Note to the reader: This is the fourth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.” Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of facts. The world of finance is full of such tendencies, and here, you’ll see some examples. Please keep in mind that not all of these examples are totally misleading — they are sometimes valid — but have too many holes in them to be worthwhile as investment concepts. And not all are directly related to investing and finance. Enjoy! – Greg

As an aerospace engineer, my education kept me far removed from the world of finance. However, over the past couple of decades, my career has since dropped me solidly into that world.

The “world of finance” is my baked-up term that includes financial academia and, in general, retail (sell side) Wall Street. (I honestly believe that the former is the marketing department of the latter.)

In engineering, we knew that in order to begin an analysis or delve into a research project, we had to start with some basic assumptions about things. These assumptions were the building blocks for the project; they launch the process. Many times, well into the project, it would be obvious that some of the assumptions were just wrong and had to be corrected or removed. The World of Finance, over the past 60 years, has produced a large number of white papers on financial theories, many of which begin with some basic assumptions.

The markets are efficient.Investors are rational.Returns are random.Returns are normally distributed.Gaussian (bell-curve) statistics is appropriate for use in finance/investing.Alpha and beta are independent of correlation.Volatility is risk.Is a 60 percent equity/40 percent fixed income appropriate? Compare forward (guesses) Price Earnings (PE) with long-term trailing (reported) PE.

The remainder of this section covers the challenges I have for the above list. Personally, I think modern finance is almost a hoax, an area of investments that has proliferated into a gigantic sales pitch. Few challenge it, and even fewer fully understand it. I think I could write an entire book about the flaws of modern finance, but will try to offer a number of examples of how shallow and truly ineffective some of the concepts are, along with examples. Hopefully, I will be successful enough with some of these that it will at least bring concern on your part and entice further study into the subject.

I should state that this isn’t so much about the problems of modern finance as it is with how investment management cherry-picks and misuses parts of it for marketing purposes.

What Modern Portfolio Theory Forgot or Ignored

Recall that the theory assumes that all investors obtain the same information at the same time, and also that they react similarly and share the same investment goals. Here are some rhetorical questions to challenge those assumptions:

Do people trade/invest using different time horizons? There are now investors/ traders who trade in extremely short intervals during the day. There are those who will never hold a position overnight. There are those who let the market determine their holding period. And there are those who buy and hold for very long periods of time.

Are there different views of risk among investors? The really sad part of this question is that most investors do not fully understand risk and certainly do not know what their risk tolerance is, let alone how to apply it to an investment strategy.

Are there different views of where the same stock’s price will be one week, one month, or one year from now? This doesn’t need any explanation, because if you read financial media or watch television, you know there is an unlimited supply of opinions on this.

The Capital Asset Pricing Model (CAPM) assumes that investors agree on return, risk, and correlation characteristics of all assets and invest accordingly. They rarely do. Some of the problems with return, risk, and correlations are dealt with elsewhere in this book. The biggest is that most use very long-term averages of these to assess future valuations. They should use an average that adapts to an investor’s investing time horizon.

Modern Portfolio Theory and the Bell Curve

I’ll let Benoit Mandelbrot explain it from his book, The (Mis)Behavior of Markets (p. 13). The bell curve fits reality quite poorly. From 1916 to 2003, the daily movements of the Dow Industrials do not spread out on graph paper like a simple bell curve. The far edges flare too high. Theory suggests that over that time, there should be 58 days when the Industrials moved more than 3.4 percent; in fact, there are 1,001 such days. Theory predicts six days of swings beyond 4.5 percent; in fact, there were 366. And swings of more than 7 percent should come once every 300,000 years; in fact, there were 48 such days. Perhaps the assumptions were wrong.

Black Monday, October 19, 1987

“The Dow Jones Industrials fell 29.2 percent. The probability of that happening, based on the standard reckoning of financial theorists, was one in 10 to the 50th power; odds so small that they have no meaning. It is a number outside the scale of nature. You could span the powers of ten from the smallest subatomic particle to the breadth of the measurable universe—and still never meet such a number.” — The (Mis)Behavior of Markets, Benoit Mandelbrot.

