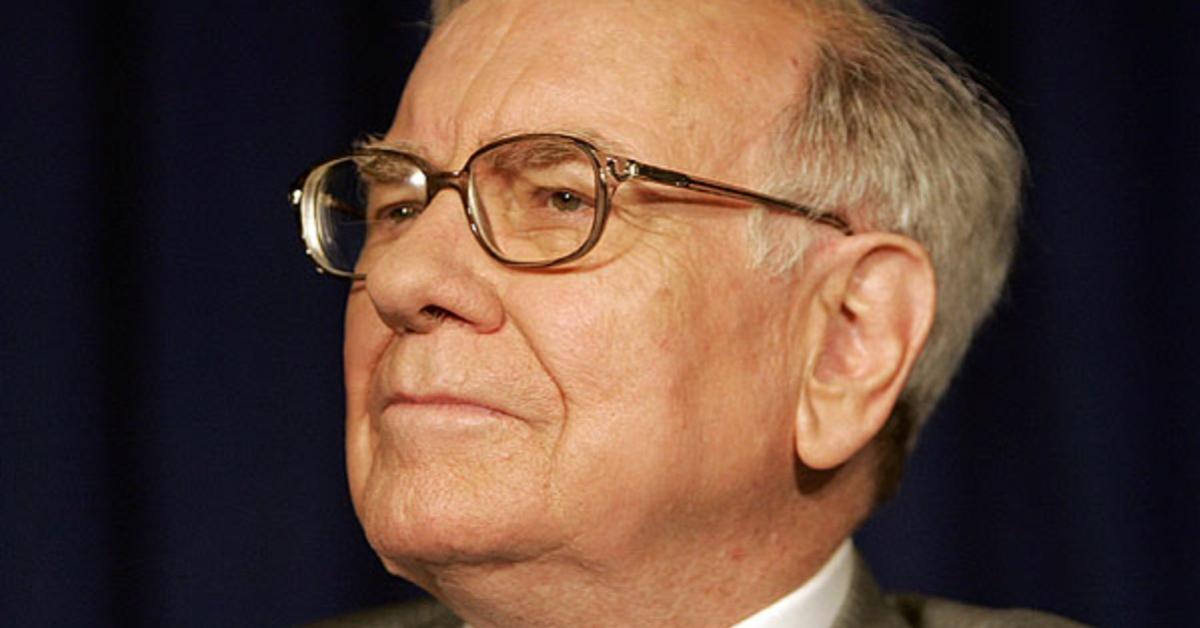

Warren Buffett, renowned as the “Oracle of Omaha,” emerges as a towering figure among the most celebrated and accomplished financiers in modern times. Throughout his illustrious career spanning numerous decades, he has accumulated unrivaled wealth, garnering an esteemed reputation in the financial realm. Presently, he holds the prestigious positions of chairman and CEO at Berkshire Hathaway, a conglomerate that mirrors his astute discernment of value and commitment to long-term, judicious investments.

In contrast to his father, Howard (the original Oracle of Omaha), who was a four-term Republican representative for the state of Nebraska and a vocal libertarian aligned with the Old Right, Warren supports expansive government intervention in the American economy. To understand Warren Buffett’s philosophy, it is important to understand Howard’s.

Howard Buffett’s story began in Omaha, Nebraska, in 1903, when he was born to the owners of a grocery business. After attending college at the University of Nebraska in 1925, Howard started a small stock brokerage firm, but as the Great Depression ruined the 1930s economy, Buffet pivoted from his career in business to a career in politics. In his home district, Howard challenged incumbent Democrat Charles F. McLaughlin during the 1942 US House elections. In a stunning upset, Howard emerged victorious as the Republicans flipped forty-seven seats, though they were still unable to take back the House since their blowout ten years earlier.

Buffett went on to win two more terms but could not pass effective agendas in a Democrat-controlled House, Senate, and presidency. In 1948, one term after the Republicans took back the House and Senate, Buffett was dethroned by Democrat Eugene D. O’Sullivan. Buffett used his two years out of Congress to focus fully on his 1950 campaign efforts. In 1950, Howard won back the office by a margin of 27 percent, reclaiming his throne from O’Sullivan.

Buffett’s victory could not have come at a more momentous time, as Harry Truman was sending money to Europe and young men to Korea. The Marshall Plan gave $13.3 billion (the equivalent of $173 billion in 2023) in economic aid to Western Europe after an expensive World War II. The Korean War pushed recent high school graduates and World War II veterans, who were finally reaping the postwar prosperity, into harm’s way. Buffett believed that it was tyrannical for Truman to send soldiers into Korea without a declaration of war by Congress, as required by the Constitution. Buffett, on every decision he voted upon, inwardly asked, “Will this add to, or subtract from, human liberty?”

Howard said:

Even if it were desirable, America is not strong enough to police the world by military force. If that attempt is made, the blessings of liberty will be replaced by coercion and tyranny at home. Our Christian ideals cannot be exported to other lands by dollars and guns. Persuasion and example are the methods taught by the Carpenter of Nazareth, and if we believe in Christianity, we should try to advance our ideals by his methods. We cannot practice might and force abroad and retain freedom at home. We cannot talk world cooperation and practice power politics.

