Argentina’s Javier Milei is racking up some solid wins, with the fiscal basket case seeing its first monthly budget surplus in 12 years.

Apparently, it took Milei just nine and a half weeks to balance a budget that was projected at 5% of GDP under the previous government. In US terms, he turned a 1.2 trillion-dollar annual deficit into a 400 billion surplus. In 9 and a half weeks.

How did he do it? Easy: he cut a host of central government agency budgets by 50% while slashing crony contracts and activist handouts.

For perspective, if you cut the entirety of Washington’s budget by 50%, you’d save a fast 3 trillion dollars and start paying off the national debt.

It turns out it can be done, and the world doesn’t collapse into chaos.

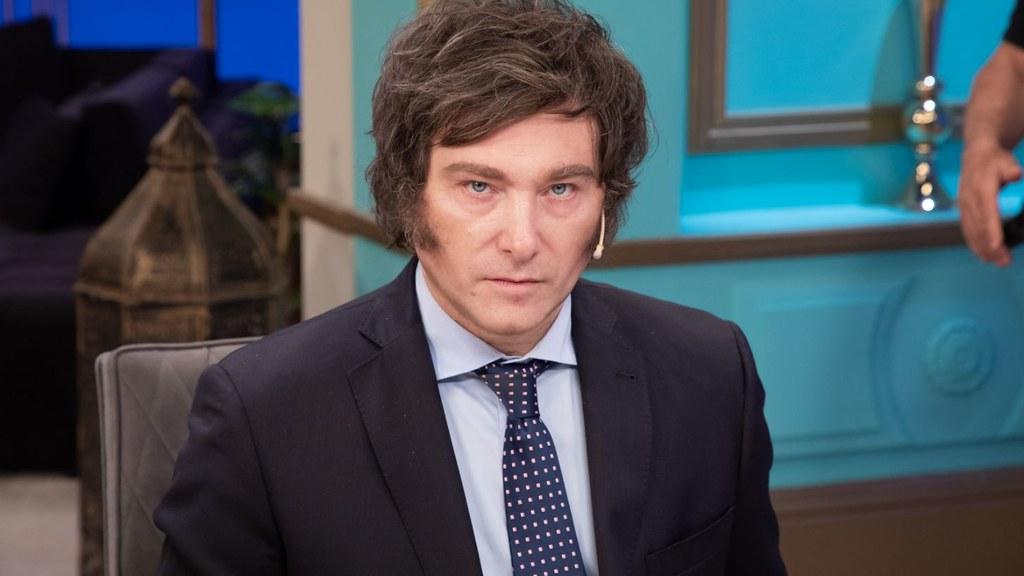

292d8d70-5f24-43bd-8a1f-b60ac8ebac87_1294x704.png

Milei Making Fast Progress

Deficits aren’t the only win Milei’s logged. He’s slashed crony regulation, got rid of currency controls, and recently slashed rent prices by removing controls — that actually led to a doubling of apartments for rent in Buenos Aires, slashing rent costs.

Unfortunately, it’s not all smooth sailing: a bill to privatize corrupt state-owned companies — to effectively de-Soviet the Argentine economy — was blocked by the socialist opposition who serve the government unions who would lose their jobs.

Meanwhile, a major Milei reform to make it a lot easier to hire people but would hurt unions was struck down by the high court, which said it must go through Congress.

Having said that, for the average Argentinian, these are deckchairs on the Titanic compared to the elephant in the economy: Argentina’s hyperinflation.

Just last week, the monthly inflation figure came in at 20.6% — on the month. That was a lot better than the outgoing government, but it still left year-on-year inflation at 254%.

Why so high? Partly because Milei had to free up the exchange rate to smooth the path to dollarization — for Argentina adopting the US dollar instead of the local confetti.

But mostly because the rivers of money printed by the previous socialists continue to run through the battered ruins they left of Argentina’s economy. After all, Milei’s only been in office for two months.

51665305-341b-480e-b4f0-024925a8f768_916x596.jpg

Argentina’s Dollarization

Milei’s reforms will continue to be trench warfare. But his inflation progress is going to be key to retaining support.

He just notched a big win with the deficit, but it only stops the bleeding — the patient is still on life support.

To fully kill Argentina’s hyperinflation, Milei would need to make real progress on the dollarization — or, dare we dream, a gold standard. On dollarization, that would involve announcing a months-long window for peso assets to be revalued in dollars.

He’s been preparing the groundwork so far — the currency controls and deficits are a big help. And he’s surely motivated to do it since dollarization in other countries like did it like Ecuador has 90% public support. But it is a complicated process, and if done badly, he’ll be dead in the water.

The stakes are high. And not just for Argentina: If Milei succeeds, he’ll be a model for radically shrinking government in other countries in Latin America, in the rest of the world, and even for our spineless goblins in Washington.

Originally published at profstonge.com.