Without knowing how he calculated the returns (daily, weekly, etc.) and the amount of data used in the calculation, it is impossible to re-create his numbers. He stated that on Black Monday the Dow Industrials fell 29.2 percent. Here are the numbers: October 16, 1987, close price was 2,246.74; October 19, 1987, close price was 1,738.74, a decline of 22.61%. If one used the low of October 19, 1987 (1,677.55), the decline would be 25.33%. The message, however, is the same; it was a huge decline and one that statistically should never happen.

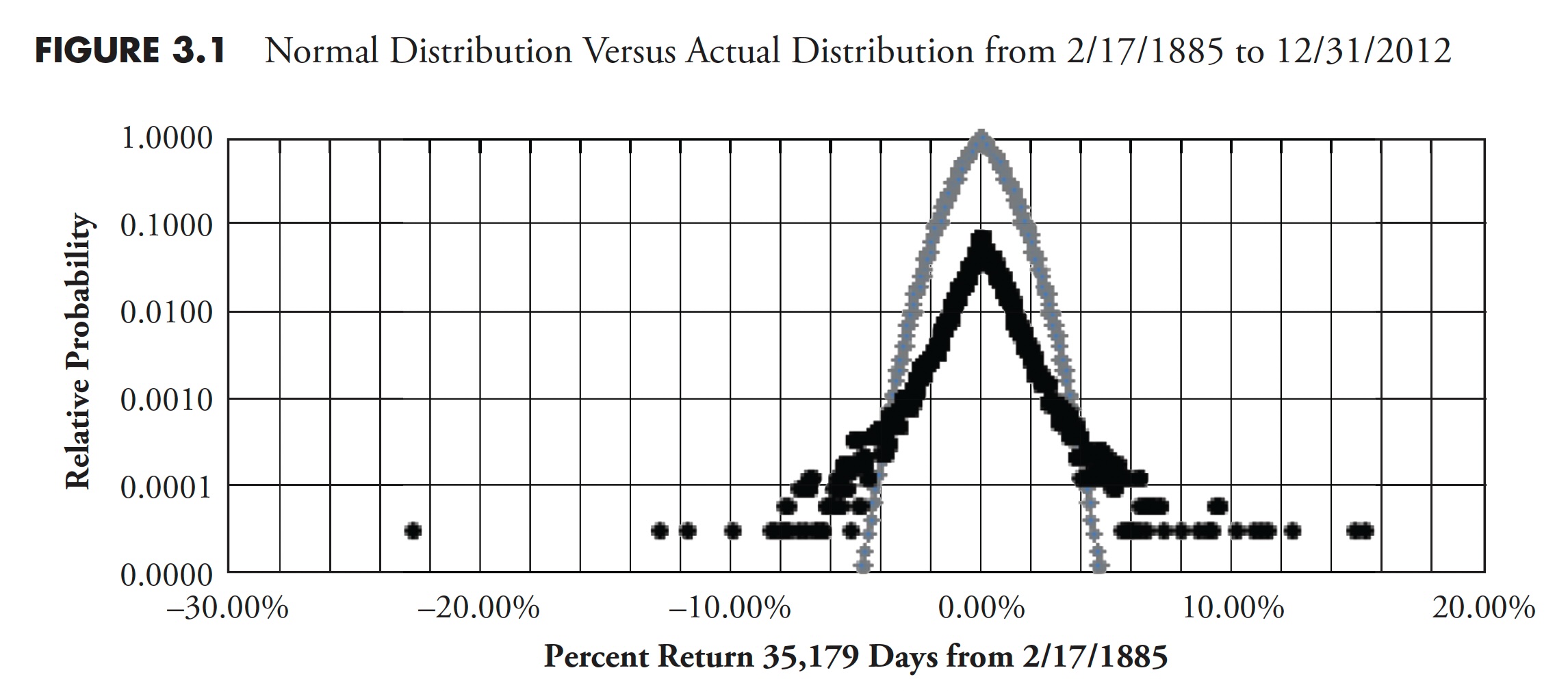

Figure 3.1

Figure 3.1 shows the huge difference between the distribution of returns from the Gaussian “normal distribution” and the actual distribution of empirical data. This is the daily return of the Dow Industrials from 1885 with the vertical axis being relative probability and the horizontal axis being percent return. The taller peak is the Gaussian normal distribution and the other is the actual returns. You can see the small dot at the far left representing the .22.61 percent day known as Black Monday, October 19, 1987.