Instead of running for another term in 1952, Buffett campaigned for Senator Robert A. Taft from Ohio to win the Republican nomination. The Republicans had suffered a record five straight presidential election losses, and because of Truman’s unpopularity, the GOP was nearly guaranteed to take the White House for the first time in twenty years. While the Republican Party was divided between Dwight D. Eisenhower, general of the army, and Taft, Buffett knew Taft to be the right choice.

Throughout the Cold War, foreign policy emerged as a significant source of disagreement: Eisenhower adopted an interventionist approach while Taft preferred a more cautious stance, advocating for avoiding entanglement in foreign alliances. While Eisenhower was more receptive to certain social welfare aspects of the New Deal, Taft staunchly opposed them. While Eisenhower believed that the North Atlantic Treaty Organization (NATO) was necessary to defend against communism, Taft opposed its globalist nature. At the Republican National Convention in Chicago, Eisenhower received 595 votes, nine shy of the nomination, which required 604, and Taft got 500. However, the Eastern Establishment members of the Republican Party, like Thomas Dewey and Henry Cabot Lodge Jr., swayed delegates to Eisenhower, who eventually became the nominee. Buffett’s efforts to put Taft in the White House fell short.

At the age of forty-nine, Howard left politics and returned to his investment business, Buffett-Falk, in Omaha, where he worked until shortly before his death in 1964. Buffett’s short tenure in Congress made him an unknown figure to nonscholars. Had Taft won in 1952, Buffett might have been promoted within the Republican Party for being aligned with the paleolibertarian causes that Taft supported. Buffett could have been the perfect candidate to run for Nebraska senator, a more powerful position in Washington. Instead, Buffett faded into the sunset as a career businessperson who’d dabbled in politics. His son, Warren, created an empire of wealth but diverged from the political values that Howard fought for.

A prominent figure in the business and financial realm, Warren Buffett has historically gravitated toward the Democratic Party, finding common ground with their stances on taxation and income inequality. With a strong voice, he advocates for higher taxes on the affluent and expresses deep concern about the increasing wealth gap in the United States. Despite his dedication to investing and overseeing Berkshire Hathaway, Buffett uses his platform to vocalize his views on economic matters, offering praise to Democratic leaders who share his agenda for creating a more equitable society.

Warren Buffett is not a “country club Republican,” like many corporate CEOs, or even a moderate Democrat. Instead, Buffett is a “limousine liberal.” Warren and Howard differ not only in their view of the economy but in their view of foreign policy as well. Although Warren has more in common with Howard on foreign policy, Warren has never shied away from investing massive amount of funds in the defense industry. In 1992, after the Cold War ended, he took a 15 percent stake in General Dynamics.

Warren has also ridiculed the gold standard, which Howard was a major supporter of because Howard believed it would limit the government’s ability to inflate the money supply and spend beyond its means. About gold, Warren has said, “[It] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head”. Even if that were true, gold cannot be printed out of thin air, unlike the dollar.

On the outside, Warren Buffett is a kind, old gentleman. But he treats Berkshire Hathaway with a ruthless and capitalistic nature, like any shrewd businessperson should. Does Warren Buffett really believe that people like him should be paying more taxes that take away from his corporate profits? (Those profits go back to shareholders, by the way.) Or does Warren want to be viewed as someone who did business the “right” way?

When people look back on Warren Buffett’s legacy one hundred years from now, there will be a disconnect between Buffett’s words on pursuing economic equality and his actual pursuit of the bottom line. For example, in 2007, Buffett testified before the Senate, urging them to preserve the estate tax. Some might think that Buffet, at his own sacrifice, was pushing to avoid a situation where the wealthy own all the American homes. But Berkshire Hathaway has historically reaped advantages from the estate tax in previous business ventures and actively marketed insurance policies to shield policyholders from potential estate tax payments in the future.

Also, Buffett is right that lower-income individuals shouldn’t pay a higher tax rate than the wealthy, which is the case under the US income tax code. However, Buffett’s $100,000 salary allows for most of his taxes to be in the form of capital gains versus income taxes, saving him a lot in taxes. Buffett has continually supported Democrats’ pursuit of income equality, and even supported Hillary Clinton in her campaign against Donald Trump in 2016. But just before the Trump tax cuts went into effect, Buffett took the same actions to benefit from them as other CEOs, who began slashing their own salaries to pay fewer taxes overall. He makes $100,000 to this day.

With the foundations laid by his father, Howard, Warren Buffett has undoubtedly done a great deal for society. His philosophy of smart investing, success with honor, and philanthropy is something to be admired. However, Warren’s economic views can never be seen in the same light as Howard’s were. The free market is clearly the way for business executives to maximize their companies’ profit. The lack of government intervention that Howard championed was very profit-friendly. Although in politics, Howard had the mind of a true business leader.