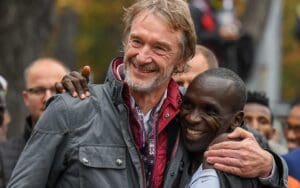

Belstaff, the luxury leather jacket brand owned by billionaire Sir Jim Ratcliffe, has reported a further £18.3m loss, raising fresh concerns over its financial sustainability. Auditors have warned the business remains reliant on ongoing support from its parent company, Ineos, to survive.

Despite selling jackets priced up to £2,125, the brand’s sales declined by 4% to £57.6m in 2023, marking its sixth consecutive year of losses since its acquisition by Ineos in 2017. To date, Belstaff has yet to report an annual profit under Sir Jim’s ownership.

In their report, auditors from Grant Thornton flagged significant risks to the brand’s viability, citing the absence of a formal financial commitment from Ineos as a “material uncertainty” regarding Belstaff’s ability to operate as a going concern.

Belstaff’s directors, however, indicated that Ineos had informally assured ongoing financial support, including not demanding repayment of previous loans. At the close of 2023, Belstaff owed Ineos a £140m loan due within the year, alongside £179m in other outstanding loans.

Founded in 1909 in Staffordshire, Belstaff initially produced waterproof clothing and rubber goods before evolving into a luxury brand known for its waxed motorcycle jackets. Ineos acquired the business in 2017 after JAB Holdings shifted focus to food and beverage brands like Pret a Manger and Krispy Kreme.

At the time, the acquisition was seen as a potential complement to Sir Jim’s Ineos Automotive venture, leveraging Belstaff’s heritage in motorcycle apparel. However, both Belstaff and Ineos Automotive have faced challenges. Last month, production at Ineos’s car factory stalled due to financial troubles at a key supplier.

Belstaff has yet to comment on the latest figures or the warnings from its auditors.

Read more:

Sir Jim Ratcliffe’s Belstaff racks up £18m loss as auditors warn of uncertain future