Tails Wagging the Dog

If an asset bubble is defined as 2 standard deviations (σ, sigma) about its mean, then… statistically it won’t happen but once every 43 years (four sigma total). Statistics dictate that only once every 1,600 years should such events be followed by a reverse move downward of 2 standard deviations. Sadly, these events happen often. Hence, once again, Gaussian statistics are not appropriate for market data.

October 2008 had some rare events. Table 3.1 shows 11 days during October 2008, ordered by absolute daily return.

Table 3.1

The top three days based upon absolute daily returns are 11.1 percent, 10.9 per.cent, and .7.9 percent. The mathematical odds of three days with greater than 7.9 percent moves is 1 in 10,000,000,000,000,000,000,000 (that’s 10 plus 21 zeros). The rise of the term “fat tails” occurred because the world of finance uses the wrong statistical analysis for the market. If the correct analysis were used, the term fat tails would not be used, it would have been addressed. This example reminds me of the e-Trade baby exclaiming that the odds are the same as being eaten by a polar bear and a regular bear in the same day. While I ‘m critical of the statistics used in modern finance, I think I ‘m more concerned about their widely-held belief as being valid. If you know something has problems, you can adjust accordingly. If you do not realize there are problems, you are in trouble.

My friend Ted Wong (TTSWong Advisory) has this to say about modern finance: “After Markowitz introduced Modern Portfolio Theory (MPT) in the 1950s, which was based on the Gaussian hypothesis, most theoreticians had since moved away from Gaussian statistics. Only the naive research analysts in the financial wire-houses and mutual fund institutions still use normal distributions in their papers. In fact, Benoit Mandelbrot, cited in your book, was the first to point out, in the mid-1960s, that the bell curve could not explain many fat tails observed in nature and in the financial markets. Fama and French pointed out that Gaussian statistics was only a special case in the family of Paretian distributions. The latter could account for all forms of fat tails by adjusting the leptokurtosis coefficient.”

Author’s note: Paretian refers to stable distributions, which should be used in modern finance but rarely are because the mathematics is more complex; anyway, that is my opinion. James Weatherall, in The Physics of Wall Street, provides a unique history of how Mandelbrot challenged modern finance and made headway, but ultimately did not change anything.

“To me, the underlying problem with modern finance is not that Gaussian distributions don’t fit the fat tails well. By adjusting the leptokurtosis coefficient, the quasi-bell curve can now be bent by the theoreticians to whatever shapes and forms to fit the empirical data. The real issue in modern finance is the “blind” faith in the random walk hypothesis. Both the MPT and the Paretian practitioners assume that market prices behave in a random fashion. The random walk doctrine assumes that price changes are independent variables; that is, today’s price change has no relationship with yesterday’s or tomorrow’s price change. They have hundreds of “proofs” to back up that claim and as a result, financial academia laughs at technical and even fundamental analysts in their efforts to predict future market prices.

“What the random walkers miss is the fact that most technical and quantitative analyses are not intended for predicting daily price changes, which I agree are more or less random. We believe that market prices are not random over a longer period of time. The distributions of totally random price events should have the mean near 0% and surrounded by a symmetrical distribution on either side, just like the bell curve or the Paretian curve (with fat tails on both sides). If the mean return is located off center and the distributions are asymmetrical around the mean, then one can surely challenge the notion of randomness. Well, look at your Figure 2.1; it’s a clear demonstration that over a one-year period, the mean percent return is off-center to the right, and the distributions are asymmetrical around the mean. Hence the historical annual return histogram proves that the market is not random. The longer the holding period, the less random (thus more predictable) the market is! Random walks are only random when one walks a short time distance. One can rightfully say that day traders are true random walkers and that technical analysis may not be as useful to them.”

Standard Deviation (Sigma) and Its Shortcomings

(Warning: This section is for nerds only!)

Definition: A light year is a distance, not a time. It is the distance that light will travel in one year.

