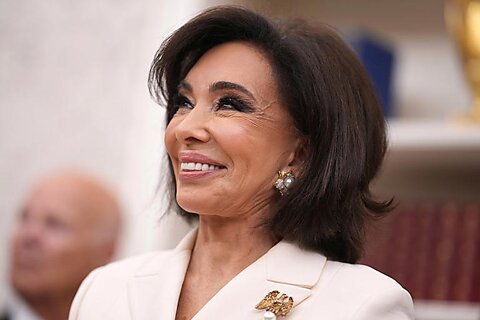

Donald Trump’s cryptocurrency portfolio posted a rare rebound in Q3 2025, climbing 36.6% in value to $3.1 million, according to new analysis from Finbold.

On-chain data tracked by Arkham Intelligence shows the former US president’s holdings rose from $2.27 million on July 1 to $3.10 million by September 30 – a paper gain of around $823,000.

The recovery comes after a brutal start to the year, when Trump’s wallet value collapsed 80.7% in Q1 (from $10.16 million to $1.96 million). By the end of H1, the portfolio had stabilised near $2.2 million, but overall it remains 69.5% below January levels, underscoring the volatility of Trump-linked crypto assets.

What drove the rebound?

Finbold’s report cites two main drivers behind the uptick:

• Unsolicited airdrops from meme-token projects, keen to associate themselves with Trump’s brand.

• Trump-themed token frenzies, where retail promotions drive short-lived spikes in on-chain valuations.

“Much of the value reflects inflows rather than traditional investment activity,” said Diana Paluteder, co-author of the report. “It’s more a snapshot of speculative flows than evidence of an active trading strategy.”

Off-chain moves and NFT royalties

Arkham has linked the wallet to Trump via past financial disclosures and royalties from his NFT collections. However, large Coinbase-linked withdrawals suggest that funds are frequently moved or converted off-chain, leaving little to no balance behind after major inflows.

WLFI’s explosive growth

Beyond Trump’s personal holdings, his influence extends to World Liberty Financial (WLFI), a DeFi project billed as a “patriotic alternative” to Wall Street. WLFI’s reported asset value skyrocketed from $179.3m to $10.81bn in Q3 – a staggering 5,931% increase. Analysts attribute this to aggressive token issuance, thin liquidity, and politically driven enthusiasm.

While eye-catching, such figures raise sustainability questions. WLFI’s surge illustrates how Trump’s brand continues to fuel speculative narratives across crypto markets, even as risks of volatility remain high.

Read more:

Trump’s crypto wallet rebounds 36% in Q3, but remains 70% down in 2025