Cue the rip-roaring rally!!

If the stock market follows its recent script, we may see some sort of bounce in stocks in the next few days. That’s because the market is oversold after last week’s beating, and the odds of yet another short covering rally are better than even, although not guaranteed.

Last week, thanks to a wild-and-woolly options expiration and a hotter-than-expected CPI reading, the stock market moved decidedly lower. The decline was quite indiscriminate, including sectors with interesting fundamentals, such as the energy stocks. Meanwhile, as I discuss below, several key support levels on major indexes were breached.

Certainly, with enough fear in the air, nimble traders could make a go at any rally. But the reality is that any bounce may be cut short once the Fed delivers its next gut punch after its upcoming FOMC meeting, scheduled to end on 9/21.

MELA Update: Liquidity is Evaporating — Just Ask FedEx and Your 401 (k) Plan

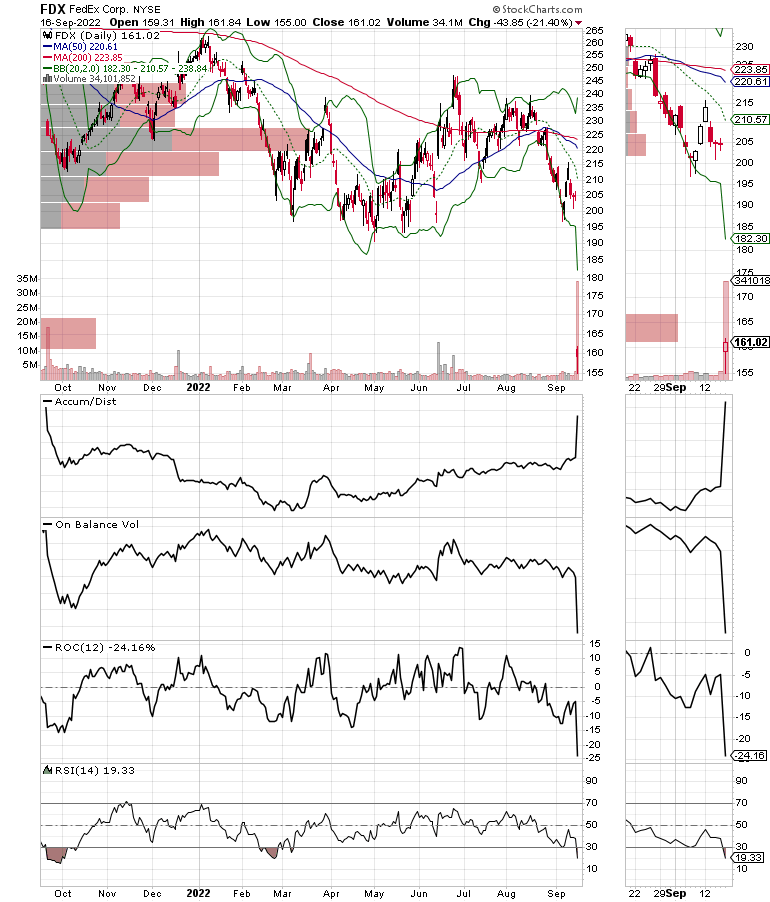

Shares of shipping and delivery giant Federal Express (FDX) delivered a precipitous decline on 9/16/22 when they pre-announced their earnings and warned that the future isn’t so bright anymore, so they will have to take their shades off.

All kidding aside, perhaps the most important point of the pre-announcement was that the company’s CEO, Raj Subramaniam, noted that shipping volumes are dropping rapidly and that he expects a global recession. He further noted that the most significant weakness is in Europe and Asia.

The news wasn’t just bad for FedEx. Perhaps the take-home message is that liquidity in the system is drying up, not just in the stock market, but in the real economy. Of course, you would expect that to happen at some point, since the stock market is the central cog in the MELA system (M for Markets, E for Economy, L for life decisions, and A for Artificial Intelligence).

Familiar readers are aware of how the MELA system works. In many cases, when employment (including side hustles) is no longer able to provide enough income to make ends meet, the stock market has become an important source of living funds for many, via their trading accounts, crypto holdings, IRAs and 401 (k) plans. When the stock market falls, the value of these important income sources declines and people spend less money. This is most noticeable in big-ticket items like homes and cars, but can extend into other areas, such as groceries and utilities.