Table 3.2 has some numbers that are beyond human capacity to imagine. They are beyond our ability to comprehend. In my normal overkill fashion, my goal here is to put these giant numbers into a believable perspective so you will believe that something is wrong with the statistics of modern finance. Black Monday, October 19, 1987, was a decline of 22.61 percent, which was approximately 22 sigma. Twenty-two sigma as shown in Table 3.2, based on Gaussian statistics, should only occur once in every 9.5 x 10^103 years. That needs to be put into perspective. The speed of light is approximately 186,282 miles per second, so the speed of light in miles per hours is 186,282 x 60 x 60 = 670,615,200 miles per hour. Further expansion shows that the speed of light per day is 670,615,200 x 24 = 16,094,764,800 miles per day, and so the speed of light per year is 16,094,764,800 x 365.25 = 5,878,612,843,200 miles per year. In scientific notation this is expressed as 5.878 x 10^12. Note that this number is similar to the value for eight sigma (see Table 3.2 ). To create an impression of sigma that is greater than eight would require the use of terms that deal with the universe, yet I’m going to give it a shot.

Table 3.2

Here is a list of galactic-like measurements to help put large-sigma events into perspective. There are many wonderful websites on astronomy and such. I checked a number of them and found a general agreement with the numbers used in these examples. Keep in mind that the numbers were generated with a scientific approach, not just a guess, but still could be in considerable error. Most of the information can be found on www.universetoday.com.

How many stars are there in the Milky Way galaxy? I found that, looking at many different sources, this number was fairly consistent — about 2,500 visible to the naked eye on Earth at any one time, and 5,800 to 8,000 total visible stars. Now here is the guess of astronomers for the total number of stars in the Milky Way: 200 billion to 400 billion (4 x 10^12). Now the Milky Way galaxy is a spiral galaxy that is approximately 100,000 light years across, so you can see that we truly do not know a precise answer other than there are billions of stars in the Milky Way galaxy.

How many galaxies are in the universe? Because we can only see a fraction of the universe, this is impossible to know, but most astronomers have said that there are 100 billion to 200 billion galaxies in the universe. Their recent supercomputer put the number at more than 500 billion; in other words, there is an entire galaxy for every star in the Milky Way.

The obvious next question, then, is how many stars in the universe? Since the determination for the number of galaxies in the universe and the number of stars in each galaxy is clearly a wide-ranging estimate, I’ll just use something near the middle of the estimates (aren’t you glad I didn’t use average?). Then, 400 billion galaxies and 400 billion stars in each galaxy equate to 160 trillion stars in the universe. In scientific notation, that is (4 x 10^12) x (4 x 10^12) = 1.6 x 10^25 . That’s a lot of stars, but keep in mind that the purpose of this cosmic exercise is to get a perspective on high sigma events. Looking at Table 3.2, you can see that this is close to about an 11-sigma event.

How many atoms in the universe? Let’s use the more conservative of the estimates, just to keep it exciting. If there are 300 billion galaxies in the universe, and the number of stars in a galaxy can be 400 billion, then the total number of stars in the universe would be about 1.2 x 10^23. Always refer to the sigma table to see where these numbers stand relative to large-sigma events to keep them in perspective. UniverseToday estimates that, on average (there’s that concept again), each star can weigh 10^35 grams. Therefore, the total mass of the universe would be about 10^58 grams (Note: Multiplication of exponents is easy, just add them: 23 + 35 = 58). Because a gram of matter is known to have about 10^24 protons (same as the number of hydrogen atoms), then the total number of atoms in the universe is about 10^82 . From Table 3.2, you can extrapolate and see that it is about the same as a 19-sigma event occurring—and Black Monday, October 19, 1987, was a 22-sigma event.

What is the age of the universe? NASA’s Wilkinson Microwave Anisotropy Probe has pegged the answer to 13.73 billion years, with a margin of error down to only 120 million years (1.2 x 10^8).

What is the age of the Earth? Plate tectonics has caused rocks to be recycled, which makes it difficult to actually determine the Earth’s age. They have found rocks in Michigan and Minnesota that are about 3.6 billion years old (3.6 x 10^9). Western Australia has yielded the oldest rocks thus far at 4.3 billion years. Moon rocks and meteorites have yielded about 4.54 billion years on average, which is also science’s determination for the age of the solar system.

