Markets love to make fools of us all. And this market is so oversold that any positive surprise could launch a huge rally as pervasive bearishness, an olive branch from the Fed and, perhaps, a short-term improvement in liquidity may have arrived.

We’re at that point in the bear market cycle where a great deal of bad news has been priced in. Traditionally, this is a prelude to prices moving sideways, or a return to a bullish trend. The proof is that last week, when the Fed leaked that it was considering reducing its interest rate increases to 0.5% from 0.75% after its November rate hike, the market rallied off of very dangerous levels.

So, what’s factored in?

Well, here’ what we know:

Inflation isn’t showing any overt signs of slowing down – yet;The Fed isn’t likely to stop raising rates anytime soon – even if it slows the rate of increase;The slow and steady reversal of globalization is proceeding;The war in Ukraine is ongoing;COVID is part of the landscape;Stealth layoffs are ongoing and may increase – think tech;Some businesses are closing their doors – especially small ones;The migration from high-regulation states for the sunbelt is ongoing – good for housing;Recession signs are slowly popping up everywhere: and Higher interest rates and low liquidity are the new normal – at least for now.

Moreover, Black Swans are out there lurking, which is why the Fed leaked its intentions. Where’s the next leak going to come from? Maybe Ukraine. Maybe China. Maybe Europe.

What’s the Fed Afraid Of?

The Federal Reserve is likely concerned about the possibility of a major financial event prior to the U.S. election, which is why they leaked the notion that they may slow down the rate of rise in their ongoing interest rate increases.

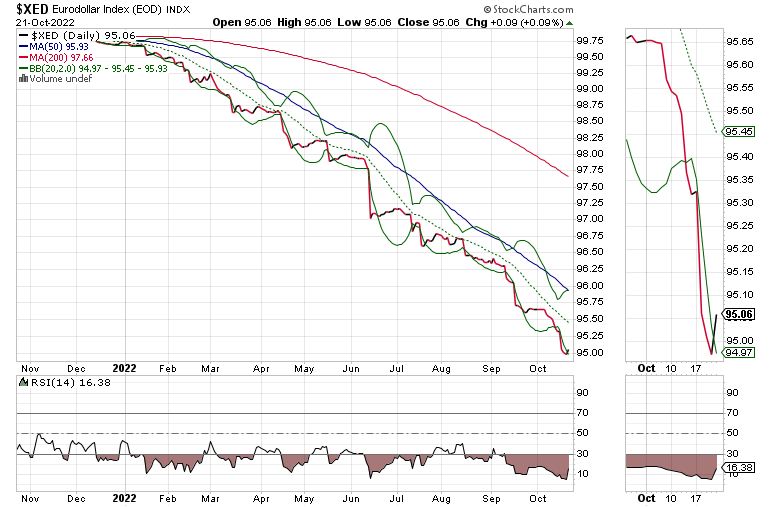

Certainly, the Fed is likely to raise interest rates by as much as 0.75 basis points just six days prior to the election. But they are now suggesting that they may slow down further rate hikes as early as their December meeting. If you’re wondering why, just look at the price chart for the Eurodollar Index (XED), which indirectly measures the stock market’s and the economy’s liquidity status made yet another new low last week before Friday’s recovery. Will the one-day bounce last?

Moreover, compare the crash in XED to the price chart for the U.S. Dollar Index (USD) and the U.S. Ten Year Note Yield (TNX).

Note the inverse relationship between the USD/TNX complex and XED. What you see is a picture of a world in which the Fed’s bond selling (QT) has increased bond yields and strengthened the dollar at the cost of the liquidity in the global financial system.

When debt payments become your number one expense, companies struggle with payrolls and capital expenditures. Individuals are pressed to decide whether to pay for food, shelter or gasoline.

So, the Fed is afraid of causing a financial calamity, and they leaked that a pause is coming. Bond yields, the dollar, and Eurodollars reverse course on a dime. For stock traders, this may be a good thing.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

Is it Almost Over? For Homebuilders and Realtors, the Bad News Keeps on Coming.

The hits keep coming for the housing sector, thanks to the Fed’s continuation of its higher interest rate and QT policies. Just this past week we saw:

Homebuilder sentiment crash to the lowest level of the year;Single family housing starts continue to fall as multifamily future permits increase; andExisting home sales fall to eight-year lows.

In response, homebuilder stocks fell, but interestingly did not make new lows. And, as I noted here last week and multiple other times, in my neck of the woods, construction is steadily increasing. Moreover, home prices are starting to stabilize after a rough summer.

In other words, supply remains well behind demand. And, in any commodity market, supply rules the roost.

I use the price trend in the shares of online realtor portal and until recently home flipper central Zillow (Z) as a gauge of where the housing market may be headed. Sure, this by no means a scientific exercise. But, it’s good enough, especially when it comes to turning points. So, when the bad housing news hit last week, Zillow shares yawned through the event, even though some homebuilder stocks took a tumble. In fact, Accumulation Distribution (ADI) and On Balance Volume (OBV) in Zillow’s shares aren’t moving. And what that means is that neither short sellers or buyers are interested in housing anymore.

The bottom line is that housing is not an area of the market that is attracting any interest from investors at this point. And who can blame anyone for avoiding housing-related stocks when the U.S. Ten Year Note yield (TNX) is making new highs on a regular basis?

From a contrarian viewpoint, this is a bullish development. Because where there is no interest, there is huge potential. And that means that, at some point, when conditions improve, the housing sector is once again likely to be a market leader.

Expect at least a short-term bounce in the housing sector if bond yields pull back, as I expect them to over the next few weeks, as the Fed takes its foot off the rate hike pedal.

Is it time to get some Zillow shares? I’m not there yet. This is a truly messed up market because of the Fed and the options related games being played by hedge funds and algos. But, if you’ve got some extra cash and can be patient, from a contrarian standpoint, this may be one of those historical opportunities.

On the other hand, I’ve recently added several energy sector picks to my Momentum Plus Portfolio. You can check them out here.

No New Lows is Good News. Liquidity Bounces.

As I noted above, we may be entering a consolidation phase in the bear market. That’s not a guarantee that we’ve seen the worst. But it’s encouraging.

Consider the fact that neither the major indexes or the New York Stock Exchange advance decline line made new lows on last week’s selling. Moreover, both recovered by the end of the week. In addition, as the S&P 500 and Nasdaq 100 charts show below, the Bollinger Bands (green bands surrounding prices) are starting to close in around the 20-day moving average. That’s usually the prelude to a big move.

Meanwhile, the CBOE Volatility Index (VIX) is rolling over, a positive sign that put option buyers are pulling back.

Rising put option volume (rising VIX) leads market makers to sell stock index futures and increase the selling pressure on the market. A falling VIX often leads stock rallies. The Eurodollar Index (XED) bounced back late in the week after falling below its lower Bollinger Band, which means that the decline in liquidity is now well beyond what is considered normal and a bounce is likely.

The S&P 500 (SPX) found support at its 20-day moving average and was able to move above 3700. Resistance looms at 3800-4000. Accumulation Distribution (ADI) and On Balance Volume (OBV) are both heading down report as short sellers dig in, forcing buyers to become sellers.

The Nasdaq 100 index (NDX) rebounded back above 11,000, with 11,500-12,000 now becoming resistance.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.