Business confidence is high among SME leaders in the UK, with three in five forecasting increases in revenue over the next 12 months.

Small businesses have been under unprecedented strain over the past few years, with the Covid-19 pandemic, the cost-of-living crisis and ongoing economic volatility creating persistent and cumulative challenges. Yet the majority of SMEs are looking ahead to the next 12 months with optimism, with two thirds confident about the outlook for the economy, a similar number assured about the end of the cost-of-living crisis and a further four in five confident about the outlook for their business.

The new figures are based on a survey of 500 UK decision-makers, supported by Dojo payments data based on spending across more than one in 10 UK high street SMEs.

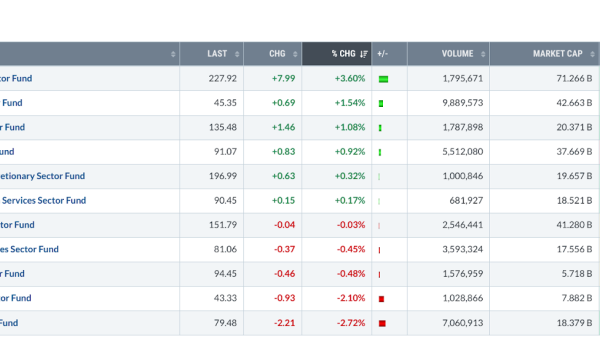

This is further illustrated through Dojo spend data which reveals that on average, the number of card transactions per location is up by 10% between January and June compared to last year. Such an increase suggests that consumers are growing in confidence, even with high inflation and surging interest rates, along with businesses investing in improved payments infrastructure.

Three in five business leaders expect their revenues will increase in the next 12 months – by an average of 22% – while a quarter expect revenues to stay the same.

Jon Knott, Head of Customer Insight at Dojo, said: “Growing businesses on the high street have been forced to weather all manner of unpredictable storms over the last three or so years – so it’s a testament to them that so many are confident of delivering growth in the current economic climate. With the right strategic investments, SMEs will be best-placed to continue improving the experiences they deliver for customers, supporting continued growth.”

Read more:

SME leaders bullish about prospects as majority expect revenues to increase in next 12 months