What about humans? Currently (seems they are always finding something older) the first Homo habilis evolved about 2.3 million years ago—these were the folks that used stone tools and looked probably not too different than a chimp. According to Recent African Ancestry theory, modern humans evolved in Africa and migrated out of the continent about 50,000 to 100,000 years ago. The forerunner for anatomically modern humans evolved between 400,000 and 250,000 years ago. Finally, many anthropologists agree that the transition to behavioral modernity (culture, language, etc.) happened about 50,000 years ago. We humans are certainly a tiny fraction compared to the universe, and, in particular, large sigma events.

Okay, I have thoroughly beat this “perspective” idea to death but hope you found the galactic information entertaining. Basically, and practically, any sigma greater than 4 is usually addressed as infinity. Moreover, in the case of the stock market, that means these events should never happen, yet they do. And way too often!

Table 3.2 shows various sigma, the percent of population, the probability of exceeding that sigma, and a calendar-based interpretation. I have noticed that Microsoft Excel and Wolfram Alpha produce slightly different values. I think that, even with the best of intentions when dealing with extremely large or small numbers, one simple rounding error or inappropriate rounding can lead to differences; however, it did not affect the message here.

Improper Process

When diving into this project on standard deviation and large market moves, I realized that, all too often, analysts who are showing similar information are making an egregious error in the calculation. If you wanted to know the standard deviation (sigma) for October 19, 1987 (Black Monday), then you cannot use any data later than or including that day to determine it. I see many times that one will use the calculation of standard deviation on a daily basis up to the day of the analysis, which often includes many years of data that did not exist at the time of the event being analyzed. Table 3.3 shows the 10 largest percentage days in the Dow Industrials since 1885. The Correct Sigma column shows the calculation for past data up to the day before the event, while the Spot Sigma column shows the calculation for the day in question using all the data available up to 12/31/2012, which I don’t believe is valid. However, you will notice that there is not a huge difference in the two columns; that is, until you look at the difference and put it into a perspective that the human brain can deal with.

Table 3.3

High Sigma Days We All Remember

In an attempt to portray certain days in the past that we have heard much about, the calculation of sigma expected and observed prior to those days is presented here for events from one sigma up to and including eight sigma. You will notice that at the high sigma data in the tables some of the data was entirely too large or too small to include. Also, the days we are discussing in the section were all much greater than 8-sigma days. This analysis is to once again show how often we experience moves in the market that our completely beyond the boundaries of modern finance. Here are the explanations of the headers in the following three tables, October 28 to 29, 1929, October 19, 1987, and all the data up to 12/31/2012.

Sigma—Standard deviation.

AM – xSD—Percent move representing the average mean (AM) less an “x” sigma move.

Expected—The number of events expected using statistics.

Observed—The actual number of events.

Ratio—The ratio of expected to observed events.

AM + xSD—Percent move representing the average mean (AM) plus an “x” sigma move.

Expected—The number of events expected using statistics.

Observed—The actual number of events.

Ratio—The ratio of expected to observed events.

Total Expected—The total of events expected above and below the mean.

Total Observed—The total of actual events above and below the mean.

Ratio—The ratio of the Total Expected and Total Observed events.

Black Monday, October 28 and Black Tuesday, October 29, 1929

Table 3.4 shows the limits for one to eight standard deviations around the arithmetic mean (AM) return for the period from 2/17/1985 until the day before Black Monday, October 28, 1929. There were actually two significant declines during this period. On Monday, October 28, 1929, the Dow Industrials declined 12.82 percent, followed by Tuesday, October 29, 1929, with a decline of 11.73 percent. The total decline from the high price on Monday to the low price on Tuesday was more than 28 percent.

Table 3.4

Black Monday, October 19, 1987

Table 3.5 shows the limits for one to eight sigma around the arithmetic mean (AM) return for the period from 2/17/1985 until the day before Black Monday, October 19, 1987. Black Monday’s decline was 22.61 percent, which is less than the two-day decline in October 1929. However, it was twice as large as Black Tuesday, October 29, 1929, which is the day recognized by most historians as the day of the crash.

