that were initiated, we can figure out the exact number by turning to the IRS Data Book. There we see that the IRS conducted 2,552 criminal investigations during the 2022 fiscal year. Therefore, 15.8 percent of that total represents 403 investigations.

In other words, despite financial institutions spending $46 billion a year complying with this regime and filing over 26 million reports, these reports only initiated 403 criminal investigations (Figure 2).

To be clear, this chart only reflects the IRS’s criminal investigations—countless other government agencies have access to these reports. So more data is certainly needed to understand the full picture here, but from what we can see, the current state of financial surveillance looks far from justified.