Things happen at the speed of light when robot traders rule the market.

You’d think that, with the Fed’s threat to cause “pain” with higher interest rates, short sellers would be crushing it these days. But instead, as with the summer rally, they’re suddenly the ones getting crushed.

That’s because hedge funds and commodity trading advisor trading programs got caught on the wrong side of the trade and had to reverse their market bias. Their short-covering was amplified by the stealth buying of value players, who seem to have been building long positions as prices have come down after the summer rally. The result was last week’s short squeeze, which may still have some legs left if the stealth buying turns into something more solid.

Glimmer of Hope

Last week, I noted that “September is traditionally a bad month for stocks. And with the Fed draining $95 billion in liquidity from the banking system as it accelerates QT, things could go from bad to worse, although bearish sentiment is increasing and the market is getting very oversold.”

I further noted: “Still, there was a glimmer of hope at week’s end, as the Eurodollar Index (XED), see below, moved decidedly higher. We’ll have to see what develops from this, as a move higher in XED is often a bullish sign for stocks.”

So far, the “glimmer of hope” seems to be another short-covering rally, which of course is tradable, at least in the short term. But, if stocks can somehow manage to take out the highs from the summer rally, we could be in a totally different trading environment for the rest of the year.

In general, stocks don’t do well when the Fed and other global central banks are raising rates. On the other hand, I often wonder what may happen if the central banks continue to raise rates and stock traders stop giving a flip about it. I mean, Fed Chairman Powell is pounding the table and spitting out fire and brimstone. The European Central Bank seems to, for once, mean business — whatever that means. And the war in Ukraine doesn’t seem to be going anywhere for now. Yet stocks are trading purely on basic technical measures, such as whether RSI is overbought or oversold. See below for details.

So what happens if the stock market tells the central banks to go pack sand and stocks rally despite aggressive interest rate increases? Wouldn’t that be something to see?

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

Bonds Yields Rise. Liquidity Reduced Further.

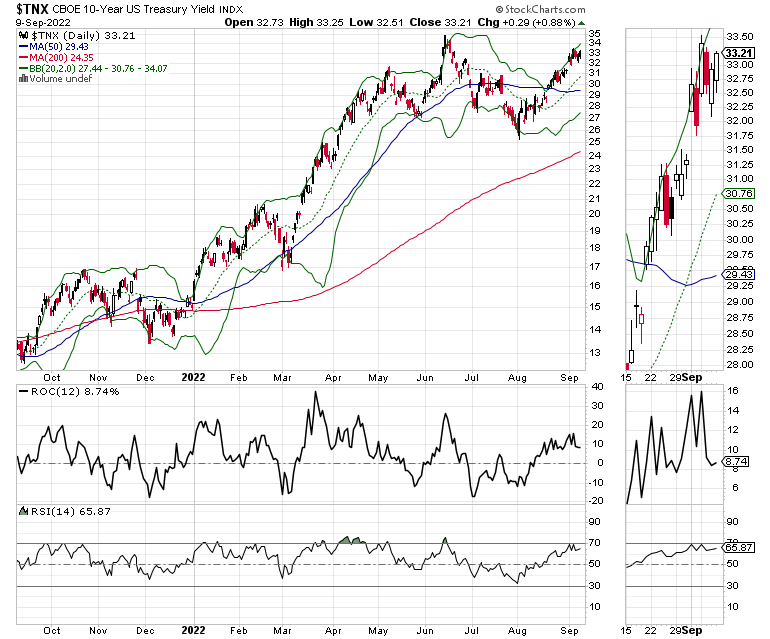

Bond yields again pushed higher last week, with the U.S. Ten Year note yield (TNX) moving beyond the 3.25% level and closing above 3.3%, on the heels of tough talk from the Fed and the ECB. A move above this area could make life difficult for stock traders. But, at this point, given the speed with which markets trade, who knows?

