The retail landscape is experiencing significant turbulence as a sharp 19% increase in insolvencies underscores the mounting challenges faced by businesses amidst higher interest rates, elevated costs, and restrained consumer spending.

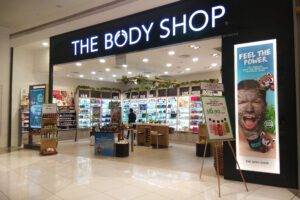

According to Mazars, a leading audit, tax, and advisory firm, a total of 2,195 retailers collapsed in the year ending January, representing a notable surge compared to the previous year. The sector witnessed prominent collapses including The Body Shop, Ted Baker, Matchesfashion, Farfetch, and Wilko, amongst others, reflecting the breadth of challenges across various retail segments.

Mazars attributes the industry’s struggles to a blend of escalating costs and cautious consumer expenditure, exacerbated by the burden of higher interest rates, particularly for retailers burdened with significant debt obligations.

Retail sales endured another setback in March, marking the sixth consecutive month of decline, according to a survey by BDO, highlighting the persistent impact of subdued consumer spending on retail operations.

While traditional brick-and-mortar retailers have borne the brunt of insolvencies in recent years, e-commerce players have also faced severe strains from escalating costs. E-commerce insolvencies surged to a five-year high of 615 in the past year, surpassing the previous year’s figure of 521, with notable casualties including Wiggle, the online bike retailer.

Rebecca Dacre, a partner at Mazars, cautioned that despite some moderation in inflation, retailers remained ensnared by high interest rates and escalating staff costs. The recent record increase in the national living wage, coupled with anticipated rises in business rates, continues to pose challenges for retailers.

Industry voices, including Currys’ chief executive Alex Baldock, have voiced concerns regarding the simultaneous surge in minimum wage and commercial property taxes, foreseeing a detrimental impact on investment, growth, and job creation within the retail sector.

Tom Ironside, director of business and regulation at the British Retail Consortium, echoed apprehensions over the looming threat posed by business rates, emphasizing its significance in preserving the vitality of high streets.

With retail administrations and insolvencies plaguing the high street, Jo Windsor, a restructuring and insolvency partner at Linklaters, highlighted the vulnerability of retailers dependent on discretionary spending or facing competition from lower-cost rivals, urging vigilance amidst ongoing economic uncertainties.

Read more:

Retail Insolvencies Surge by 19% Amidst Economic Challenges