Marc Joffe

With California’s very late publication last month, all fifty states have now produced audited financial reports for their 2022 fiscal year. The availability of these reports allows us to compare the balance sheet health of all state governments on an apples‐to‐apples basis because they all use the same accounting standard.

Former California State Senator John Moorlach, a certified public accountant, has implemented a simple but powerful approach to analyzing state (and local) government finances. He takes the Unrestricted Net Position (UNP) for each state government and divides it by the state’s population.

UNP is a concept requiring some explanation. Net position is synonymous with net worth and is simply the difference between an organization’s assets (e.g., cash, receivables, buildings) and liabilities (e.g., payables, bonds outstanding). These remaining balances may be tied up in illiquid assets, making them not readily available. Any residual assets that are not spoken for make up the government’s “unrestricted net position”.

UNP is a balance sheet concept and is not typically found in state budgets. The measure indicates how fiscally responsible a state government has been over many recent years, not just the current year.

Moorlach’s analysis only covers a state’s “governmental activities”. He excludes “business type activities” like public utilities because they vary so much across governments. Focusing only on core governmental functions allows for more of an “apples to apples” comparison.

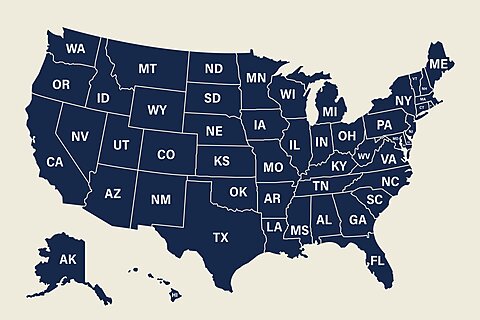

The accompanying map shows per capita unrestricted net position by state for fiscal year 2022. States colored in shades of red on the map have a negative unrestricted net position, indicative of poor financial health. In most cases, states that are in the red financially turn out to be blue politically: the six states with the most negative unrestricted net positions have Democratic legislatures. Deep blue New York and California are also in the red financially.

But Republican governance is no guarantee of fiscal probity. Texas has a UNP per capita of -$2,590 despite the lack of Democrats controlling policy at the state level. This deficit is fully accounted for by Texas’s large liabilities for underfunded public employee retirement benefits, including pensions and retiree healthcare. Other states that are both red financially and politically include Missouri and South Carolina. By contrast, Florida is above water, albeit slightly.

The financially strongest states, Alaska, North Dakota, and Wyoming benefit from having “permanent funds” based on natural resource endowments in each of these states.