Table 3.5

1885–2012

Table 3.6 shows the limits for one to eight sigma around the arithmetic mean (AM) return for the period from 2/17/1885 until 12/31/2012.

Table 3.6

Rolling Returns and Gaussian Statistics

This section attempts to show that high sigma is a much more frequent event than modern finance thinks it is. A number of examples using the Dow Industrials back to 1885 on a daily basis are shown. Each begins with setting a look-back period to determine the average daily return and the standard deviation, and then a look-forward period is set to see if the look-back data continues into the look-forward data.

Figure 3.2 is an attempt to help visualize this process. A look-back period is determined (in-sample data) and a look-forward period is also determined (out-of-sample data). The look-back period is used to determine the average daily return and the standard deviation of returns. From that data, a range of three sigma about the mean is determined. Then in the look-forward data, the number of daily returns outside the +/- 3 sigma band are tallied, with the total being displaying as a plot; any point on the plot represents the data used in the look-back and the look-forward periods.

Figure 3.2

In Figure 3.3, a look-back period of 1,260 days (five years) is used to calculate an average daily return and the standard deviation of returns. On 10/24/2002 (circle on Figure 3.3) the average return over the past 1,260 days was 0.07 percent, and the standard deviation over the same period was 0.71 percent. Therefore, a 3-sigma move up was up to 2.21 percent, and a 3-sigma move down was -2.06 percent. The look-forward period, also 1,260 days, is counting the number of days in which the returns were outside of the look-back range. There were 49 days with returns greater than 2.21 percent and 69 days with returns less than -2.06 percent, for a total number of days with returns outside the +/- 3 sigma range (based on the previous five years) equal to 118. Table 3.7 puts this into another format.

Figure 3.3

Table 3.7

For a +/- 3 sigma event, the expected number of observations should be 1.7, whereas there were 118, which is 59 times more than expected (events must be in whole numbers, so we’re using 2 for the expected number). Figure 3.3 shows the 1,260-day rolling total number of days outside the +/- 3 sigma range. As of 12/31/2007, the total is 116, with an expectation of only 1.7. This is more than 58 times more returns outside the +/- 3 sigma band than expected. Of those 116 days outside the 3-sigma band, 54 were above 2.45% and 62 were below -2.37%.

Reducing the look-forward period to one year (252 days) while maintaining the five-year look-back period yields the chart in Figure 3.4 of rolling number of days outside a +/- 3-sigma (standard deviation) event. Remember that the determination of +/- 3 sigma is determined by the previous five years of data at any point on the chart. For a one-year look-forward, there is only an expectation of 0.34 events (days) outside the sigma band.

Figure 3.4

Taking this concept to another view, Figure 3.5 shows the rolling number of days outside the +/- 3 sigma band for a look-forward of one year and a look-back of 10 years (2,520 days).

Keeping the look-forward period to one year and expanding the look-back period to 20 years (5,020 days) is shown in Figure 3.6. This chart is quite similar to the previous one, with only a 10-year look-back. Extrapolating the past into the future always has its surprises. Keeping the look-forward period the same (one year) and increasing the look-back period does not significantly affect the rolling returns outside the sigma range.

Figure 3.5

Figure 3.6

Finally, in Figure 3.7, taking a 50-year look-back period (12,600 days), as expected, the number of times the following year had exceeded the +/- 3 sigma envelope was similar.

Bottom line: Gaussian (bell-curve) statistics are not appropriate for market analysis, yet modern finance is totally wrapped up in using standard deviation as volatility and then saying that is risk. There are actually two big problems: one is the use of standard deviation to represent risk, and two is that past standard deviation has very little to do with future standard deviation. The first problem does not account for the fact that standard deviation (sigma) is also measuring both upside moves and downside moves with no attempt to separate the two. Clearly, upside volatility is good for long-only strategies. The second problem was adequately covered in this section showing how inadequate standard deviation is from the past in predicting how it would be in the future.

Figure 3.7

Thanks for reading this far. I intend to publish one article in this series every week. Can’t wait? The book is for sale here.