As I noted recently, the Fed is removing $95 billion from the financial system per month as part of its QT program. And when the Fed drains liquidity, the Eurodollar market usually falls, which is what happened this week. This suggests that we are still in an illiquid market, and that volatility will continue. On the other hand, it doesn’t rule out that this rally, which at this point seems to be another short squeeze, can’t go on for a while.

Bond yields have broken out to a new high, while the Eurodollar Index (XED) has made a new low. That means that the system’s liquidity is falling.

You can get a working overview of how this works in my latest Your Daily Five video here.

Is Kroger the Next Whole Foods?

Shares of grocery giant Kroger Co. (NYSE: KR) delivered a nifty price chart breakout on 9/9/22, on the heels of a better-than-expected earnings report and an equally bullish guidance update for the full year. I’m not really surprised, since I shop at Kroger, and what I see every time I step into the store is lots of people who probably feel the same way.

Perhaps more than anything, the major reason people like me are flocking to their stores is that, unlike some of their competitors, their shelves are usually well stocked. No supply chain problems here, for the most part. In fact, Kroger’s recent performance reminds me of the heyday of Whole Foods before the Amazon buyout. In those heady days, earnings beats, spearheaded by sound management’s steering of the shift to healthier food, were the norm.

Sure, Kroger’s got all the organic and gluten free bells and whistles available. But they also cater to the Frito Lay’s and Blue Bell ice cream crowd. The resemblance with Whole Foods, however, is more about management’s ability to steer the company to the moment. They have the right products for a wide variety of customers for sale. And they are selling lots of them, while passing on a good chunk of their expenses to customers who are just glad that there are still things they can buy to feed their families and brush their teeth with.

Consider the fact that Kroger grew its sales by 8.4% without fuel costs included (5.8% with). Revenues and earnings also rose robustly. Meanwhile, KR lowered its debt-to-EBITDA ratio and raised its dividend by 24% this year. Moreover, the company raised its full year sales guidance. In addition, it continues to expand its rapidly growing lower cost in-store brands, as well as its digital shopping and delivery networks, especially in fast-growing areas of the U.S. such as the sunbelt.

The price chart shows a key move above a very large resistance area near $50, anchored by the final bar of a large Volume by Price (VBP) bar cluster in the range of $45-$50. Note the bar at $45 proved to be excellent support. This suggests that the price move above the $50 bar has a good chance to hold.

Accumulation Distribution (ADI) shows that short sellers have been slowly giving up on the stock lately. Meanwhile, On Balance Volume (OBV) has stopped falling. Given the breakout, the stock could consolidate near the current price levels for a short period of time. This may be a good time to add to positions or enter the stock.

I recommended Kroger several weeks ago in my Rainy Day Portfolio. You can see the rest of my picks here. I own shares in KR.

Oversold Bounce Seems to Have Legs

Last week I noted: “The stock market is well overdue for a bounce. But oversold markets can stay oversold for a long time.” Apparently, the market was oversold enough to trigger an explosive short squeeze, which took the New York Stock Exchange Advance Decline line (NYAD) back above its 50-day moving average and well off of its recent RSI oversold level near 30.

The CBOE Volatility Index (VIX) rolled over, falling below 25, which is a sign that put option volume is falling. This is bullish for stocks, as it reduces the need for market makers to hedge their risk by selling stock index futures. That, in turn, takes pressure off of the sell side of the market as buyers take over.

The S&P 500 (SPX) reversed the prior’s week crash below 4000 and the 50-day moving average, turning the intermediate term positive for now. Accumulation Distribution (ADI) reversed its short-term downtrend as short sellers got overwhelmed by buyers. On Balance Volume (OBV) also turned up slightly. If OBV starts to pick up steam, it will be bullish, as it will signify that buyers are moving in.

The Nasdaq 100 index (NDX) also bounced but remained below 13,000. The index ended the week at its 50-day line and below its 20-day moving average. On the positive side, Accumulation Distribution (ADI) and On Balance Volume (OBV) both reversed their recent decline.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.