Jeffrey Miron

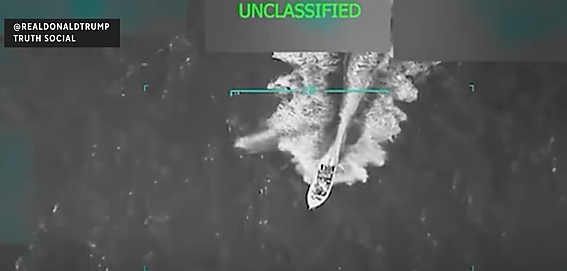

Since September 2025, the US has carried out five lethal strikes on small boats off the coast of Venezuela, leaving 27 people dead as of October 14. Even granting the government’s account—that these were traffickers and the strikes were effective interdictions—the policy question remains: does escalating force in prohibited markets reduce violence?

In short: no.

When prohibition forces a widely demanded product underground, participants still engage in the purchase and sale of it. And, with no legal avenue to resolve disputes over territory, quality, and debts, buyers and sellers often turn to violence.

Empirical evidence supports such a conclusion. A 1999 study covering roughly a century of US homicide data finds that stronger enforcement of alcohol and drug prohibitions corresponds to higher homicide rates.

Especially problematic is the kingpin approach, in which authorities “decapitate” cartels via short-run seizures, arrests, or assassinations. A 2018 study finds that after these “successes,” homicides increase in the affected municipalities and spill over to nearby areas. Likewise, a 2015 study of organizational “beheadings” shows removing bosses destabilizes protection rackets and boosts killings rather than pacifying markets. In these cases, removals create power vacuums, dissolve informal agreements, and increase uncertainty over territory and payments. Consequently, the expected return to preemptive violence rises, and competing factions test boundaries until a new equilibrium emerges.

Thus, by pushing high-demand markets underground, prohibition replaces contracts with retaliation, selects for firms best at coercion, and turns “enforcement wins” into violent reshuffling. If the aim is fewer homicides and less cartel power, the better path is to repeal drug prohibition rather than promote militarization.

Cross-posted from Substack. Jonah Karafiol, a student at Harvard College, co-wrote this piece.