What the FedEx announcement and its CEO’s remarks bring home is that we may now have reached the point where the market’s lack of liquidity is fully extending into the economy. Moreover, the effects of this liquidity squeeze spread rapidly, because the presence of Artificial Intelligence (algos) in every aspect of life makes everything happen faster. Consider the fact that, when the stock market falls and economic statistics start to falter, the trusty algos at Amazon.com quickly jigger prices in order to maximize profits. When the Fed raises rates, the algos at your favorite credit card company raise interest rates accordingly, and nearly instantly. Check out your latest statement and compare it to last month’s.

You can see how rapidly gas prices change at the pump based on the price of oil daily. And, at the grocery store, you can bet that Kroger’s algos are scouring their supply chains looking for ways to keep their margins growing. And the gas company’s algos have already warned that prices are going up this winter. I got my letter recently. Moreover, algos don’t know when to stop until the program tells them to stop. And because they are all responding to the same cues, everything is now in sync and change happens at the speed of light.

Thanks, HAL.

FedEx Chart is a Textbook Example

The price chart for FedEx is a perfect example of how algos work. The news hit, the stock got crushed and the stock market followed because the CEO uttered the words “global recession,” which cued the algos to sell.

And if you ever want to see a textbook chart which validates the fact that Accumulation Distribution (ADI) is a great way to see what short sellers are doing, this is the one.

Check out the rise in ADI as the shorts covered at the end of the trading day, while On Balance Volume (OBV) just crashed as the buyers panicked.

I’m not surprised, especially when FDX blamed weakness in Europe and Asia as major reasons for its developing problems. Unfortunately, it doesn’t seem as if this situation is going to be remedied any time soon.

It’s Getting Worse

The squeeze from the Fed on MELA is starting to get worse. Consider that bond yields continue to move higher. And last week was impressive after the CPI came in hotter than expected, with the U.S. Ten Year note yield (TNX) now testing the 3.5% yield area.

Moreover, the U.S. 2-Year note is now close to yielding 4%.

And yes, since the Fed is removing $95 billion from the financial system per month as part of its QT program by selling bonds, that means that, until they stop, the odds of yields falling meaningfully are low.

Meanwhile, the Eurodollar Index (XED) has made a new low, confirming what FedEx just told us and confirming what I’ve noted here for some time: liquidity is now falling more rapidly.

Check out my Your Daily Five video on how to adjust your trading based on liquidity.

Low Liquidity Means Fewer Stock Buybacks

If your portfolio bounced around like a yo-yo last week, you’re not alone, as the algos went totally crazy after the hotter-than-expected CPI print rebalanced asset allocation models during an options expiration week. The volatility is directly related to the actions of the Federal Reserve, whose QT is removing $95 billion from the financial system per month now, leaving a big hole on the balance sheets and cash flow of trading houses. And the lack of liquidity is starting to spread, as companies like Federal Express (FDX), whose bearish earnings pre-announcement put the icing on the bad week’s cake, are now more prone to pause, slow, or perhaps even end their share buyback programs.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

Oversold Bounce Could Develop in Short Term

We could see an oversold bounce just before the Fed makes its next move; likely a 75-basis point increase in the Fed Funds rate. If they really want to destroy everything, they will raise a full point and threaten to do it again at their next meeting. This isn’t likely to happen, but anymore who knows?

It’s going to be hard to trust that rally if it materializes. Yet, it’s important to remember that markets love to make fools out of the majority.

Meanwhile, the New York Stock Exchange Advance Decline line (NYAD) reversed its rise above its 50-day moving average and looks set to test its recent lows, although it may not go that far, at least until after the Fed’s next meeting. Of course, Mr. Powell may say something that the algos interpret as “dovish,” and we could be moving higher in a hurry.

There is certainly enough fear in the air for anything to happen, as the CBOE Volatility Index (VIX) rolled over and is back above 25. However, it reversed its rise late in the day on 9/16, which could mean that the market makers will try to rally stocks early in the week in order to give their books some room before the Fed.

The S&P 500 (SPX) closed just below 3900, but did rebound at the end of the trading day as short-sellers covered some of their bets. Accumulation Distribution (ADI) and On Balance Volume (OBV) were inconclusive.

The Nasdaq 100 index (NDX) got crushed after failing to make it back to 13,000.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.