A government initiative reminiscent of the famed “Tell Sid” campaign could soon see NatWest shares made available to the public, with plans potentially taking shape as early as June, according to an official from the entity managing the state’s nearly £7 billion stake in the bank.

Speculation has been mounting regarding the timing of a potential sale since Chancellor Jeremy Hunt hinted in November at the possibility of the first retail offer of the taxpayer’s stake to individual investors.

Overseen by UK Government Investments (UKGI), the shareholding is undergoing strategic consideration, with Holger Vieten, representing the group, indicating to MPs on the Commons treasury committee that a sale could materialize “around summertime,” at the earliest, possibly in June.

“We are in the development and design stage; we are looking at various options,” Vieten stated.

Assisting UKGI in charting the course are advisors from Goldman Sachs and Barclays, alongside legal counsel from Freshfields Bruckhaus Deringer.

NatWest’s emergence as the largest shareholder for the taxpayer dates back to the 2007-2009 financial crisis when the state intervened with a £45.5 billion rescue package for the bank.

The government’s stake, initially at 84 per cent, has since been reduced to 35 per cent through a series of transactions, involving the sale of significant share blocks to institutional investors and back to the FTSE 100-listed bank. Shares have gradually entered the stock market via a trading plan.

However, these sales have incurred losses for the taxpayer due to pricing well below the 502p bailout rate, with shares closing recently at 220p.

Charles Donald, head of UKGI, stressed the importance of clarity regarding NatWest’s leadership before proceeding with a retail sale.

Following a scandal involving the bank’s Coutts private banking arm, Dame Alison Rose stepped down as chief executive, with Paul Thwaite overseeing operations on an interim basis. Rick Haythornthwaite, slated to assume the chairmanship in April, will play a pivotal role in the decision-making process.

Donald highlighted the necessity for “clarity” on Rose’s successor “for the market to be comfortable” with a share sale.

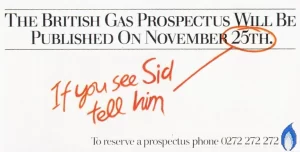

Ministers envision a retail offer of NatWest stock as a means to engage public interest, drawing parallels to the iconic 1986 privatisation of British Gas, famously promoted through the “Tell Sid” advertising campaign.

Hunt emphasized the aim to reignite individual investor participation, coinciding with reports of the Treasury enlisting M&C Saatchi, the advertising agency, to spearhead a campaign.

Read more:

‘Tell Sid’ NatWest sale to start in June